Prologue:

Imagine if the foundations of our financial world trembled one day, sending shockwaves through global markets and leaving behind an altered landscape. On April 1, 2015, such a cataclysm unfolded in the realm of foreign exchange (forex), forever etching its mark on the economic annals. It was a day that shattered complacency, tested the mettle of investors, and ushered in a new era of market volatility.

Image: indzara.com

Forex: The Invisible Hand Shaping Our World

Forex, the colossal marketplace where currencies are traded, is not readily visible to the average person, yet its pulse profoundly affects their lives. From the price of imported goods to the value of investments abroad, forex plays a pivotal role in shaping our economic realities. It is a stage where central banks, multinational corporations, and currency speculators dance in a complex choreography, their moves cascading into every corner of the globe.

The Swiss Franc Earthquake

On that fateful April day, it was the Swiss National Bank (SNB) that triggered a financial earthquake. In a surprise move, the SNB abruptly abandoned its three-year peg of the Swiss franc to the euro, sending the franc soaring against major currencies. The move stunned markets, leaving traders reeling and sending ripples of uncertainty throughout the financial world.

Aftershocks and Fallout

The Swiss franc’s sudden appreciation sent shockwaves through global markets, triggering a chain reaction of events. Currency values gyrated wildly, stocks plummeted, and the fear of contagion spread like wildfire. Investors who had leveraged positions in euro-denominated assets found themselves trapped in a currency trap, facing severe losses.

Image: mgtblog.com

Lessons from the Forex Storm

The forex earthquake of April 1, 2015, served as a stark reminder of the volatility and interconnectedness of global markets. It laid bare the fragility of currency pegs and the risks inherent in speculative trading. However, it also presented valuable lessons for investors and policymakers alike.

Expert Insights:

“The Swiss franc shock was a wake-up call,” says Dr. Anna Schwartz, a renowned financial economist. “It underscored the importance of sound monetary policies and the dangers of ignoring market forces.”

Professor Maurice Obstfeld, former chief economist of the International Monetary Fund, adds, “Central banks must communicate their intentions clearly and avoid sudden policy shifts that can destabilize markets.”

Actionable Tips:

- Diversify your portfolio across various currencies to mitigate risk.

- Avoid leveraged trading unless you have a deep understanding of the risks involved.

- Stay informed about global economic trends and geopolitical events that can impact currency markets.

- Consult with financial professionals before making major currency-related investment decisions.

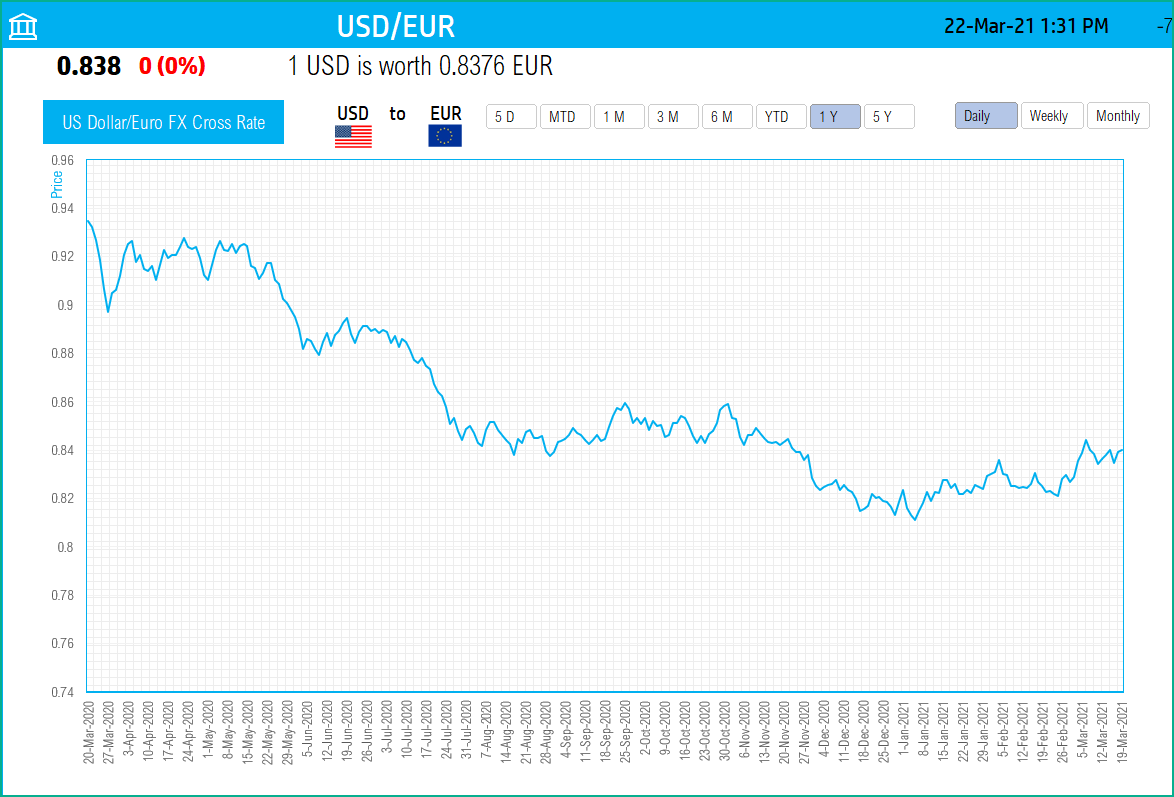

Forex Rate 1 April 2015

Conclusion:

The forex earthquake of April 1, 2015, was an event that shook the very foundations of global currency markets. It served as a stark reminder of the volatility and interconnectedness of our financial world and highlighted the importance of sound monetary policies and prudent risk management. By embracing the lessons of that fateful day, investors and policymakers can better navigate the ever-changing forex landscape and mitigate the risks associated with currency fluctuations.