The global financial landscape has been rocked by the recent announcement from Standard & Poor’s (S&P), one of the world’s leading credit rating agencies. The decision to downgrade the long-term credit rating of the United States from AAA to AA+ has sent shockwaves through the foreign exchange market, triggering a rollercoaster ride of reactions.

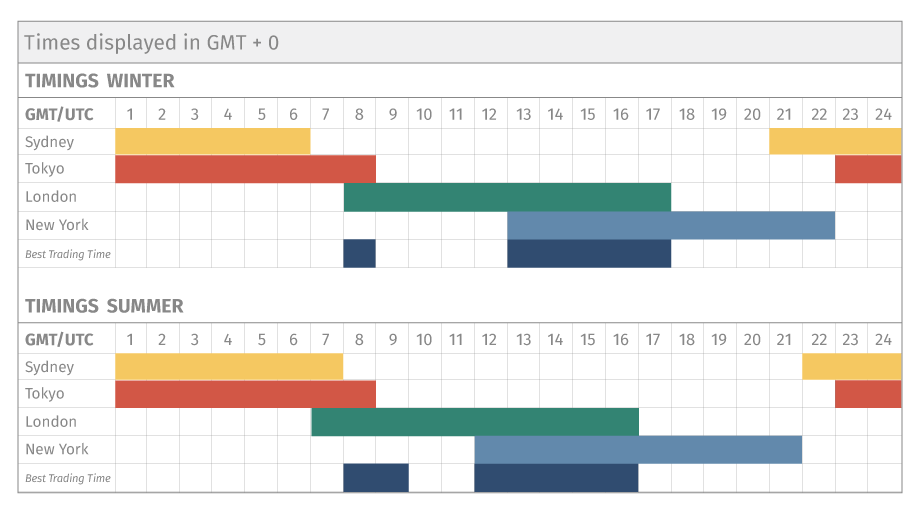

Image: www.fxstreet.de.com

This article delves into the ramifications of S&P’s bold move, exploring its profound impact on currency valuations, risk appetites, and the delicate balance of global economies. With a focus on accuracy, transparency, and actionable insights, we aim to unravel the intricacies of this financial tempest and empower our readers with an in-depth understanding of the forex market in this new era.

S&P’s Downgrade: A Seismic Shock

The downgrade of the United States’ credit rating was not taken lightly by the world. S&P cited concerns over the country’s mounting debt burden, slow economic recovery, and political gridlock as key factors behind their decision. This triggered an immediate reevaluation of the US dollar’s strength and the appeal of other currencies as haven assets.

The Ripple Effect: Currency Valuations in Turmoil

Following S&P’s announcement, the US dollar initially weakened against major currencies like the Euro, Swiss Franc, and Japanese Yen. Investors flocked to these safe-haven currencies, driven by heightened risk aversion and uncertainty about the future of the US economy. However, subsequent developments, including the European sovereign debt crisis and concerns over slowing growth in China, have since reversed this trend.

Risk Appetite: A Delicate Balance

S&P’s downgrade has also had a profound effect on risk appetite. Investors are now more cautious, leading to a reduction in demand for riskier assets like emerging market currencies and commodities. As a result, we have seen a shift towards safer investments and a retreat from emerging markets.

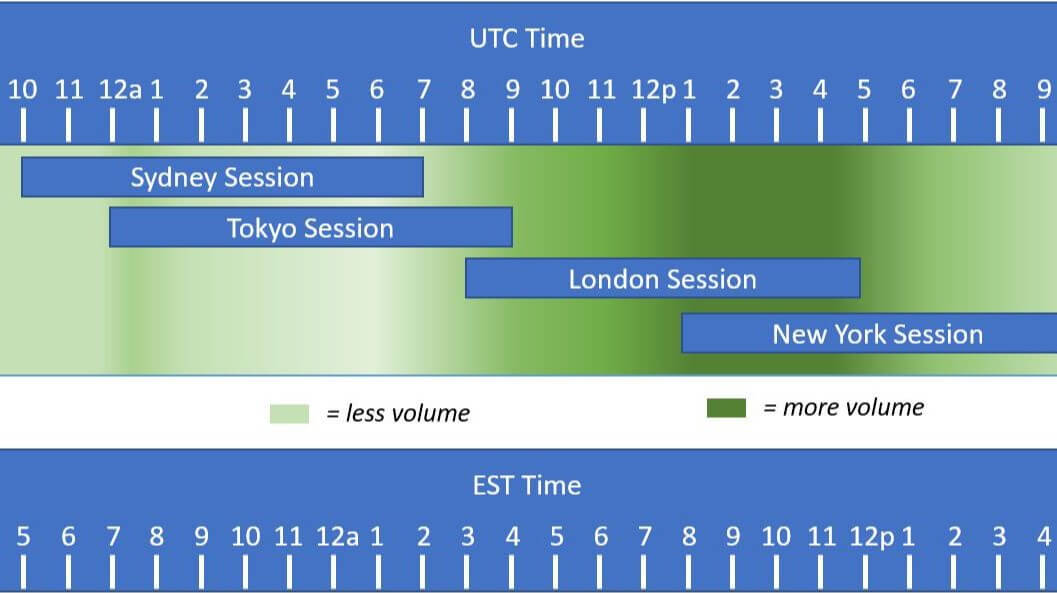

Image: www.forex.academy

Beyond Borders: Implications for Global Economies

The reverberations of S&P’s decision have extended beyond the forex market, affecting economies worldwide. A weaker US dollar can lead to inflationary pressures in other countries that are tied to the US dollar through trade or currency pegs. Additionally, the risk aversion and reduced demand for risky assets can stifle investment and economic growth.

Navigating the Turbulence: Expert Insights and Actionable Tips

Amidst the turmoil, it is crucial to seek guidance from renowned experts in the field. They advise against panic selling or knee-jerk reactions. Instead, investors should take a holistic approach, diversifying their portfolios and considering a mix of currencies and asset classes to mitigate risk.

Forex Market After S&P Rating

https://youtube.com/watch?v=X6bieeb0FPk

Conclusion: An Evolving Landscape

The downgrade of the United States’ credit rating by S&P has left an indelible mark on the forex market and global economies. The repercussions are still unfolding, but by understanding the dynamics at play and seeking expert advice, we can navigate this challenging financial landscape and make informed decisions that preserve our financial well-being.

The future of the forex market remains uncertain, but one thing is for sure: it will continue to evolve in response to global economic events and policy decisions. By staying abreast of the latest developments and leveraging the insights provided here, investors can position themselves to thrive in this ever-changing environment.