The fast-paced world of forex trading demands precision in time management. Whether you’re a seasoned pro or a novice yearning to navigate the forex market, understanding market hours is paramount to informed decision-making.

Image: npifund.com

Navigating the Forex Market Time Zones: EST to IST

The forex market, spanning the globe, operates across various time zones. The United States Eastern Time (EST) and Indian Standard Time (IST) are two key time zones that forex traders navigate. Knowing the conversion between these time zones is essential for aligning trading strategies with market availability.

EST to IST: A Comprehensive Conversion

The time difference between EST and IST is 10 hours and 30 minutes. When it’s 9:00 AM EST in New York City, the capital of forex trading in the United States, it’s 7:30 PM IST in Mumbai, India’s financial hub. This time difference needs to be considered when analyzing market trends and placing trades.

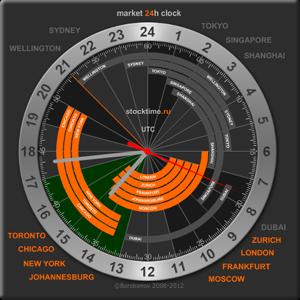

Forex Market Hours: A Global Perspective

The forex market operates 24 hours a day, five days a week, opening on Sunday evening and closing on Friday evening. However, the most active trading hours align with the overlap of major financial centers. For the EST time zone, the most liquid hours generally fall between 8:00 AM and 4:00 PM, aligning with business hours in New York City.

Image: www.mql5.com

Trading Strategies and Time Zone Awareness

Time zone awareness is crucial for effective forex trading strategies. By understanding when markets are open in different regions, traders can align their trading hours with periods of higher liquidity and volatility. It also allows for the timely execution of trades, avoiding potential losses due to market fluctuations during inactive hours.

Tips and Expert Advice for Successful Forex Trading

Successful forex trading requires a combination of knowledge, skill, and experience. Here are some expert tips to enhance your trading strategy:

- Keep a close eye on economic calendars: News events and economic data releases can significantly impact market movements. By monitoring these events and their potential impact on currency pairs, traders can make informed trading decisions.

- Understand market sentiment: Market sentiment can be gauged through technical analysis, fundamental analysis, and news analysis. Identifying prevailing bullish or bearish trends can help traders align their trades accordingly.

Common FAQ on the Forex Market

Q: What factors can affect the forex market?

A: Numerous factors influence the forex market, including economic data releases, geopolitical events, natural disasters, and central bank policies.

Q: How do I calculate the time difference between two time zones?

A: Use a currency converter such as XE Convert or Google Currency Converter, or refer to specific time zone converter tools available online.

Q: What is the most favorable time to trade forex?

A: Trading during the overlap of major financial centers typically offers the highest liquidity and volatility, making it the preferred time for many forex traders.

Forex Market Hours Clock Est Convertor To Ist

Conclusion

Navigating the forex market hours clock from EST to IST is essential for effective trading. By understanding the time differences and aligning trading strategies accordingly, traders can maximize opportunities and mitigate potential risks. Remember, knowledge and preparation are key to successful forex trading. Now that you’re equipped with the knowledge and resources, are you ready to delve deeper into the world of forex and explore its potential?