The bustling world of foreign exchange trading came to a temporary halt on January 15, 2019, as the forex market shuttered for the first time in history. This historic shutdown, triggered by the U.S. federal government shutdown, left traders and investors alike grasping for clarity and direction. In this comprehensive guide, we delve into the reasons behind this unprecedented closure, its implications for the global financial system, and what it means for your financial future.

Image: a-defense.blogspot.com

A Perfect Storm: Government Shutdown Meets Trading Holidays

The closure of the forex market was a culmination of unfortunate circumstances, namely the ongoing partial shutdown of the U.S. federal government and the confluence of major holidays. As the government shutdown dragged on, concerns began to mount over the potential impact on the Commodity Futures Trading Commission (CFTC), the primary regulator of the forex market in the United States.

With the CFTC unable to fully function due to the lack of appropriated funding, fears arose that the integrity of the forex market could be compromised. Trading without regulatory oversight carries inherent risks, leaving both retail and institutional traders vulnerable to potential manipulation and fraud.

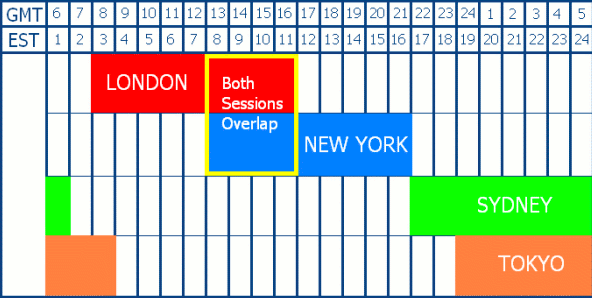

Adding fuel to the fire was the coincidence of major holidays in Japan and the United Kingdom, two of the world’s largest forex trading centers. With Tokyo and London absent from the global trading stage, liquidity dwindled to unprecedented levels, making it virtually impossible to conduct meaningful trades.

Implications for the Global Financial System

The shutdown of the forex market, albeit temporary, sent shockwaves throughout the global financial system. Forex trading plays a crucial role in facilitating international trade and investment, allowing businesses and individuals to convert currencies in order to conduct cross-border transactions.

With the market closed, businesses faced difficulties settling payments and hedging against currency fluctuations. Investors were left unable to adjust their portfolios or liquidate their forex positions. The resulting uncertainty created a ripple effect that spread across markets, from stocks to commodities.

Impact on Retail and Institutional Traders

Retail traders were significantly affected by the closure, as they were unable to enter or exit trades for an extended period. This disruption could have led to missed opportunities and potential losses for those actively trading the forex market.

Institutional traders, on the other hand, had mixed reactions. Some welcomed the respite from the relentless trading frenzy, while others lamented the loss of potential profits. Ultimately, the impact on institutional traders was more muted due to their ability to engage in longer-term trading strategies.

Image: www.pinterest.com

Lessons Learned and the Road Ahead

The closure of the forex market highlighted the interconnectedness of the global financial system and the importance of robust regulatory oversight. It also exposed potential vulnerabilities that could have been exploited in the absence of a functioning regulatory body.

Now that the forex market has reopened, the lessons learned from this historic shutdown should guide future policy decisions and strengthen the resilience of our financial markets. Enhanced redundancy measures, increased funding for regulators, and better coordination between global trading centers are all areas that warrant careful consideration.

Forex Market Closed 15 January 2019

Empowering Your Financial Decisions

As the global economy continues to navigate uncertain times, informed financial decision-making has never been more critical. Stay up-to-date with the latest economic developments, monitor currency markets closely, and seek professional guidance when necessary.

By arming yourself with knowledge and sound financial strategies, you can weather market volatility and position yourself for long-term success. The closure of the forex market may have been temporary, but the lessons learned should serve as a permanent reminder of the importance of a resilient and well-regulated financial system.