Introduction

In the tumultuous realm of finance, where fast-paced transactions and volatile market conditions reign supreme, a well-informed trading strategy holds the key to success. Embarking on a forex market adventure requires a firm grasp of the dynamics that shape market behavior. Enter the Forex Marketing Trading Hour Committee – a beacon of knowledge that empowers traders with critical insights.

Understanding Forex Market Hours

The Forex (Foreign Exchange) market, unlike traditional stock exchanges, operates 24 hours a day, five days a week, spanning the globe from its hubs in London, New York, Tokyo, and Singapore. To navigate this global web of currency trading, traders need an in-depth understanding of market hours, which vary across time zones.

Trading Session Overlap and Volatility

As different market sessions overlap, the trading activity intensifies, creating windows of heightened volatility. The most significant overlap occurs during the London and New York sessions, making this period a prime time for traders to capitalize on market movements. However, during less active periods, such as the Asian and Pacific sessions, volatility tends to be lower, resulting in slower price movements.

Selecting the Optimal Trading Hours

Each trader’s trading style and risk tolerance should dictate their choice of trading hours. Scalpers, who prefer short-term trades within minutes, find the high volatility of the London-New York overlap ideal. Conversely, swing traders, who hold positions for days or weeks, may favor the relatively calm waters of the Asian or Pacific sessions.

Expert Advice for Forex Traders

Seasoned traders recommend meticulous market analysis before entering any trade. This involves studying historical price movements, identifying market trends, and assessing current economic news and events. Additionally, managing risk effectively through proper position sizing and stop-loss placement is paramount to preserving capital.

Integration of Technology for Enhanced Performance

The technological landscape has revolutionized Forex trading, offering an array of tools to enhance trading efficiency. From automated trading systems to real-time market news feeds, the integration of technology empowers traders with data-driven insights and faster execution.

Frequently Asked Questions

Q: What are the key factors to consider when choosing trading hours?

A: Market volatility, trading style, and risk tolerance are crucial factors to consider.

Q: How does economic news impact the Forex market?

A: Economic news and events can cause significant price fluctuations, so staying informed about major releases is vital.

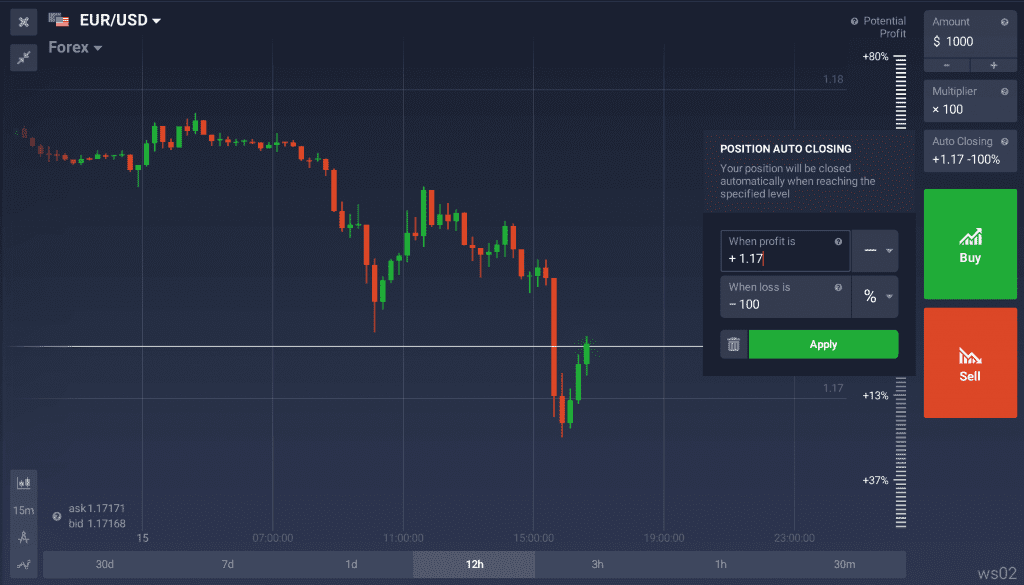

Image: blog.iqoption.com

Q: What are the benefits of using technology in Forex trading?

A: Technology offers automated trade execution, real-time market analysis, and enhanced risk management capabilities.

Image: www.bank2home.com

Forex Marketing Trading Hour Committee

Conclusion

The Forex market presents a dynamic and exciting arena for traders seeking financial success. By understanding the intricacies of market hours, traders can optimize their trading strategies, capitalize on market movements, and navigate the complexities of currency trading with confidence.

Would you like to delve deeper into the intricacies of the Forex market? Share your questions below, and let us guide you on your journey to becoming a savvy trader.