The foreign exchange market, commonly known as Forex, is an ever-evolving landscape characterized by constant fluctuations. Within this dynamic realm, volatility stands as a critical element that traders must navigate effectively to maximize profits. This article will delve into the intricacies of forex multi-currency volatility, and introduce you to the versatility of MetaTrader, a powerful trading platform that empowers traders to harness this volatility to their advantage.

Image: analyticstrade.com

Defining Multi-Currency Volatility in Forex

Multi-currency volatility refers to the simultaneous fluctuation of exchange rates between multiple currency pairs. These movements can be attributed to various factors, including economic news, geopolitical events, and market sentiment. Understanding multi-currency volatility is crucial as it can influence the performance of your trading strategies and risk profiles.

MetaTrader: Your Gateway to Multi-Currency Analysis

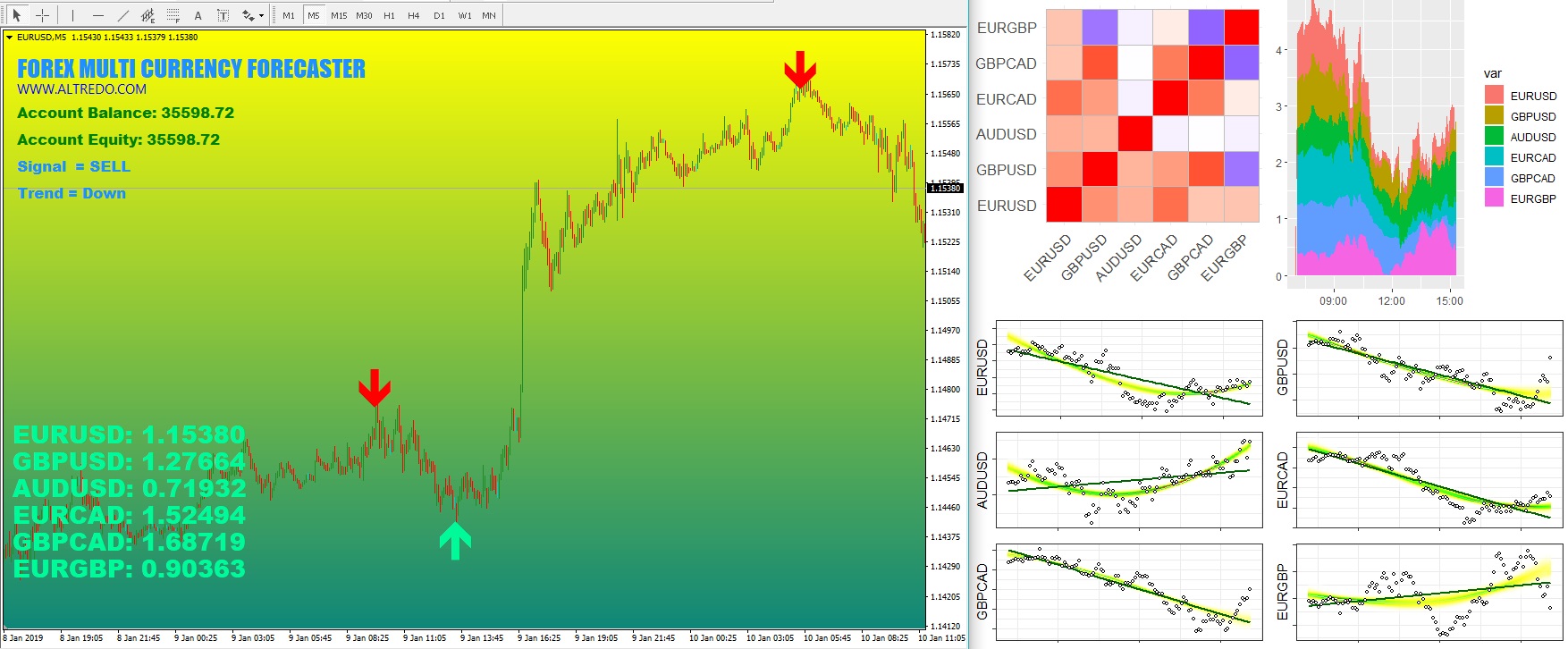

MetaTrader, the industry-leading trading platform, provides an extensive arsenal of tools and features tailored specifically for analyzing multi-currency volatility. Its user-friendly interface and advanced charting capabilities enable traders to monitor exchange rates, identify trends, and make informed trading decisions.

Key Features of MetaTrader for Multi-Currency Volatility Analysis

- Multi-market Watch: Track the real-time performance of multiple currency pairs simultaneously, enabling you to identify correlations and potential trading opportunities.

- Technical Analysis Tools: Utilize a comprehensive suite of technical indicators, including moving averages, Bollinger Bands, and Ichimoku Kinko Hyo, to analyze price movements and predict potential price movements.

- Multi-Timeframe Analysis: Analyze multi-currency volatility across various timeframes, from intraday to monthly charts, providing a comprehensive view of market behavior.

- Custom Indicators and Expert Advisors: Extend the capabilities of MetaTrader by downloading custom indicators and Expert Advisors (EAs), enabling you to tailor your analysis and trading strategies to your specific needs.

Image: tradingrobot.trade

Harnessing Multi-Currency Volatility for Profitable Trading

Armed with the power of MetaTrader, traders can harness multi-currency volatility to develop effective trading strategies. Here are some proven techniques:

- Correlation Trading: Identify currency pairs that exhibit strong positive or negative correlation. By trading pairs with high correlation, you can potentially reduce risk and enhance your profit potential.

- Divergence Trading: Analyze the divergence in price movements between different currency pairs. This strategy involves buying or selling currency pairs that are moving in opposite directions.

- Volatility Breakout Trading: Identify periods of high or low volatility and place trades accordingly. Breakouts from volatility ranges can signal potential trading opportunities.

Forex Multi Currency Volatility Metatrader

Conclusion

In the ever-fluctuating world of forex, understanding and leveraging multi-currency volatility is paramount. MetaTrader, with its advanced analysis tools and user-friendly interface, empowers traders to navigate this complex market with confidence. By mastering the techniques described in this article, you can unlock the potential of multi-currency volatility and enhance your trading profitability. Explore the possibilities of MetaTrader today and unlock the secrets to successful forex trading.