Foreign Exchange: A Comprehensive Guide from A to Z

Image: moneteo.com

Introduction:

Imagine having the power to transform currencies into vast fortunes or unimaginable losses with a click of a button. That’s the exhilarating and treacherous world of foreign exchange (forex), where currencies dance in a perpetual waltz of value exchange. In this comprehensive guide, we’ll delve into the depths of forex, guiding you from its origins to its intricate machinations, empowering you to navigate this enigmatic financial arena with confidence and knowledge.

Demystifying Foreign Exchange

Foreign exchange is essentially the buying and selling of currencies. It’s like a colossal marketplace where individuals, banks, and corporations exchange currencies to facilitate international trade, make investments, or simply travel abroad. The heartbeat of forex lies in its exchange rates, which determine how much of one currency can be bought or sold for another.

The Genesis of Foreign Exchange

Foreign exchange has its roots in ancient times, when traders bartered goods and services across borders. Over time, coins and currencies came into being, and the need for exchange rates to facilitate commerce became evident. The formalization of forex trading emerged in the 1970s with the collapse of the Bretton Woods system, which had pegged currencies to the US dollar.

Key Concepts of Forex

To comprehend forex, grasping a few fundamental concepts is imperative:

- Currency Pair: Forex trading involves the exchange of two currencies simultaneously, such as EUR/USD, where EUR denotes the base currency and USD the quote currency.

- Exchange Rate: The exchange rate between two currencies indicates how much of the base currency is required to buy one unit of the quote currency.

