Introduction

Image: ydigatocop.web.fc2.com

In the ever-evolving realm of forex trading, leverage plays a pivotal role in amplifying profits and multiplying gains. For traders in India, the availability of a 400:1 leverage ratio offers unparalleled trading power, allowing them to control substantial positions with minimal capital outlay. This article delves into the intricacies of 400:1 leverage in India, elucidating its benefits, risks, and critical considerations for successful implementation.

Understanding Leverage in Forex Trading

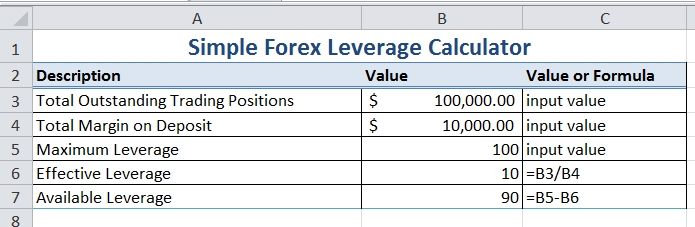

Forex leverage is a financial instrument that enables traders to access capital many times greater than their initial investment. For instance, with a 400:1 leverage ratio, a trader with a capital of ₹1,000 can trade positions worth up to ₹400,000. While leverage can potentially multiply profits, it also magnifies losses proportionate to the amount of capital borrowed.

Benefits of 400:1 Leverage

-

Enhanced Profit Potential: Leverage serves as a force multiplier, allowing traders to generate significant profits from relatively small price movements. With a 400:1 leverage ratio, a mere 1% price change on a position worth ₹400,000 would yield a profit of ₹4,000.

-

Increased Trading Power: Leverage empowers traders to execute larger trades than their available balance would otherwise permit. This feature expands trading horizons and enables traders to tap into market opportunities that would otherwise remain inaccessible.

-

Flexibility and Scalability: 400:1 leverage provides traders with the agility to adjust their trading strategies dynamically. It allows them to scale their positions based on market conditions and capitalize on favorable opportunities.

Risks Associated with Leverage

Just as leverage can amplify profits, it can also exacerbate losses, especially when used imprudently. The following risks must be carefully considered before employing high leverage:

-

Magnified Losses: As mentioned earlier, leverage magnifies both profits and losses. A 1% adverse price move on a leveraged position can result in significant capital depletion, potentially wiping out a trader’s account balance.

-

Margin Calls: If losses exceed the trader’s available margin, brokers may issue a margin call. This triggers a mandatory deposit of additional funds to maintain the position or face forced liquidation.

-

Emotional Trading: Leverage can induce emotional and impulsive trading decisions. Traders may succumb to the temptation of chasing profits or minimizing losses, potentially escalating risk exposure.

Considerations for Using 400:1 Leverage

Given the risks associated with 400:1 leverage, traders should adhere to the following prudent practices:

-

Start Small: Begin with a conservative leverage ratio that aligns with your risk tolerance and trading experience. Gradually increase leverage as you gain proficiency and confidence.

-

Understand Risk Management: Leverage is a double-edged sword that demands robust risk management strategies. Determine appropriate stop-loss levels and position sizes to protect against potential losses.

-

Educate Yourself: Thoroughly research leverage and the markets before implementing it into your trading arsenal. Read books, attend webinars, and seek guidance from experienced mentors.

-

Practice on a Demo Account: Experiment with different leverage ratios on a demo account before employing them in real-money trading. This allows you to gain hands-on experience and fine-tune your trading strategies.

Conclusion

Leverage is a powerful tool that can enhance trading potential but must be used with caution. The 400:1 leverage ratio available to Indian traders offers immense opportunities while posing potential risks. By prudently managing leverage and adhering to sound risk management practices, traders can harness the power of this instrument to unlock profitable trading horizons. Remember, the key lies in understanding the inherent risks, educating oneself, and using leverage judiciously to minimize potential setbacks and maximize trading success.

:max_bytes(150000):strip_icc()/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)

Image: www.investopedia.com

Forex Leverage Ratio 400 1 India