<!DOCTYPE html>

Image: www.piranhatrader.com

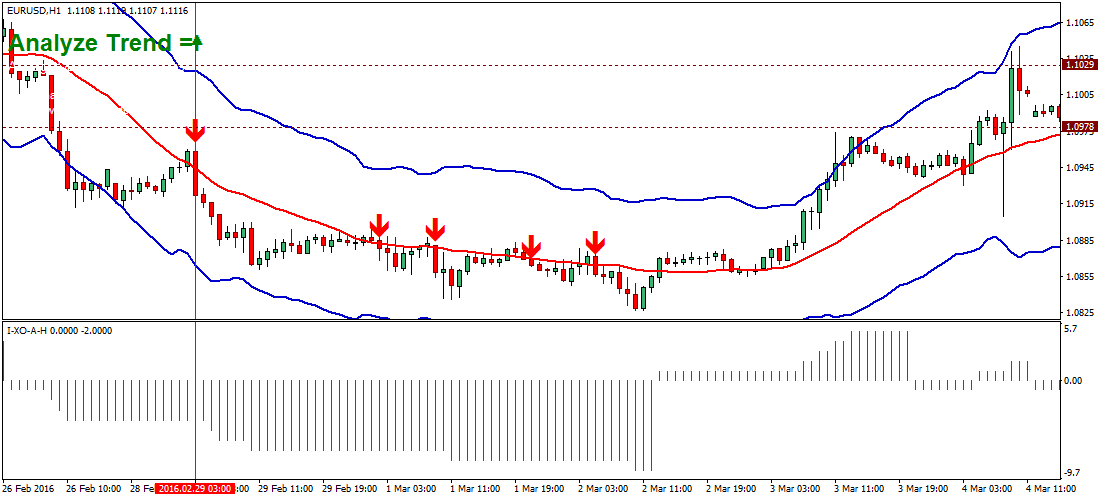

Harnessing Precision and Potential in Forex Markets

In the dynamic and ever-evolving world of forex trading, the Keltner Channel trading system has emerged as a beacon of hope for aspiring traders. This innovative technical analysis tool, pioneered by renowned trader Chester Keltner, has proven its mettle in guiding traders towards informed and profitable decisions. Embark on this comprehensive journey into the Keltner Channel trading system, and unlock the secrets to Forex market mastery.

The Keltner Channel is an invaluable tool for identifying market trends and determining potential trade setups. It comprises three distinct lines: the central moving average (CMA), the upper Bollinger Band (UBB), and the lower Bollinger Band (LBB).

Unveiling the Components of the Keltner Channel

- Central Moving Average (CMA): The backbone of the Keltner Channel, the CMA represents the simple moving average of a given period. It serves as a reference point for price action and indicates the overall trend of the market.

- Upper Bollinger Band (UBB): The UBB is calculated by adding two standard deviations of the average true range (ATR) to the CMA. It acts as an indicator of potential resistance levels, highlighting areas where the market may encounter selling pressure.

- Lower Bollinger Band(LBB): The LBB is derived by subtracting two standard deviations of the ATR from the CMA. It signifies potential support levels, signaling zones where the market is likely to find buyers.

Empowering Traders through Keltner Channel Dynamics

The Keltner Channel’s strength lies in its ability to provide a comprehensive snapshot of market conditions. When the channel is wide, it suggests increased volatility and a potential for significant price swings. Conversely, a narrowing channel indicates lower volatility and a period of consolidation.

Traders can leverage the Keltner Channel to identify potential trading opportunities based on the following principles:

- Buy Signals: A buy signal arises when the market price breaks above the UBB, indicating a potential uptrend. This suggests that the market is likely to continue moving higher, creating an opportunity for long positions.

- Sell Signals: A sell signal is generated when the market price pierces below the LBB, suggesting a potential downtrend. This indicates that the market is expected to fall, giving rise to short position opportunities.

- Range Trading: The Keltner Channel also allows traders to identify potential trading ranges. When the market price oscillates within the channel, it suggests a period of consolidation. Traders can capitalize on such periods by employing rangebound trading strategies.

Image: forextraininggroup.com

Tips and Expert Advice from Seasoned Traders

- Trend Filters: Combine the Keltner Channel with other trend-following indicators to enhance trading decisions. This can help filter out false signals and increase the probability of success.

- Risk Management: Exercise prudent risk management by setting appropriate stop-loss and take-profit levels. This helps mitigate potential losses and preserve trading capital.

- Confirmation: Seek confirmation of trade signals from multiple indicators or candlestick patterns to strengthen your trading rationale.

FAQs on Keltner Channel Trading

- What is the ideal period for the CMA? The optimal period varies depending on the market and trading style. Generally, periods of 20-50 are recommended for intraday trading, while longer periods (100-200) are suitable for swing trading.

- Can the Keltner Channel be applied to all timeframes? Yes, the Keltner Channel can be applied to any timeframe. However, it is most commonly used in intraday and swing trading contexts.

- What is the significance of ATR in the Keltner Channel? ATR is vital in determining the width of the channel and identifies periods of volatility. Higher ATR values indicate higher volatility, while lower values signal lower volatility.

Forex Keltner Channel Trading System

Conclusion

Mastering the Keltner Channel trading system can unlock a world of trading possibilities in the forex markets. By harnessing the power of this technical analysis tool, you can gain a comprehensive understanding of market dynamics, identify potential trading opportunities, and enhance your trading decision-making. Whether you’re a novice trader or an experienced professional, the Keltner Channel is an invaluable tool in your trading arsenal.

Are you ready to revolutionize your Forex trading journey and navigate the markets with precision and confidence? Embark on a transformative learning experience by exploring the Keltner Channel trading system and unlocking its potential for your trading success.