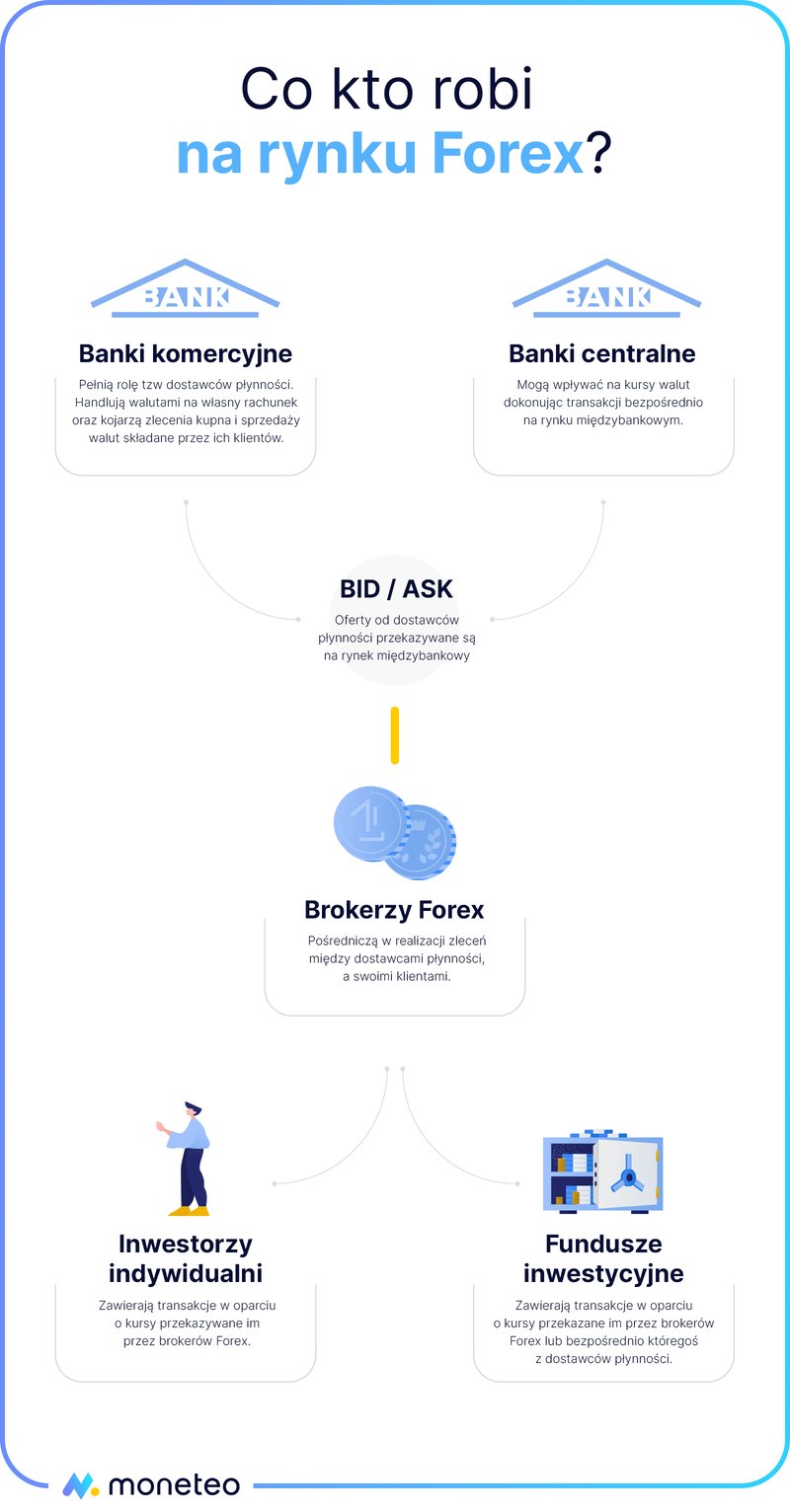

- Market Participants: Forex participants span a diverse spectrum, including retail traders, institutional investors, banks, and even central banks.

- Major Currency Pairs: Forex markets primarily focus on seven major currency pairs, which account for a significant share of global trading volume.

Understanding Market Forces

The value of currencies fluctuates constantly due to a complex interplay of economic, political, and social factors. Economic indicators like inflation, interest rates, and GDP have a profound impact on currency valuations. Political events, such as elections or international conflicts, can also trigger market volatility.

Types of Forex Orders

Forex traders utilize various order types to execute their strategies. Some common orders include:

- Market Order: An order to buy or sell at the prevailing market price.

- Limit Order: An order to buy below or sell above a specified price.

- Stop Order: An order to close a position once a predetermined price level is reached.

Trading Strategies

Forex traders employ diverse trading strategies to maximize their gains. Some popular strategies include:

- Trend Following: Capitalizing on continuing market trends by buying in uptrends and selling in downtrends.

- Scalping: Aiming for small, frequent profits by trading on small price movements.

- Day Trading: Closing all trades before the market closes for the day to avoid overnight risks.

Managing Risk

Risk management is paramount in forex trading. Effective risk mitigation strategies include:

- Stop-Loss Orders: Automatic orders that close a position if it reaches a predetermined loss threshold.

- Trading with Leverage: Using borrowed funds to amplify trading positions, thereby increasing potential profits but also risks.

- Diversification: Spreading investments across different currency pairs or asset classes to reduce overall risk.

Expert Insights

Seasoned forex traders offer valuable insights that can enhance your trading prowess:

- “Thoroughly research before investing, understanding the macroeconomic factors that influence currency values.” – Mark Mobius, Value Investor

- “Stay disciplined and manage your emotions. Avoid impulsive trading decisions.” – George Soros, Investor and Philanthropist

Actionable Tips for Forex Traders

- Learn the basics: Gain a thorough understanding of forex concepts and terminology.

- Practice on a demo account: Experiment with trading strategies before risking real capital.

- Manage your risk: Implement risk management measures such as stop-loss orders and controlled leverage.

- Stay updated with news: Monitor economic and political developments that impact currency valuations.

- Consult with experts: Seek guidance from experienced forex traders and analysts.

Conclusion:

Foreign exchange trading presents an opportunity to navigate the global financial markets in pursuit of lucrative returns. By mastering the intricacies of forex, implementing prudent risk management strategies, and harnessing expert insights, you can embark on a journey of financial empowerment and potential wealth creation. Approach forex with a blend of knowledge, discipline, and a dash of audacity, and you will find yourself equipped to navigate the treacherous waters of currency markets and claim your place among the successful forex traders.

Image: maxprofit24.pl

Forex Od A Do Z

https://youtube.com/watch?v=Ly_Z7XLpFTk