Harnessing the Power of Leading Indicators

In the ever-evolving world of forex trading, astute traders relentlessly seek an edge, an advantage that can help them navigate market volatility and emerge victorious. One potent tool in their arsenal is the employment of leading indicators. These forward-looking metrics provide invaluable insights into potential trend reversals, allowing traders to anticipate market movements before they unfold. In this blog, we delve into the realm of leading indicators and their significance in identifying key support and resistance levels in forex.

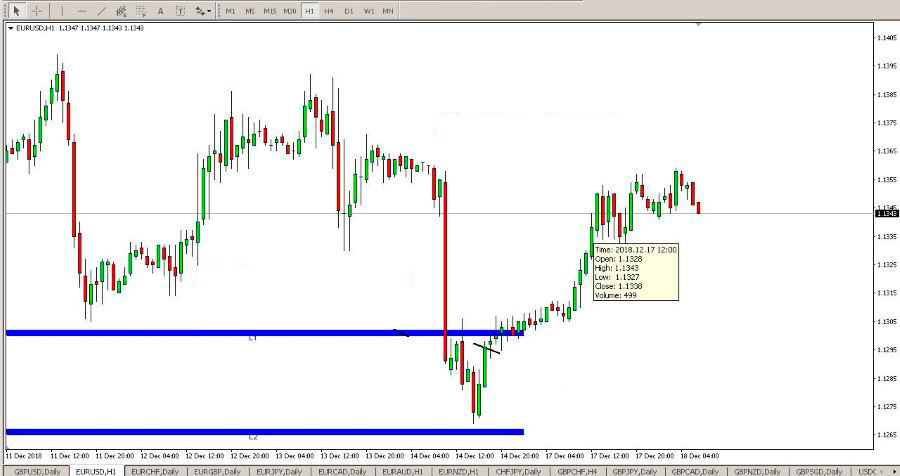

Image: www.forex-ratings.com

Defining Support and Resistance

In forex trading, support and resistance levels represent pivotal price points that act as barriers to price movement. Support is the price level below which a currency pair is unlikely to fall, while resistance is the price level above which a currency pair finds difficulty in rising. These levels serve as magnets, attracting price action and often leading to reversals or consolidations.

Identifying Support and Resistance with Leading Indicators

Leading indicators, as their name suggests, provide signals that anticipate future price direction. By analyzing these indicators, traders can gain insights into the strength or weakness of a trend and make informed decisions about potential support and resistance levels. Some of the most commonly used leading indicators include:

- Moving averages (MAs): MAs smooth out price data and minimize the impact of short-term fluctuations. Traders often use the 50-day, 100-day, and 200-day MAs to identify major support and resistance zones.

- Relative Strength Index (RSI): The RSI measures the magnitude of price changes, helping traders assess whether a trend is overbought or oversold. When the RSI crosses below 30, it indicates potential oversold conditions, often leading to a price reversal toward a support level. Conversely, an RSI crossing above 70 suggests overbought conditions and a potential reversal toward a resistance level.

- Stochastic oscillator: The stochastic oscillator analyzes price action over a specific period and measures the momentum of a trend. When the stochastic oscillator enters the overbought zone (above 80), it signals a potential trend reversal or a move toward a resistance level. Conversely, a fall below 20 indicates oversold conditions, potentially leading to support level testing.

- Commodity Channel Index (CCI): The CCI compares the current price to the average price over a defined period. A CCI above +100 suggests overbought conditions and potential resistance levels, while a CCI below -100 indicates oversold conditions and support levels.

Tips and Advice for Utilizing Leading Indicators

- Use multiple indicators: Don’t rely on a single leading indicator for support and resistance analysis. Combine different indicators to enhance the reliability of your signals.

- Consider the trend: Assess the prevailing trend before interpreting leading indicator signals. Support and resistance levels are more effective within established trends.

- Confirm signals with other technical analysis tools: Integrate leading indicator analysis with other technical tools, such as price action patterns or candlestick formations, to strengthen your conclusions.

- Manage risk effectively: Always implement proper risk management measures, such as stop-loss orders, to mitigate potential risks.

Image: www.babypips.com

FAQ

Q: How do I know if a support or resistance level is valid?

A: Valid support and resistance levels are typically confirmed by multiple leading indicators and historical price data. Price action should respect the level and exhibit a tendency to bounce off it.

Q: Can leading indicators predict support and resistance levels with 100% accuracy?

A: While leading indicators provide valuable insights, they should not be considered foolproof predictors. Market conditions can change rapidly, and no indicator can guarantee complete accuracy.

Q: Which leading indicators are the most effective for identifying support and resistance?

A: The effectiveness of leading indicators can vary depending on the currency pair, market conditions, and individual trading strategies. However, MAs, RSI, stochastic oscillator, and CCI are commonly used and have proven reliable for many traders.

Forex Leading Indicator Support And Resistance

Conclusion

Mastering the art of identifying support and resistance levels using leading indicators is a pivotal skill for savvy forex traders. These forward-looking metrics empower traders to anticipate price movements, make informed decisions, and enhance their profit potential. By harnessing the power of leading indicators, you can gain a competitive edge in the dynamic and ever-changing forex market. And before leaving just answer this,

Are you serious about the topic you read above? Would you like to master the art of forex trading using leading indicators and other techniques employed by seasoned professionals? If so, I highly recommend enrolling in my comprehensive forex trading course, where I share a wealth of knowledge and proven strategies to help you succeed in this lucrative field.