Introduction:

In the labyrinthine world of international finance, the Forex multi-currency card has emerged as a beacon of convenience and control. Designed to simplify cross-border transactions, these cards enable individuals and businesses alike to navigate the complexities of global currencies seamlessly. This article delves into the intricacies of Forex multi-currency cards, exploring their far-reaching benefits, limitations, and the maximum thresholds that govern their usage.

Image: cardinsider.com

Forex multi-currency cards, as the name suggests, are payment instruments that hold multiple currencies simultaneously. This eliminates the hassle of exchanging currencies at unfavorable rates or carrying a multitude of physical cards. By offering a single card solution, Forex multi-currency cards empower users with the flexibility to transact in various currencies at the touch of a button.

Understanding Forex Multi-Currency Cards:

Forex multi-currency cards function by consolidating balances from multiple currency accounts into a single card. Each currency account is assigned a specific sub-account on the card, allowing users to store funds and conduct transactions in their preferred currencies. The card is linked to a central account, which facilitates easy transfer of funds between the different sub-accounts.

The key advantage of Forex multi-currency cards lies in their ability to convert currencies at competitive interbank rates, typically more favorable than those offered by traditional money changers or banks. This can result in significant savings on exchange fees, especially for individuals or businesses that frequently travel or engage in cross-border transactions.

Forex Multi-Currency Card Maximum Limits: Striking a Balance

To ensure responsible use and prevent excessive overspending, Forex multi-currency cards come with maximum limits that restrict the amount of funds that can be loaded onto the card or used during a specific period. These limits vary depending on the card issuer and account type and can be categorized into daily withdrawal limits, spending limits, and maximum card balance limits.

Understanding the maximum limits associated with Forex multi-currency cards is crucial for users to optimize their financial planning. Daily withdrawal limits determine the maximum amount of cash that can be withdrawn from ATMs using the card, while spending limits control the total amount of purchases that can be made within a given time frame. The maximum card balance limit, on the other hand, restricts the aggregate value of funds that can be stored on the card at any one time.

Navigating Forex Multi-Currency Card Limits:

To navigate Forex multi-currency card limits effectively, users should consider the following strategies:

-

Assess Spending Habits: Prior to setting maximum limits, it is advisable to evaluate typical spending patterns and determine the appropriate limits that align with personal or business needs.

-

Adjust Limits Prudently: Card issuers often allow users to request limit adjustments. However, it is essential to approach limit increases cautiously and avoid exceeding individual financial capabilities.

-

Monitor Transactions: Regular monitoring of transactions helps users stay within their limits and avoid potential penalties or account restrictions.

-

Communicate with Issuer: If users anticipate exceeding their limits, timely communication with the card issuer may enable temporary adjustments or alternative arrangements.

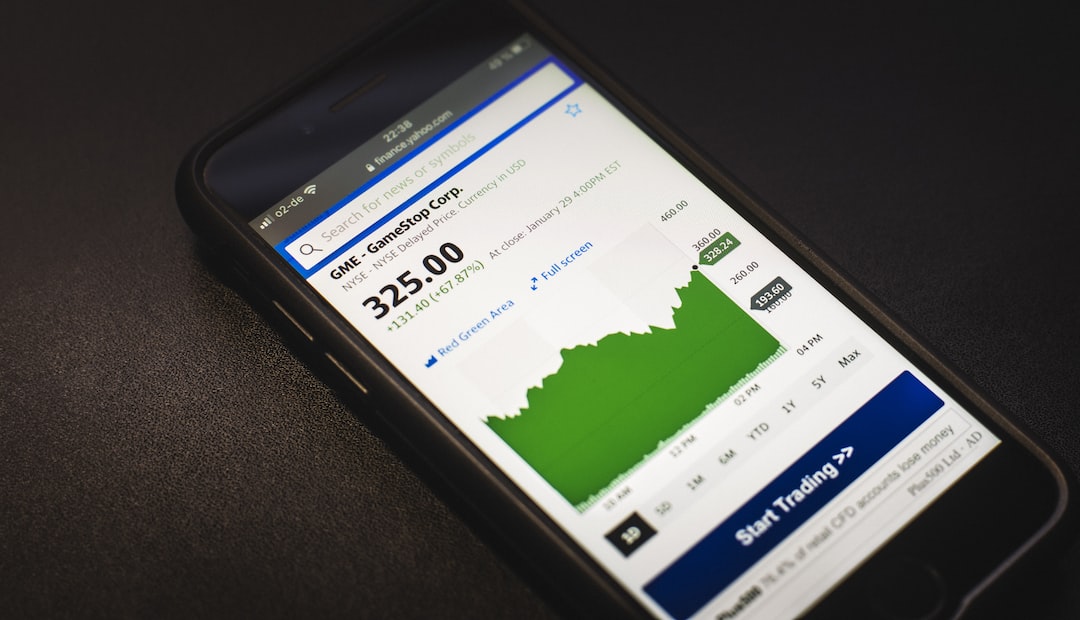

Image: www.forex.academy

Forex Multi Currency Card Maximum

Conclusion:

Forex multi-currency cards offer unparalleled convenience and cost-effectiveness for global financial transactions. However, understanding and adhering to the maximum limits associated with these cards is paramount to responsible and efficient use. By carefully considering spending habits, adjusting limits judiciously, monitoring transactions, and communicating with card issuers, users can unlock the full potential of Forex multi-currency cards and experience the transformative power of seamless international financial management.