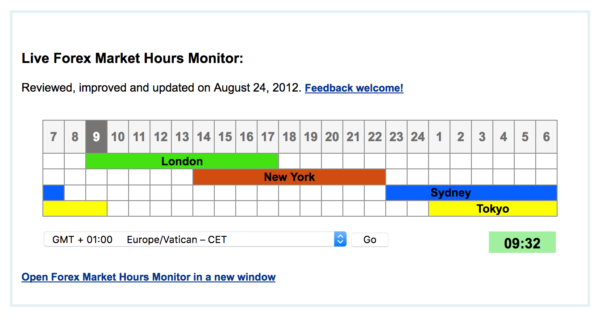

The foreign exchange (forex) market is a global decentralized marketplace where currencies are traded. As a continuous market that operates 24 hours a day, it’s crucial to understand the trading hours of different regions to optimize trading strategies. One crucial aspect is knowing when the Sydney forex market closes in GMT.

Image: theforexgeek.com

The Sydney forex market is among the largest financial hubs in the Asia-Pacific region, with trading hours that significantly impact global market activity. Comprehending the timing of its close in relation to GMT (Greenwich Mean Time) allows traders to adjust their strategies accordingly.

Sydney Forex Market Hours: GMT Equivalents

The Sydney forex market opens at 7:00 AM Australian Eastern Standard Time (AEST). Translated into GMT, this equates to 23:00 GMT the previous day. Trading continues until 5:00 PM AEST, which corresponds to 07:00 GMT. It’s important to note that these hours may vary slightly due to daylight saving time adjustments.

Understanding the Sydney forex market’s closing time in GMT is fundamental for traders operating in other parts of the world. For instance, traders in London can anticipate the Sydney market to close at 9:00 AM GMT, while those in New York see the market close at 2:00 AM EST.

Trading After Sydney Market Close

The Sydney forex market’s closure presents both opportunities and challenges for traders. Here are some key considerations:

- Reduced Liquidity: As the Sydney market closes, liquidity in the forex market decreases due to the absence of Asian traders. This can lead to wider spreads and increased volatility, potentially impacting trade execution and profitability.

- Potential Reversals: Following the Sydney market close, the market often experiences a period of consolidation or reversals. This occurs as traders assess overnight news and economic data released during the Sydney session. Monitoring market movements during this time can provide insights into potential trading opportunities.

- News and Events: Major news events, such as central bank announcements or economic reports, released during the Sydney session can significantly impact currency pairs. Traders need to stay informed and quickly adjust their positions after the market close to capitalize on these events.

- Overnight Trading Opportunities: While liquidity may be lower after the Sydney market closes, it doesn’t mean trading opportunities cease. Overnight trading strategies, such as carry trades or breakout trades, can still be viable during this period, albeit with increased risk.

Understanding the impact of the Sydney forex market close is vital for traders to optimize their trading strategies. By anticipating the reduction in liquidity and potential price movements, traders can plan their trades accordingly and make informed decisions to navigate the market effectively.

Image: porukeicestitke.com

Forex Market Hours Sydney Close In Gmt

Conclusion

The Sydney forex market’s closing time in GMT acts as a crucial reference point for traders globally. The reduced liquidity and potential for market movements present both challenges and opportunities. Traders who comprehend the implications of this closing time can adjust their strategies, monitor market news, and identify trading opportunities effectively. Staying informed and adapting to the changing market landscape is essential for maximizing trading success in the dynamic world of forex.