Introduction

The forex market, also known as the foreign exchange market or FX market, is the world’s largest financial market, facilitating the exchange of foreign currencies. Understanding the fundamental concepts of the forex market is crucial for navigating this complex and dynamic realm. In this comprehensive guide, we will delve into the intricacies of the forex market, exploring its history, core principles, and practical applications, guided by the expertise of SAPForex24, a leading provider of forex trading solutions.

1. Market Basics

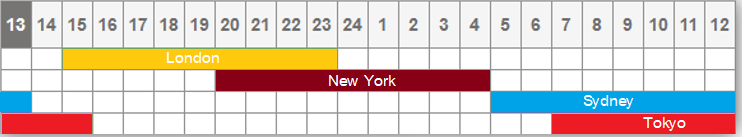

The forex market operates as a decentralized global marketplace where individuals, institutions, and central banks trade currencies. Unlike centralized exchanges like stock markets, forex transactions are executed over-the-counter (OTC), directly between the parties involved. This vast network of participants contributes to the market’s 24-hour accessibility, five days a week, making it possible to trade currencies anytime, anywhere.

Image: forexnew.org

2. Currency Pairs and Quotes

Currencies in the forex market are always traded in pairs, with one currency being the base currency and the other being the counter currency. The base currency is expressed as the unit being purchased, while the counter currency is the unit being sold. For example, the currency pair EUR/USD represents the Euro (EUR) being purchased against the US Dollar (USD).

Currency quotes indicate the exchange rate between a base currency and counter currency. The most commonly quoted rate type is the bid-ask spread, which represents the price at which a market maker is willing to buy the base currency (bid price) and the price at which they are willing to sell it (ask price).

3. Market Participants

The forex market hosts a diverse range of participants, each playing a vital role in maintaining market liquidity and efficiency. Major banks and financial institutions are the primary market makers, providing liquidity by offering buy and sell prices. Central banks participate in the market to manage their countries’ exchange rates. Institutional investors, such as hedge funds and asset managers, use the forex market to execute complex strategies and allocate foreign assets. Retail traders, including individual investors and small businesses, also participate by speculating on currency price movements.

4. Market Forces and Trends

The forex market is influenced by a multitude of economic, political, and social factors. Key drivers include interest rates, inflation, economic growth, political stability, and global events. Currency prices fluctuate continuously as market participants react to news, data releases, and changing market conditions. Identifying and understanding these factors is essential for making informed trading decisions.

Image: www.slideserve.com

5. Technical and Fundamental Analysis

Forex traders employ a combination of technical and fundamental analysis to identify trading opportunities. Technical analysis involves studying historical price data to identify patterns and trends that may indicate future price movements. Fundamental analysis, on the other hand, focuses on economic and financial indicators to assess a country’s economic health and its currency’s value. By combining both approaches, traders can make more informed decisions and mitigate risk.

6. Forex Trading Platforms and Education

Navigating the forex market requires reliable and user-friendly trading platforms. SAPForex24 provides a comprehensive suite of trading tools, including a powerful web-based platform, mobile apps, and advanced charting features. Access to real-time market data, market analysis, and educational resources is crucial for successful trading.

7. Risk Management and Trading Strategies

Managing risk is paramount in forex trading. Traders should implement proper risk management strategies, such as using stop-loss orders to limit potential losses and controlling leverage to reduce the risks associated with margin trading. Developing a sound trading strategy aligned with individual risk appetite and trading goals is essential for long-term success.

8. Choosing a Forex Broker

Selecting a reputable and reliable forex broker is vital for protecting capital and trading effectively. Factors to consider include the broker’s regulation, trading platform, customer service, spreads and commissions, and account types. SAPForex24 stands as a trusted and regulated forex broker, offering tailored account options and competitive trading conditions.

Forex Market Concepts With Sapforex24

9. Conclusion

Understanding the core concepts of the forex market is a cornerstone of successful trading. This comprehensive guide has provided a deep dive into forex market mechanics, currency pairs, participants, driving forces, and essential trading tools. By incorporating the insights of expert providers like SAPForex24, traders can