Understanding Forex Market Volatility

In the dynamic realm of the foreign exchange market, volatility plays a pivotal role. Volatility measures the extent to which exchange rates of currency pairs fluctuate over time. It is a key indicator of market risk and can significantly impact trading strategies.

Image: strafx.com

Real-Time Forex Pairs Volatility Table

Traders and investors rely on real-time forex pairs volatility tables to gain insights into the current market conditions. These tables provide up-to-date information on the volatility of different currency pairs, allowing traders to make informed decisions and adjust their risk management strategies accordingly.

Factors Influencing Currency Pair Volatility

The volatility of a currency pair can be influenced by several factors, including economic indicators, political events, and market sentiment. Some of the key factors that impact volatility are:

- Interest rate decisions: Changes in interest rates by central banks can significantly affect exchange rates, leading to increased volatility.

- Economic growth: Positive economic outlooks can lead to currency appreciation and lower volatility, while economic downturns can lead to currency depreciation and increased volatility.

- Political stability: Political uncertainty and instability can create market jitters, increase volatility, and impact currency values.

- Market sentiment: The overall sentiment of market participants towards a particular currency or economy can have a strong influence on volatility. A positive sentiment can lead to reduced volatility, while a negative sentiment can increase volatility.

Tips to Manage Volatility in Forex Trading

Navigating forex volatility requires a combination of knowledge, experience, and effective strategies. Here are some tips for managing volatility in forex trading:

- Choose the right currency pairs: Traders should carefully select currency pairs based on their risk tolerance and volatility preferences. Some currency pairs, such as AUD/USD or EUR/USD, tend to have lower volatility than others.

- Use stop-loss orders: Stop-loss orders can limit potential losses by automatically exiting a trade when the market price reaches a predetermined level.

- Diversify trading strategy: Diversification involves spreading investments across multiple currency pairs and different trading strategies to reduce overall risk and volatility.

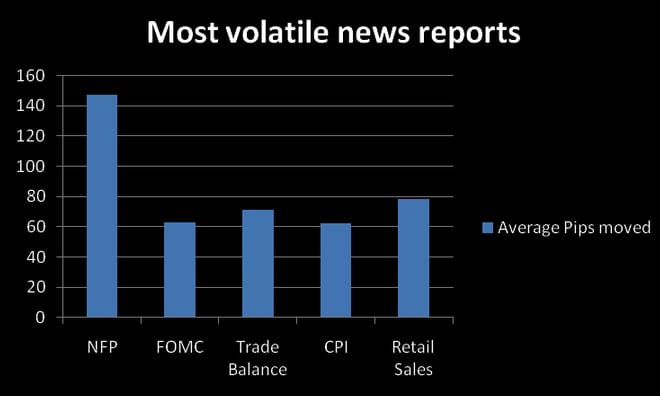

- Monitor market news and economic events: Staying informed about upcoming economic events and news releases can provide valuable insights into potential market volatility.

Image: gohabizaw.web.fc2.com

FAQ about Forex Pairs Volatility

Q: What is the most volatile currency pair?

A: Trading forex has its level of risk and no currency can be appointed to be the most volatile currency as such. Cryptocurrencies can be considered the most volatile currency pairs to trade.

Q: How do I measure forex volatility?

A: Forex volatility is commonly measured through statistical measures such as standard deviation and variance.

Q: What are the benefits of using a volatility table?

A: A volatility table provides real-time insights into market volatility, empowering traders to make informed decisions, manage risk effectively, and adjust their trading strategies accordingly.

Forex Pairs Volatility Table Real Time

Conclusion

In the ever-evolving world of forex trading, comprehending and managing market volatility is essential. Real-Time Forex Pairs Volatility Tables offer valuable information for traders to navigate the dynamic market conditions. By understanding the factors that drive volatility and employing effective trading strategies, forex traders can optimize their trading performance and achieve their financial goals.

Are you ready to explore the exciting and potentially lucrative realm of forex trading?