For those who are new to the world of forex, one of the most important aspects to understand is where the market is actually traded.

Image: techonlineblog.com

This is a question that often comes up for those who are first starting out in forex trading, given that it is not as straightforward as the stock or futures markets.

The Interbank Market

The vast majority of forex trading, which accounts for around $5 trillion worth of transactions each day, takes place in the interbank market.

This is a global network of banks and other financial institutions that trade currencies with each other.

How the Interbank Market Works

When a retail forex broker receives an order to buy or sell a currency pair from a customer, they will send that order to their liquidity provider, which is often a large bank.

The bank will then match the order with an opposite order from another client of the broker.

This process occurs in a completely decentralized manner, with no central exchange or clearing house involved.

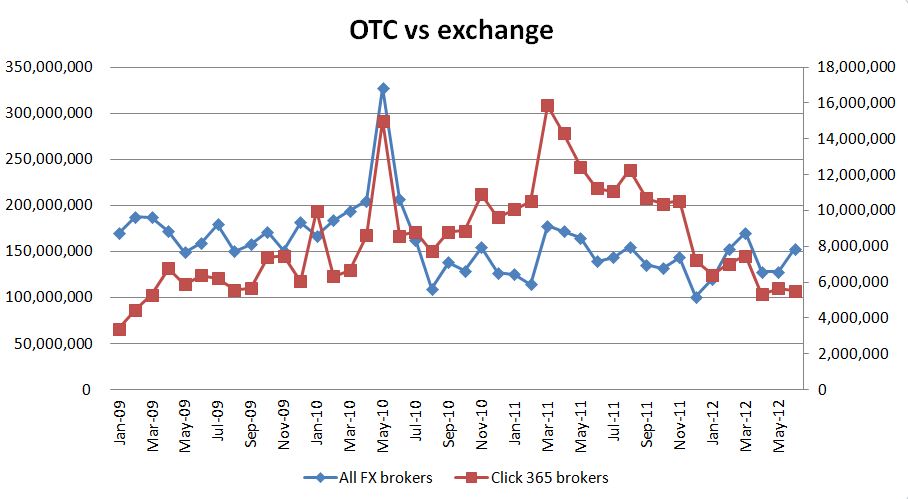

Over-the-Counter (OTC) Trading

In addition to the interbank market, there is also a large amount of forex trading that takes place over-the-counter (OTC).

This occurs between two parties directly, without the use of an exchange or other intermediary.

Image: acuvugax.web.fc2.com

How OTC Forex Trading Works

OTC forex trading is typically conducted through electronic platforms, such as those provided by liquidity providers and prime brokers.

The two parties in the trade will agree on the price at which they want to buy or sell the currency pair, and the trade will be executed through the platform.

Differences Between Interbank and OTC Trading

There are some key differences between interbank and OTC forex trading.

- Interbank trading is typically more transparent, as the prices are set by the market itself.

- OTC trading is more flexible, as the two parties can agree on any terms they want.

- Interbank trading is more regulated, as it is subject to the rules and regulations of the different exchanges.

- OTC trading is more open to retail traders, as it does not require them to have a bank account.

Conclusion

Hopefully, this article has helped you understand the difference between interbank and OTC forex trading.

If you are a retail trader, it is important to choose a broker that offers access to both the interbank market and OTC trading.

This will give you the flexibility to trade in the best market for your needs.

FAQ

What is the Forex Market?

The Forex Market, short for Foreign Exchange Market is a decentralized global market where currencies are traded.

It is the most liquid financial market globally, with a daily trading volume of around $5 trillion.

How Do You Trade Forex?

Forex is traded through retail forex brokers.

When you open an account with a forex broker, you will be able to buy and sell currency pairs using their trading platform.

Forex Market Is Traded On Exchange Or Otc

https://youtube.com/watch?v=tW-q6tBv-KA

What is a Currency Pair?

A currency pair is two different currencies that are traded against each other.

For example, the EUR/USD currency pair is the Euro vs. the U.S. Dollar