When trading forex, nothing beats the feeling of making an informed decision. The forex position size calculator indicator is your secret weapon, giving you the knowledge to enter trades with confidence and purpose. Picture this—you’ve found an ideal trading opportunity, but how much should you allocate? With this tool at your disposal, guesswork becomes a thing of the past, empowering you to trade smarter and potentially enhance your returns.

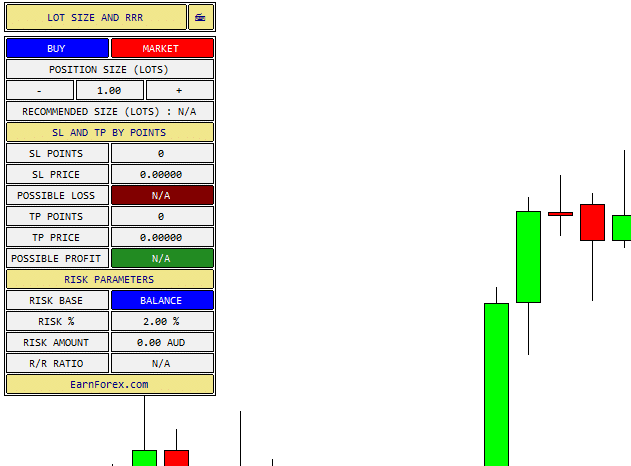

Image: learnpriceaction.com

Strap yourself in for an in-depth dive into the world of position sizing—from its inception to the nuances that make it a game-changer for forex traders like you! We’ll explore the latest trends, unravel expert advice, and provide a comprehensive FAQ that leaves no question unanswered. Knowledge is power, and with this article as your guide, you’ll unlock the secrets to calculated and potentially profitable forex trading.

The Art of Position Sizing: A Journey Through Time

Position sizing, the art of determining your exposure to risk, has its roots in the realm of futures trading. It wasn’t until the mid-2000s, with the advent of retail forex trading, that position size calculators evolved specifically for the currency market.

Over the years, these tools have undergone a technological metamorphosis. Today’s indicators are highly refined, offering a plethora of customization options to suit your unique trading style. Whether you prefer fixed ratios, floating percentages, or dynamic adjustments, there’s a position size calculator out there tailored just for you.

A Comprehensive Roadmap to Effective Position Sizing

Step 1: Define Your Risk Tolerance

Every trader’s risk tolerance is unique, influenced by factors like their financial goals, risk appetite, and emotional resilience. Before venturing into position sizing, it’s crucial to honestly assess your tolerance for potential losses. Remember, risk tolerance is not static; it can fluctuate depending on market conditions and personal circumstances. Regularly reassessing your tolerance ensures your position sizing remains aligned with your risk appetite.

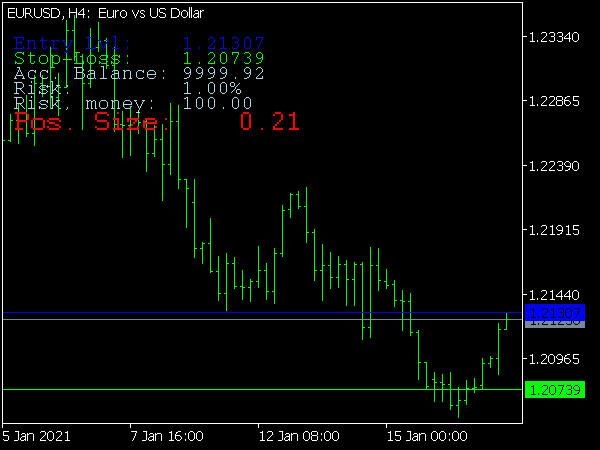

Image: www.best-metatrader-indicators.com

Step 2: Calculate Your Position Size

With your risk tolerance defined, it’s time to harness the power of the position size calculator indicator. Simply input your account balance, risk tolerance percentage, and stop-loss distance. The indicator will crunch the numbers and present you with a recommended position size. You can further fine-tune the calculation by incorporating other factors, such as the volatility of the currency pair you’re trading and the potential reward-to-risk ratio.

Step 3: Monitor and Adjust

Position sizing is not a one-and-done process. As market conditions evolve and your risk tolerance shifts, you’ll need to continuously monitor and adjust your position sizes accordingly. Regularly reviewing your trades, analyzing your performance, and making necessary adjustments are key to maintaining a disciplined and potentially profitable trading strategy.

Expert Tips for Position Sizing Success

From seasoned traders come these invaluable tips to elevate your position sizing prowess:

- Start small: Begin with small position sizes until you gain confidence in your trading strategy and risk management skills.

- Diversify your portfolio: Reduce risk by spreading your trades across multiple currency pairs and asset classes.

- Use a trailing stop-loss: Protect your profits and limit losses by incorporating a trailing stop-loss into your trading plan.

- Manage your emotions: Avoid letting emotions cloud your judgment. Stick to your trading plan and position sizing strategy, even during market fluctuations.

- Continuously educate yourself: The forex market is constantly evolving, so it’s essential to stay up-to-date on the latest trends and developments.

Frequently Asked Questions

- Q: What factors should I consider when choosing a position size calculator?

- A: Consider the calculator’s customization options, accuracy, ease of use, and compatibility with your trading platform.

- Q: Can I use a position size calculator for all my trades?

- A: While position size calculators provide valuable guidance, they should not be your sole decision-making tool. Use them in conjunction with your trading plan and risk management strategy.

- Q: How often should I adjust my position size?

- A: Regularly review your position sizes and adjust them as needed based on market conditions, performance analysis, and changes in your risk tolerance.

- Q: What are the risks associated with using a position size calculator?

- A: Position size calculators are not foolproof. They rely on the accuracy of the input data and assumptions. It’s important to remember that trading involves risk, and position size calculators do not guarantee profit or prevent losses.

- Q: Can position sizing help me become a profitable trader?

- A: Position sizing is an essential element of risk management, which is crucial for long-term trading success. While it cannot guarantee profitability, effective position sizing can potentially enhance your returns and protect your capital.

Forex Position Size Calculator Indicator Free

Conclusion: Empowering Forex Traders with Informed Decision-Making

The forex position size calculator indicator is an indispensable tool for any trader seeking to navigate the forex market with confidence and precision. By harnessing its power, you can determine optimal position sizes that align with your risk tolerance and trading goals. Remember, knowledge is your greatest asset in the world of forex trading. Embrace continuous learning, adapt to changing market conditions, and trade wisely. The path to success lies in informed decision-making, and the position size calculator indicator is your guide along that journey.

Ask yourself this: Are you ready to take control of your forex trading destiny? If so, embrace the forex position size calculator—your secret weapon to informed position sizing and potentially enhanced trading returns.