The forex market is a constantly evolving landscape, with sentiment often playing a major role in determining price movements. While technical analysis and fundamental data provide valuable insights, incorporating sentiment indicators into your trading strategy can further enhance your decision-making process. In this comprehensive review, we’ll dive into the intricacies of forex market sentiment indicators, exploring their benefits, limitations, and practical applications.

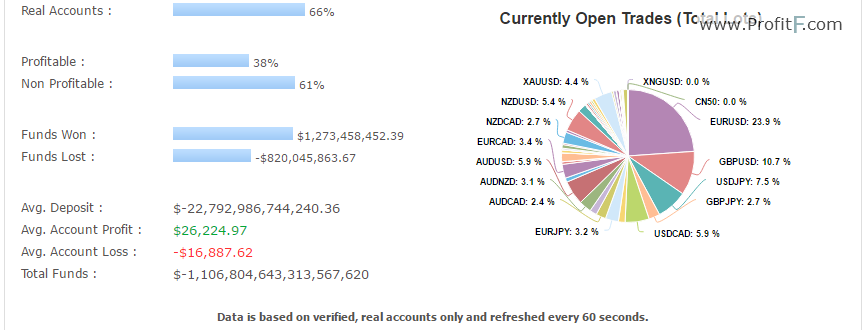

Image: www.profitf.com

Navigating the ever-changing forex market can be daunting. Imagine yourself as a lone sailboat venturing into a vast, tempestuous ocean. Amidst the crashing waves and swirling currents, the ability to gauge the prevailing wind direction can guide you toward calmer waters. Forex sentiment indicators serve as your compass, providing you with a glimpse into the collective mindset of market participants.

Sentiment Indicators: A Gateway to the Market’s Pulse

Sentiment indicators attempt to measure the overall sentiment or mood of market participants. Contrary to popular belief, price action alone does not reveal the complete picture; it often conceals the underlying forces driving market movements. Sentiment indicators aim to fill this void by capturing the collective optimism or pessimism prevailing among traders, institutional investors, and retail participants.

Types of Sentiment Indicators

Forex sentiment indicators come in various forms, each with its unique strengths and weaknesses. Some common types include:

• **Commitment of Traders (COT) Report:** Tracks futures or forward contracts held by different categories of traders, such as large speculators, commercial hedgers, and non-commercials.

• **Currency Futures Speculative Positioning Index:** Measures the net speculative positioning in futures contracts for a given currency pair.

• **Social Media Analysis:

• **Bull/Bear Ratio:** Indicates the relative strength of buyers versus sellers in a given market.

Each sentiment indicator provides a different perspective on market sentiment, enabling traders to triangulate their analysis.

Benefits of Sentiment Indicators in Forex Trading

Integrating sentiment indicators into your forex trading strategy offers several compelling benefits:

• **Enhanced Decision-Making:** By understanding the prevailing market sentiment, you can make more informed decisions about potential trading opportunities.

• **Market Confirmation:** Sentiment indicators can provide confirmation of existing trends or highlight potential reversals.

• **Increased Confidence:** Trading with confidence is crucial. Sentiment indicators can boost your conviction in your trading decisions.

