The foreign exchange (forex) market is a vast and dynamic global marketplace where currencies are traded. Forex trading involves the conversion of one currency to another, and it plays a crucial role in international commerce and finance.

Image: www.aiohotzgirl.com

When a company engages in forex trading, it exposes itself to the risk of currency fluctuations. Adverse currency movements can lead to losses that impact the company’s financial statements, particularly the balance sheet. Forex loss in balance sheet is an important consideration for companies operating in the global arena, and this article delves into its implications.

Understanding Forex Loss in Balance Sheet

Forex loss arises when there is a decrease in the value of a company’s foreign currency assets or an increase in the value of its foreign currency liabilities due to exchange rate fluctuations. This can occur when a company holds foreign currency assets or owes money in foreign currencies, and the value of those currencies changes relative to the company’s reporting currency.

For instance, if a U.S. company reports its financial statements in U.S. dollars (USD) and has receivables denominated in euros (EUR), a decline in the value of EUR against USD would result in a forex loss for the company. Conversely, if the value of EUR increases, the company would realize a forex gain.

Recognition and Measurement of Forex Loss

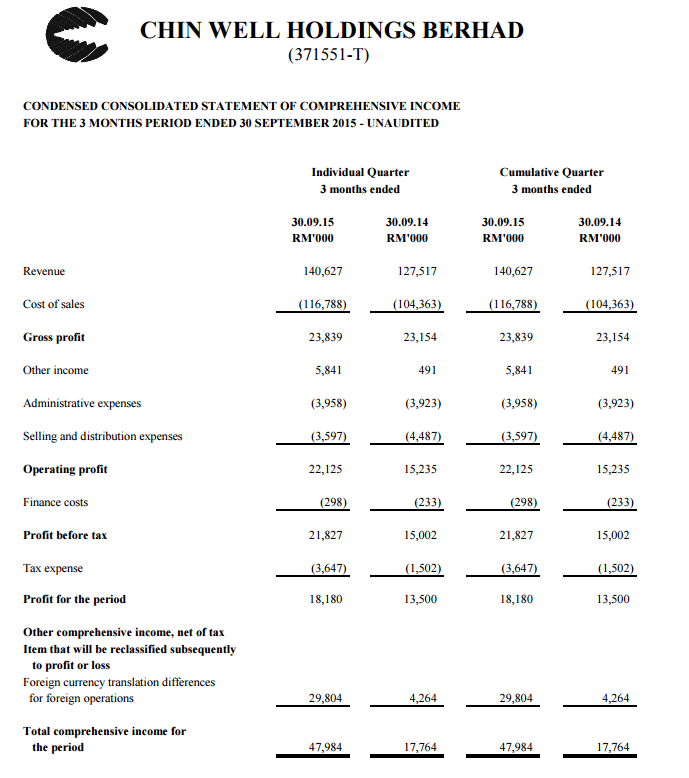

Under U.S. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), forex losses are recognized in the income statement as part of other comprehensive income (OCI). OCI is a separate component of equity that includes gains and losses that are not recognized in net income.

Forex losses are typically measured based on the closing exchange rates at the end of the reporting period. Companies may use forward contracts or other hedging instruments to mitigate forex risk, which can impact the recognition and measurement of forex losses.

The Impact of Forex Loss on Financial Performance

Forex loss can have a significant impact on a company’s financial performance. Large or unexpected forex losses can erode profits, reduce shareholders’ equity, and impair the company’s overall financial health.

For example, a multinational company with substantial foreign operations may experience significant forex losses during periods of currency volatility. This can adversely affect its earnings per share (EPS) and other key financial metrics.

Image: www.coursehero.com

Managing Forex Risk

To mitigate the risks associated with forex fluctuations, companies can employ various risk management strategies, including:

- Hedging: Utilizing financial instruments such as forward contracts or options to offset potential forex losses.

- Natural Hedging: Balancing foreign currency assets and liabilities to reduce the overall exposure to exchange rate fluctuations.

- Currency Diversification: Investing in multiple foreign currencies to spread the risk and minimize exposure to any single currency.

Forex Loss In Balance Sheet

Conclusion

Forex loss in balance sheet is an important consideration for companies that engage in international trade and finance. It arises due to fluctuations in currency exchange rates and can impact the company’s financial performance. By understanding the implications of forex loss, recognizing and measuring it accurately, and implementing effective risk management strategies, companies can navigate the complexities of the foreign exchange market and mitigate the associated risks.