Introduction

In today’s globalized economy, understanding foreign exchange (forex) markets is paramount for businesses and individuals alike. Forex trading, the exchange of one currency for another, presents both opportunities and risks for those looking to capitalize on currency fluctuations. To navigate these markets effectively, it is imperative to grasp the fundamentals of forex trading. This article demystifies the world of forex, providing a comprehensive guide for beginners and seasoned traders.

Image: www.rightsofemployees.com

Defining Forex Trading

Forex trading involves the buying and selling of currencies with the intention of profiting from their price movements. Unlike traditional stock exchanges, forex markets operate 24/5, allowing traders to respond to news and events in real time. The liquidity of forex markets, with daily trading volumes exceeding $5 trillion, ensures that trades can be executed swiftly and efficiently. Currencies are typically traded in pairs, with the exchange rate representing the value of one currency relative to the other.

Key Concepts in Forex Trading

Before embarking on the journey of forex trading, it is essential to understand a few fundamental concepts.

- Currency Pair: Forex trades involve the simultaneous buying of one currency and selling of another. The value of the currency pair is expressed as the exchange rate, which fluctuates constantly.

- Pip: Pip (point in percentage) is the smallest increment of price movement in forex trading. It represents a one-hundredth of a percent or one basis point.

- Leverage: Leverage allows traders to amplify potential profits by borrowing capital, increasing both rewards and risks. It is important to understand the mechanics of leverage and use it judiciously to avoid substantial losses.

- Spread: The spread is the difference between the bid price (at which you can sell a currency) and the ask price (at which you can buy a currency). The spread is crucial in determining the profitability of your trades.

Getting Started with Forex Trading

Once you have grasped these core concepts, the next step is to open a forex trading account with a reputable broker. Choose a broker that offers competitive spreads, reliable execution, and a user-friendly trading platform. Before jumping into live trading, practice on a demo account to hone your skills and gain familiarity with the platform.

Image: cdacmohali.in

Trading Strategies and Analysis

Succeeding in forex trading requires a well-defined trading strategy that aligns with your risk tolerance and trading style. There are numerous trading strategies available, each with its own merits and application. Some popular strategies include:

- Trend Trading: This strategy involves identifying and trading with the prevailing trend of the currency pair.

- Scalping: Scalpers capitalize on small price fluctuations within short time frames, aiming for quick profits.

- News Trading: News-based traders react to economic and political events that can significantly impact currency values.

Technical analysis and fundamental analysis are two primary methods for evaluating market conditions and making trading decisions. Technical analysis focuses on historical price action, charting patterns, and technical indicators to identify potential trading opportunities. Fundamental analysis examines economic, political, and social factors that can influence currency values.

Risk Management: The Key to Survival

Risk management is the cornerstone of successful forex trading. As a trader, you must recognize and manage risks effectively to protect your capital.

- Stop-loss Orders: Stop-loss orders are essential for limiting potential losses. They automatically close a trade if the price moves against you by a predetermined amount.

- Position Sizing: It is crucial to manage the size of your trades in relation to your account balance and risk tolerance. Avoid risking more than you can afford to lose.

- Hedging: Hedging involves using strategies to reduce the risk of a loss-making position. One common hedging technique is opening an opposite trade with a smaller position size.

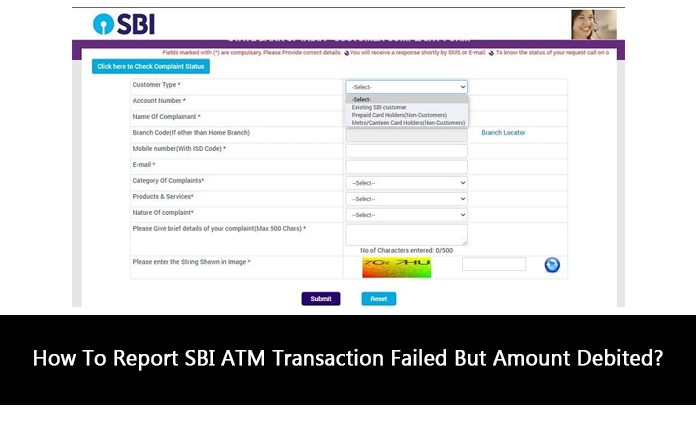

Forex Or Routine Atm Sbi

Conclusion

Navigating the world of forex trading requires knowledge, skill, and a disciplined approach to risk management. By comprehending the basics outlined in this article, you can lay the groundwork for informed trading decisions and long-term success in forex markets. As with any financial instrument, it is essential to conduct thorough research, seek guidance from experienced traders, and perpetually educate yourself in the ever-evolving realm of foreign exchange.