Immerse yourself in the dynamic world of forex trading, where identifying profitable trading opportunities is an art form. Forex pairs, the cornerstone of currency trading, coupled with the strategic selection of time frames, empower traders to navigate market intricacies and capitalize on market fluctuations. Unleash the potential of this powerful combination as we explore the intricacies of forex pairs and time frames.

Image: ulurahopyyiza.web.fc2.com

The Essence of Forex Pairs

The foreign exchange market, commonly known as forex, is a global marketplace where currencies are traded. Forex pairs represent the exchange rate between two different currencies. For instance, EUR/USD denotes the exchange rate between the Euro and the US Dollar. Understanding the relationship between currencies is crucial for successful trading.

When trading forex pairs, traders speculate on the potential appreciation or depreciation of one currency against the other. By analyzing economic data, market sentiment, and technical indicators, traders aim to predict future price movements and position themselves for potential profit.

Time Frames: The Temporal Compass

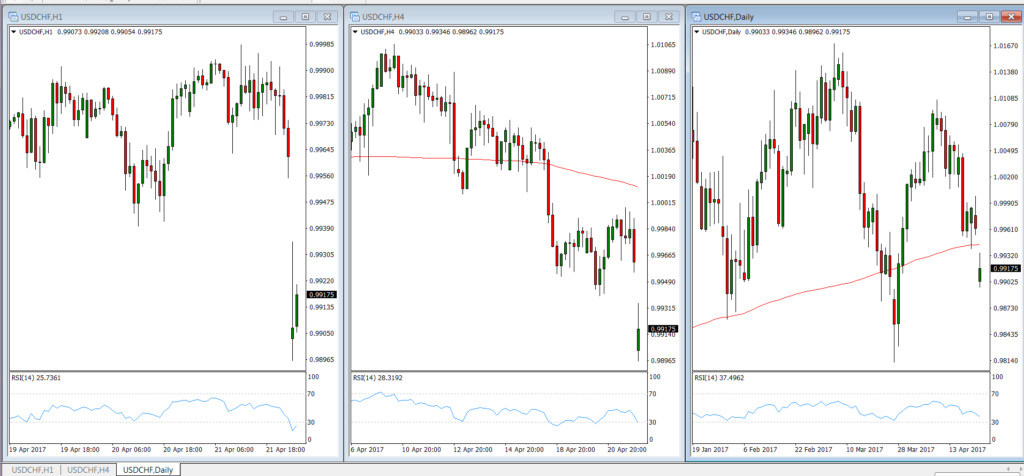

Time frames, an essential component of forex trading, refer to the duration over which price movements are analyzed. Selecting the appropriate time frame aligns with the trader’s trading strategy and risk tolerance. Popular time frames include:

- Short-term: Scalping (seconds to minutes), intraday (15-minute to 1-hour candlesticks)

- Medium-term: Day trading (4-hour to daily candlesticks), swing trading (daily to weekly candlesticks)

- Long-term: Position trading (weekly to monthly candlesticks), investing (months to years)

Traders should consider the volatility and speed of market movements when selecting a time frame. For instance, short-term time frames are suited for capturing quick price fluctuations, while long-term time frames provide a broader perspective for evaluating overall trends.

Unveiling the Significance of Forex Pairs and Time Frames

The synergy between forex pairs and time frames bestows several advantages upon traders:

- Tailored Trading Strategies: Matching specific time frames with trading strategies enhances efficiency and profitability.

- Precision Timing: Identifying precise entry and exit points is made possible by carefully considering time frames.

- Risk Management: Controlling risk exposure becomes more manageable by selecting time frames compatible with the trader’s risk appetite.

- Opportunity Identification: Different time frames reveal diverse trading opportunities, catering to traders with varying preferences.

Understanding the relationship between forex pairs and time frames empowers traders to navigate market complexities and seize profitable trading opportunities. By aligning their trading strategy with the appropriate time frame, traders can achieve maximum efficiency and enhance their overall trading performance.

Image: www.imperodeglisposi.it

Expert Advice for Forex Success

Embrace Dynamic Time Frames: Adapt trading strategies to different market conditions by adjusting the time frame.

Align Time Frames with Risk Tolerance: Choose time frames compatible with risk tolerance to prevent excessive losses.

Harness the Power of Multiple Time Frames: Analyze the same pair across multiple time frames to gain insights into long-term trends and short-term fluctuations.

Avoid Single Time Frame Reliance: Relying on a single time frame can limit trading opportunities and increase exposure to sudden market changes.

Understanding the Correlation Between Forex Pairs: Specific pairs, such as EUR/USD and GBP/USD, often move in tandem during market sessions.

Implement these expert recommendations to refine your forex trading strategy and maximize your chances of success. Remember, mastering the art of forex trading requires continuous learning, market analysis, and a disciplined approach.

Common Forex Pair Time Frame Combinations

| Trading Style | Forex Pair | Time Frame |

|---|---|---|

| Scalping | EUR/USD | 1-minute candlestick |

| Day Trading | GBP/USD | 15-minute candlestick |

| Swing Trading | USD/JPY | Daily candlestick |

| Position Trading | AUD/USD | Weekly candlestick |

These combinations provide a glimpse into how traders match time frames with their trading style and currency pairs of interest.

Frequently Asked Questions

Q: What is the best time frame for forex trading?

A: The optimal time frame depends on the trader’s trading strategy and risk tolerance.

Q: Can I trade forex pairs on multiple time frames simultaneously?

A: Yes, analyzing the same pair across different time frames provides a comprehensive market view.

Q: How do I choose the right forex pair for my trading strategy?

A: Consider the pair’s volatility, liquidity, and correlation with other pairs when selecting.

Q: Is it necessary to have extensive experience to trade forex?

A: While experience is valuable, beginners can start with a demo account to gain familiarity with the process.

Q: How can I improve my forex trading performance?

A: Continuously educate yourself, analyze market data, and refine your trading strategy through practice.

Forex Pair And Time Frame No Comments Posted Yet

Conclusion

Recognizing the intrinsic connection between forex pairs and time frames is a pivotal step towards honing your forex trading skills. By embracing the right combination, you empower yourself with the ability to identify profitable trading opportunities, navigate market intricacies, and achieve long-term success in the dynamic world of forex trading.

Are you ready to embark on the journey of mastering forex pairs and time frames? Enhance your trading knowledge, refine your strategy, and seize the opportunities that the forex market has to offer. Remember, the path to success is paved with perseverance, dedication, and a thirst for continuous learning.