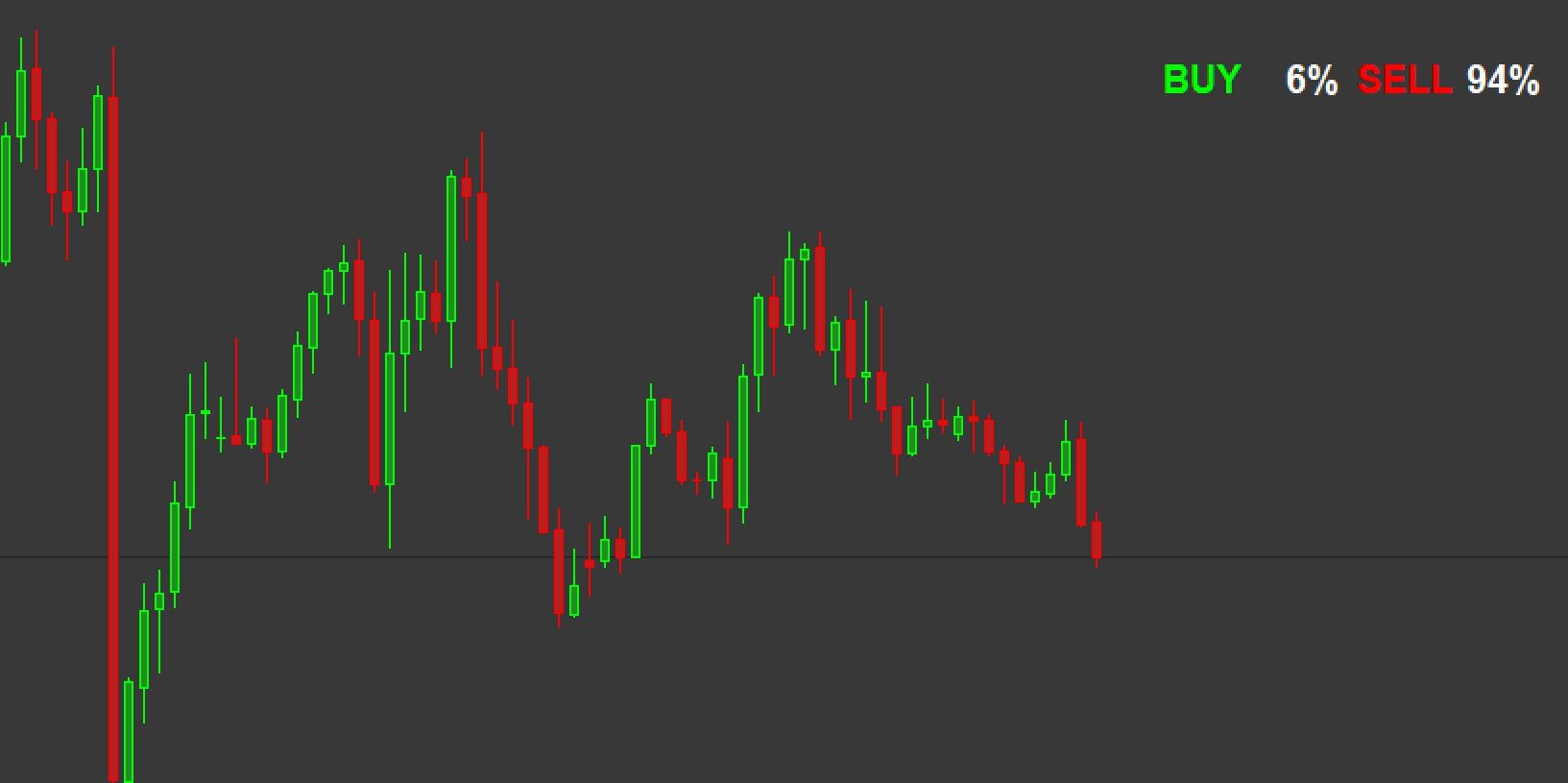

Image: www.fx141.com

Limitations and Practical Applications

While sentiment indicators offer valuable insights, it’s important to note their limitations:

• **Lag Time:** Sentiment indicators often trail price action, which can lead to delayed signals.

• **False Signals:** Sentiment indicators are not infallible and can sometimes produce false signals.

To mitigate these limitations, consider the following practical applications:

• **Trend Confirmation:** Use sentiment indicators to confirm existing trends or identify potential reversal points.

• **Trading Divergence:** Monitor discrepancies between price action and sentiment indicators as they can provide trading opportunities.

• **Multiple Sentiment Indicators:** Employ a combination of sentiment indicators to enhance your analysis.

Tips and Expert Advice

To maximize the efficacy of sentiment indicators, consider these tips:

• **Understand Sentiment Indicator Limitations:** Be aware of the limitations of sentiment indicators and use them judiciously.

• **Combine Technical and Fundamental Analysis:** Use sentiment indicators in conjunction with technical and fundamental analysis for a comprehensive approach.

• **Calibrate Sentiment Indicators:** Adjust sentiment indicator parameters based on your personal risk tolerance and trading strategy.

Frequently Asked Questions (FAQs)

Q: Do sentiment indicators guarantee profits?

A: No, sentiment indicators are not foolproof and should not be relied upon solely for trading decisions.

Q: Which sentiment indicator is the most reliable?

A: The reliability of sentiment indicators varies, and the most appropriate indicator depends on the specific market conditions and trading strategy.

Q: How often should sentiment indicators be checked?

A: The frequency of checking sentiment indicators depends on the trader’s strategy and trading style. It’s generally recommended to monitor sentiment indicators regularly, but avoid overanalyzing them.

Forex Market Sentiment Indicator Review

Conclusion

Forex market sentiment indicators provide a valuable tool for traders seeking to gauge market sentiment and make informed trading decisions. While they offer benefits such as enhanced decision-making, market confirmation, and increased confidence, it’s crucial to be aware of their limitations and use them in conjunction with other trading methods.

Before implementing sentiment indicators into your trading strategy, consider your personal trading style, risk tolerance, and the specific market conditions. By understanding the purpose, benefits, and limitations of sentiment indicators, you can harness their power to navigate the tumultuous waters of the forex market with greater confidence and potential for success.

Are you eager to delve deeper into the world of forex market sentiment indicators? Share your questions or thoughts in the comments section below.