The world of forex trading can be overwhelming, especially for beginners. However, with a reliable broker like Zerodha, paired with a solid understanding of forex pair trading, you can navigate the market effectively. This detailed guide will provide you with a comprehensive overview, covering key concepts, essential tips, and insider secrets to help you optimize your forex trading experience in Zerodha.

Image: fxssi.es

Understanding Forex Pair Trading

Forex pair trading involves simultaneously buying one currency while selling another. These currency pairs are typically quoted in three-letter currency codes, such as EUR/USD, indicating the value of the euro relative to the US dollar. By accurately predicting exchange rate fluctuations between currency pairs, traders aim to profit from the price movements.

The Basics of Forex Pair Trading in Zerodha

Zerodha is one of India’s leading online brokerages, offering a user-friendly platform and advanced trading tools. To initiate forex pair trading in Zerodha, you must create an account and fund your trading balance. Once your account is active, you can access the forex market via the Zerodha trading platform.

Selecting the right forex pairs is crucial. Popular pairs like EUR/USD, GBP/USD, and USD/JPY offer high liquidity and lower spreads. Spreads refer to the difference between the bid and ask prices, and lower spreads translate to reduced trading costs.

Essential Tips for Success

- Thoroughly Research Markets: Study market trends, economic indicators, and geopolitical events that may impact currency pairs.

- Set Realistic Trading Goals: Avoid setting unrealistic profit targets, as this can lead to emotional trading decisions.

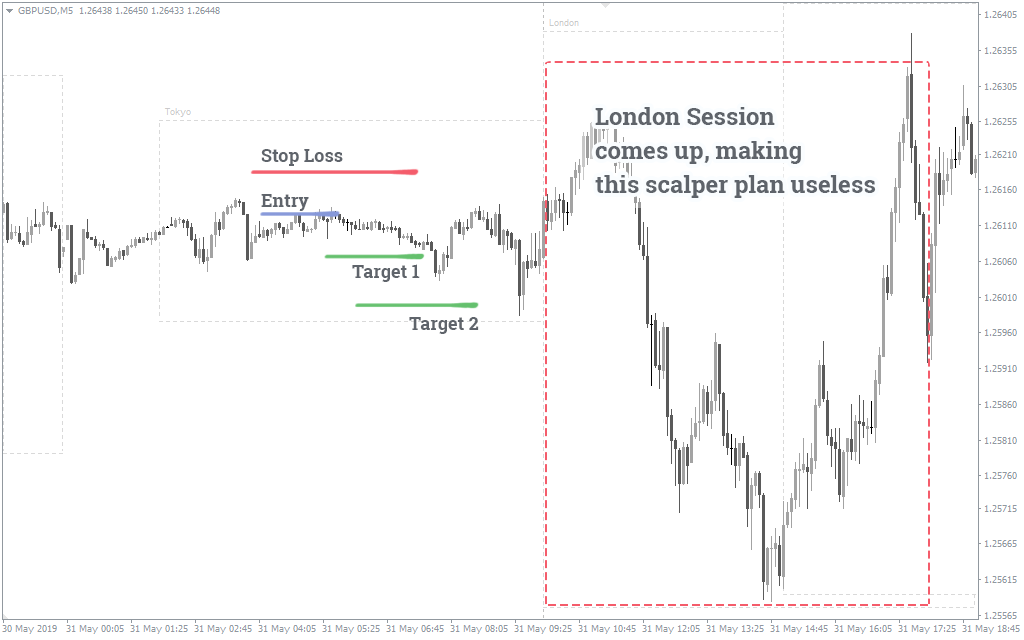

- Use Technical Analysis: Technical analysis involves studying historical price charts to identify trading opportunities, such as support and resistance levels.

- Manage Risk: Employ risk management strategies, such as setting stop-loss orders, to limit potential losses.

- Stay Informed and Adapt: Constantly monitor market news and make adjustments to your trading strategy based on changing market dynamics.

Image: www.audacitycapital.co.uk

FAQs on Forex Pair Trading in Zerodha

- Q: What is the minimum deposit required for forex pair trading in Zerodha?

A: The minimum deposit required is ₹2,000. - Q: What are the available order types in Zerodha for forex pair trading?

A: Zerodha offers limit orders, market orders, stop-loss orders, and trailing stop-loss orders. - Q: What is the difference between a buy stop and a sell stop order?

A: A buy stop order is placed when the price is above the current market price, indicating a desire to buy the pair if the price rises to that level. A sell stop order is the opposite, where the order is placed below the current market price, indicating a desire to sell if the price falls to that level.

Forex Pair Trading In Zerodha

Conclusion

Forex pair trading in Zerodha provides a rewarding opportunity to leverage market fluctuations for potential profits. By following the insights shared in this guide, you can equip yourself with the knowledge and strategies necessary to navigate the forex market effectively. So, are you ready to embark on the exciting journey of forex pair trading with Zerodha? Remember, education, research, and risk management are the keys to success in this dynamic financial arena.