The Forex market presents a realm of lucrative possibilities, but navigating its complexities requires expert guidance and meticulous timing. Forex Kingle EA, an automated trading system, empowers traders with sophisticated tools to maximize profits and minimize risk. However, selecting the ideal time frame for this powerful EA is a crucial decision that can significantly impact your trading success. This comprehensive guide unveils the intricacies of Forex Kingle EA’s time frame selection, empowering you with a thorough understanding to optimize your trading strategies.

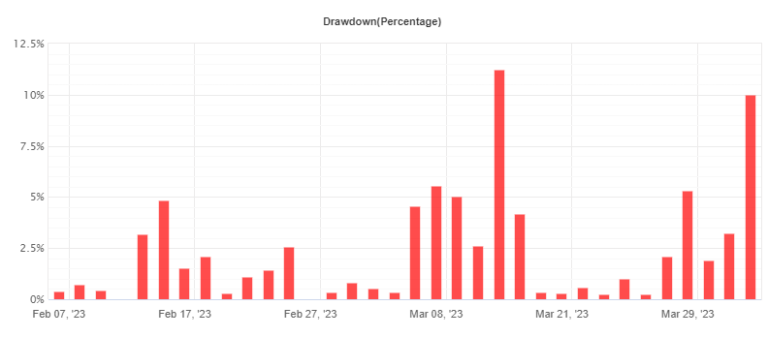

Image: www.fxcracked.com

Defining Time Frames in Forex Trading

Time frames in forex trading represent the intervals at which price data is sampled and analyzed. The most commonly used time frames are M1 (1 minute), M5 (5 minutes), M15 (15 minutes), H1 (1 hour), H4 (4 hours), and D1 (1 day). Each time frame offers unique advantages and drawbacks, suiting different trading styles and strategies.

Exploring the Impact of Time Frames on Forex Kingle EA

Forex Kingle EA is designed to adapt to various time frames, employing technical indicators and mathematical models to identify profitable trading opportunities. The optimal time frame depends on several factors, including:

- Market volatility: Higher volatility, characterized by rapid price fluctuations, favors shorter time frames for capturing quick profits. Lower volatility, where prices move more gradually, aligns better with longer time frames.

- Trading style: Scalpers, who execute numerous trades within a short period, prefer lower time frames. Swing traders, who hold positions for several hours or days, favor higher time frames.

- Trading strategy: Trend-following strategies excel on higher time frames, as they require more time for trends to develop. Range-bound strategies, which exploit price fluctuations within a specific range, perform well on lower time frames.

Identifying the Best Time Frame for Forex Kingle EA

Consider the following guidelines to determine the optimal time frame for Forex Kingle EA:

- M1 and M5: Ideal for scalping or day trading, where entering and exiting positions occur within minutes or hours. Suitable for capturing quick profits in highly volatile markets.

- M15 and H1: Well-suited for short-term swing trading, where positions are held for a few hours or overnight. Offer a balance between speed and stability.

- H4 and D1: Appropriate for long-term trend trading, as they allow ample time for trends to form and develop. Suitable for traders seeking consistent profits over extended periods.

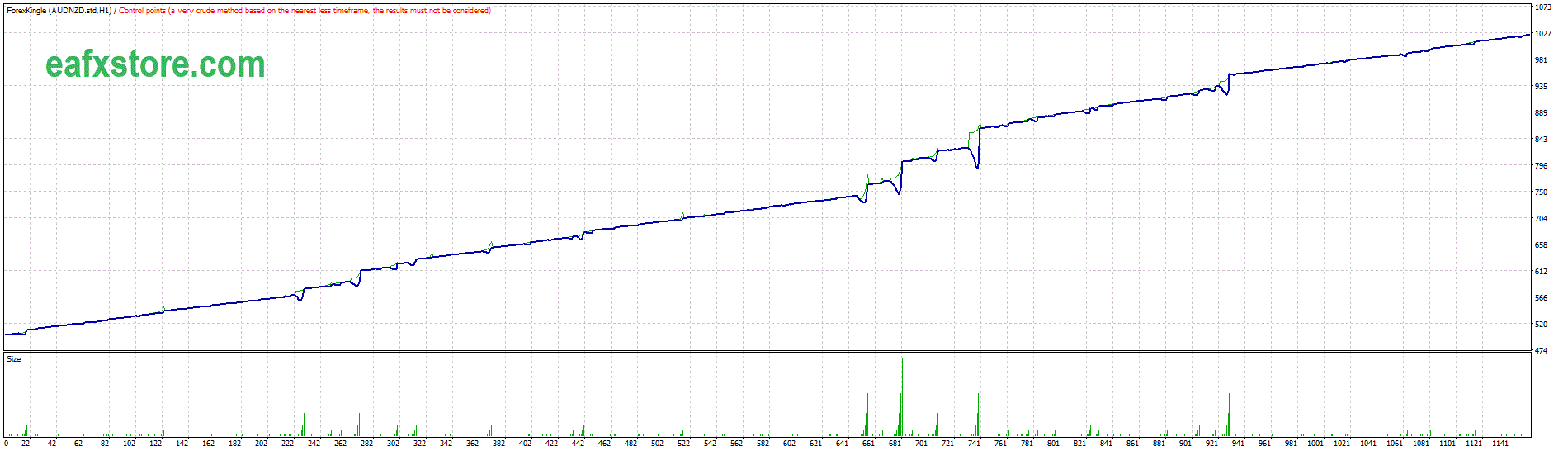

Image: eafxstore.com

Optimizing Time Frame Selection for Specific Market Conditions

- Trending markets: Higher time frames, such as H4 or D1, align better with trending markets. Forex Kingle EA can identify and ride the momentum of established trends, maximizing profits.

- Ranging markets: Lower time frames, such as M15 or H1, suit ranging markets better. Forex Kingle EA can exploit price fluctuations within well-defined price ranges.

- Volatile markets: Extremely volatile markets call for short time frames, such as M1 or M5. Forex Kingle EA can capitalize on rapid price movements, allowing traders to profit from short-term volatility.

Forex Kingle Ea Best Time Frame

Conclusion

Mastering the art of time frame selection for Forex Kingle EA equips traders with an invaluable advantage. By aligning the time frame with market conditions, trading style, and strategy, traders can maximize profits and navigate the complexities of the forex market with confidence. Remember, the optimal time frame is not static but dynamic, requiring traders to adapt to changing market conditions. Embrace the knowledge and insights provided in this guide, and elevate your trading experience to new heights.