Up until recently, the foreign exchange market (forex) was a hotbed of activity, with traders generating substantial profits amid heightened volatility. However, the landscape has shifted dramatically in recent weeks, as profits have plummeted alongside a decline in volatility.

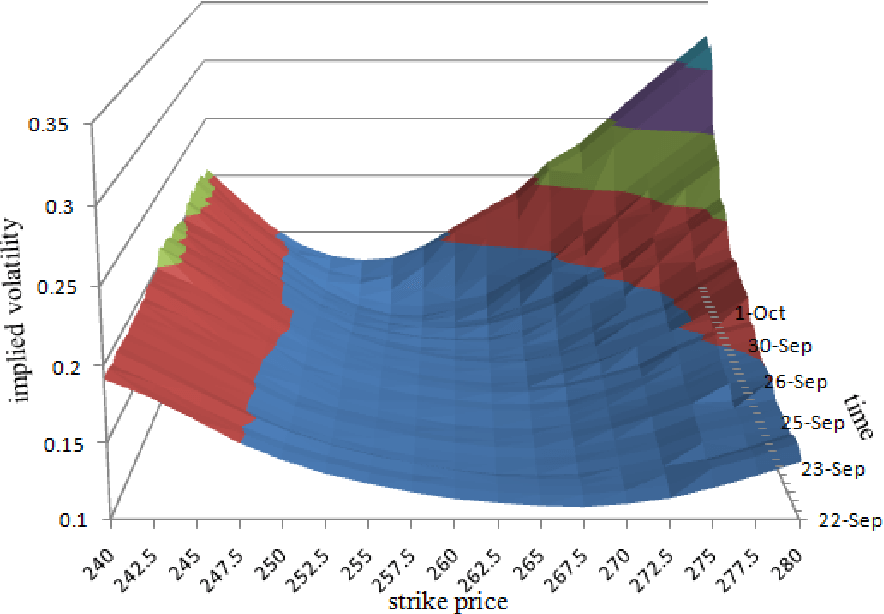

Image: www.risk.net

This sudden downturn has left many traders scratching their heads, wondering what went wrong. In this article, we’ll delve into the reasons behind this reversal and explore the implications for traders moving forward.

Understanding Volatility and Its Impact

Volatility refers to the fluctuations in an asset’s price over time. High volatility indicates large price swings, while low volatility suggests a more stable market. In the forex market, volatility can be influenced by various economic and political events, news announcements, and central bank actions.

Traders often capitalize on volatility by buying and selling currencies at opportune moments. When volatility is high, they have more opportunities to profit from price movements. However, as volatility decreases, so too do the chances of substantial gains.

Causes of the Recent Volatility Decline

Several factors have contributed to the recent decline in forex volatility. First and foremost, global economic conditions have improved significantly. Governments and central banks worldwide have injected trillions of dollars into the economy to stimulate growth and prevent a recession.

As economic activity has picked up and uncertainty has diminished, investors have become more risk-averse. They are less inclined to engage in speculative trading and more likely to seek solace in safer assets. This reduced speculation has reduced demand for currency trading and contributed to the decline in volatility.

Implications for Traders

The drop in volatility presents challenges for forex traders. As the frequency and magnitude of price movements diminish, it becomes more difficult to generate substantial profits. Traders may need to adjust their strategies and risk management approaches to adapt to the new market conditions.

Some traders may choose to focus on trading major currency pairs, such as the EUR/USD or GBP/USD, which typically exhibit higher volatility even during periods of market stability. Others may opt for more exotic currency pairs that offer potential for higher returns but also come with increased risk.

Image: www.forex.academy

Tips for Trading in a Low-Volatility Environment

While the recent decline in volatility may seem daunting, there are steps that traders can take to navigate the market and achieve success:

- Manage Risk Conservatively: Traders should limit their risk exposure by using proper stop-loss orders and maintaining a prudent risk-to-reward ratio.

- Focus on Technical Analysis: During periods of low volatility, technical indicators can provide valuable insights into price trends and potential trade setups.

- Consider Long-Term Trades: Holding positions for longer periods can increase the potential for gains, even during times of low volatility.

Conclusion

The recent decline in forex volatility has significantly impacted traders, reducing their profit-generating opportunities. However, by understanding the reasons behind this trend and adapting their strategies accordingly, traders can navigate this challenging market environment and continue to find success.

As always, it is essential to remember that trading in the foreign exchange market carries inherent risk. Traders should thoroughly understand the risks involved and only allocate funds that they can afford to lose.

Forex Profits Slide As Volatility Falls

Are you interested in the forex profits slide as volatility falls?