A Practical Guide to Understanding Currency Markets and Trading

Welcome to the fascinating world of forex trading, where currency pairs dance in a delicate balance of time and global events. Whether you’re a seasoned trader or just dipping your toes into this dynamic market, this comprehensive guide is your roadmap to success.

Image: easyforexpips.com

Forex Pairs: The Basics

Forex pairs are simply the exchange rates between two different currencies. These pairings, such as EUR/USD or GBP/JPY, represent the value of one currency against another. The first currency in the pair is the base currency, while the second is the counter currency. Understanding these pairs is crucial as you navigate the complex world of currency trading.

The Role of Time

Time is a crucial factor in forex trading. Currency markets are in constant flux, influenced by economic, political, and even natural events. Successful traders keep a close eye on the time, both in their own time zones and in the regions of the currencies they’re trading. News released at specific times, such as central bank announcements or economic data, can trigger significant market movements.

Current Market Trends

The forex market is constantly evolving, with new trends emerging regularly. Oversupply and undersupply of certain currencies, driven by factors such as interest rate differentials and geopolitical events, can lead to significant price movements. Staying abreast of these trends through reputable news sources and market analysis platforms can help you stay ahead of the curve.

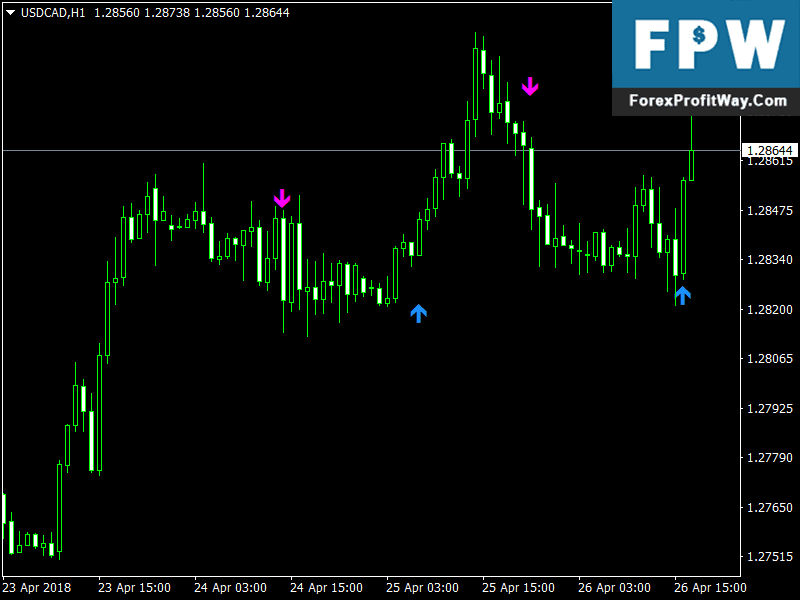

Image: forexprofitway.com

Tips for Success

As a blogger with years of experience in forex trading, I’ve learned a few essential tips to help you maximize your chances of success:

- Master Risk Management: Know your risk tolerance and use proper stop-loss orders to limit potential losses.

- Stay Informed: Follow reputable news sources and economic calendars to stay up-to-date on market-moving events.

- Practice Discipline: Stick to your trading strategy and avoid emotional decision-making.

- Use Leverage Wisely: Leverage can magnify profits but also risks. Use it cautiously and understand the potential consequences.

- Find a Mentor or Community: Learn from experienced traders or join online forums to connect with others sharing your interests.

FAQ on Forex Pairs and Time

Q: What is the most traded currency pair?

A: EUR/USD is the most frequently traded currency pair, accounting for over 24% of global forex turnover.

Q: What is the best time to trade forex?

A: The best time depends on factors such as market volatility, time zone, and your trading strategy. Generally, high-liquidity sessions overlap major financial centers, such as 10:00 – 16:00 GMT during the London session.

Q: How long should I hold a forex position?

A: Holding periods vary depending on your trading strategy. Short-term traders may hold positions for minutes or hours, while swing traders typically hold for a few days to weeks.

Forex Pairs And Time Powered By Ip.Board

Conclusion

Forex trading can be a rewarding but demanding endeavor. Understanding forex pairs, the role of time, and the latest market trends is essential for success. By incorporating the tips and advice shared here, you can enhance your trading skills and navigate the dynamic currency markets with confidence.

So, are you ready to unlock the world of forex trading? Share your thoughts and experiences in the comments below, and let’s continue exploring this exciting world together!