What happened in the world of foreign exchange on June 30, 2019? As a forex enthusiast, I was eagerly keeping an eye on the market, anticipating exciting movements and potential trading opportunities. Let’s dive into the forex rates that shaped this day and explore the insights they offer.

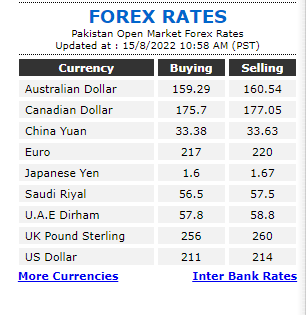

Image: dailytimes.com.pk

Unlock the Historical Significance of Forex Rates

Before delving into the specific rates, let’s take a step back and appreciate the significance of forex market rates. These rates, expressing the relative values of currencies, paint a vivid picture of global economic health, political stability, and investor sentiment. By analyzing historical forex rates, we gain invaluable insights into past market dynamics, helping us make informed decisions in the present.

The Forex Market: A Global Hub

The foreign exchange market, often abbreviated as forex, serves as the world’s largest financial market, facilitating trillions of dollars’ worth of transactions daily. Currencies are traded in pairs, with the value of one currency quoted relative to another. These rates are constantly fluctuating, influenced by a myriad of factors, including economic data, central bank decisions, political events, and even natural disasters.

Tracking historical forex rates allows us to identify trends, patterns, and correlations that shape the market. By understanding these factors, traders can develop strategies to capitalize on market movements and mitigate risks.

Unveiling the Forex Rates of June 30, 2019

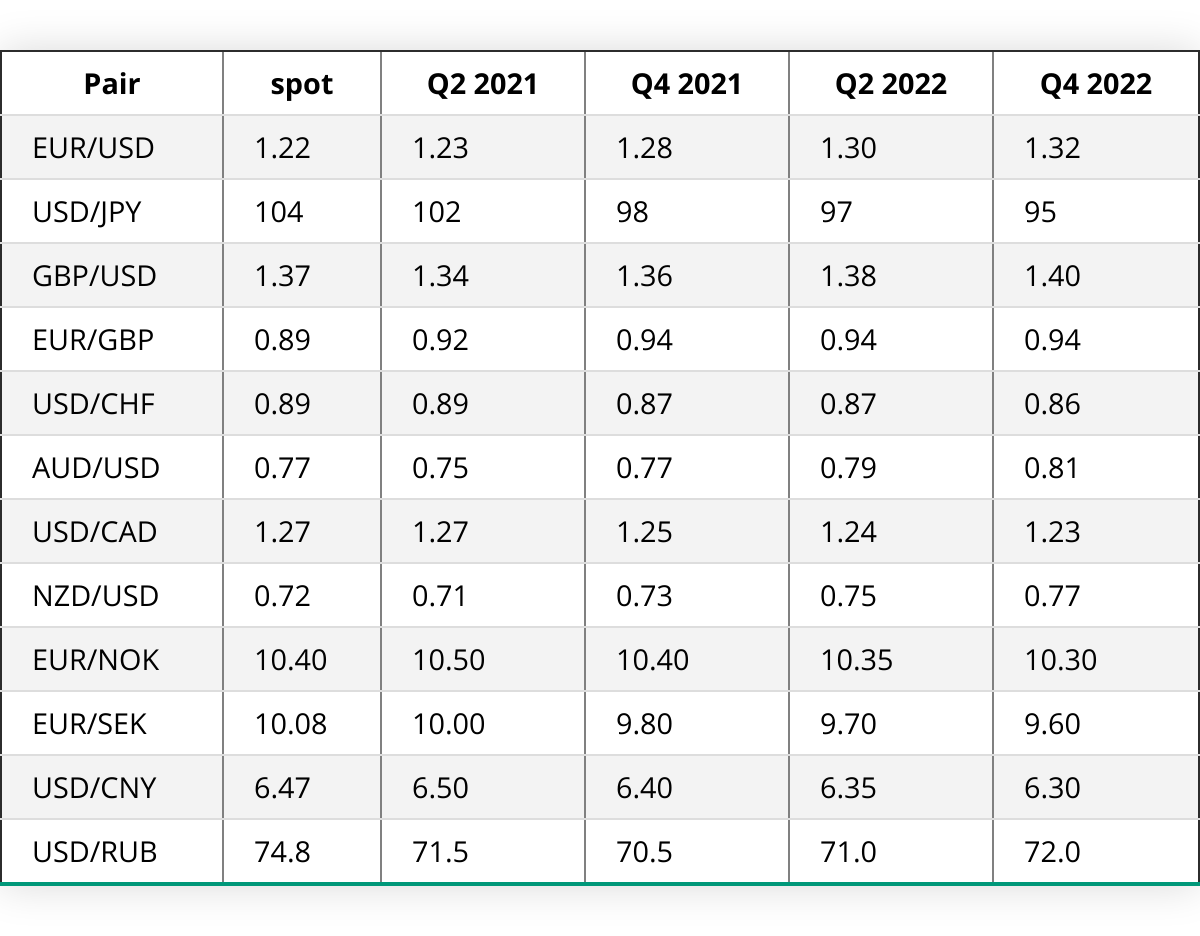

On June 30, 2019, the forex market witnessed several noteworthy movements. The euro (EUR) strengthened against the US dollar (USD), reaching a high of 1.1370. This appreciation was attributed to positive economic data from the eurozone, suggesting a recovering economy. The US dollar, on the other hand, witnessed some weakness due to ongoing trade tensions and concerns over the Federal Reserve’s monetary policy.

The Japanese yen (JPY) also gained ground against the USD, reaching a high of 108.30. This strength was largely driven by safe-haven demand, as investors sought refuge in the yen due to global economic uncertainties. The British pound (GBP), however, struggled against the USD, dropping to a low of 1.2510. This decline was primarily due to political uncertainty surrounding Brexit negotiations at the time.

Image: allysqrochella.pages.dev

Expert Insights and Tips for Navigating Forex Markets

As an experienced forex trader, I’ve gained valuable insights and tips that can help you navigate the complexities of the market. Here are a few key pointers to consider:

Stay Informed and Track News Events

Keeping abreast of global economic and political developments is crucial in forex trading. Major events, such as central bank announcements, economic data releases, and geopolitical tensions, can significantly impact currency prices. By staying informed, you can anticipate potential market movements and adjust your trading strategies accordingly.

Master Technical and Fundamental Analysis

Technical analysis provides traders with insights into historical price movements, identifying patterns and trends that can guide trading decisions. Fundamental analysis, on the other hand, focuses on economic indicators, political stability, and other fundamental factors that influence currency values. Combining both technical and fundamental analysis offers a comprehensive approach to understanding the market.

FAQs: Addressing Common Forex Market Queries

Here are some frequently asked questions (FAQs) to provide further clarity on forex market intricacies:

- What factors influence forex rates?

- How can I trade forex?

- Is forex trading risky?

A wide range of factors affect forex rates, including economic data, interest rate decisions, geopolitical events, trade flows, and investor sentiment.

To trade forex, you need to open an account with a regulated forex broker. Once your account is funded, you can buy and sell currencies in pairs.

Forex trading involves risk, as currency prices can fluctuate rapidly. However, by employing prudent risk management strategies, such as using stop-loss orders and managing your leverage, you can mitigate potential losses.

Forex Rate 30 June 2019

Conclusion: Embracing the Forex Frontier

Understanding historical forex rates, such as those on June 30, 2019, offers valuable insights into the dynamic nature of the foreign exchange market. By staying informed, mastering technical and fundamental analysis, and implementing effective risk management strategies, you can navigate the forex frontier with confidence. Remember, the forex market presents both opportunities and challenges, and it’s up to you to embrace its complexities and harness its potential for financial success.

Were you captivated by the world of forex rates? Share your thoughts and experiences in the comments section below. Let’s continue the conversation and explore the fascinating realm of global currency markets together.