The foreign exchange market (Forex), a global decentralized marketplace where currencies are traded, plays a pivotal role in international trade and finance. However, like any financial market, Forex is prone to volatility, posing both challenges and opportunities for businesses and investors engaged in cross-border transactions.

Image: zyfaluyohod.web.fc2.com

Volatility refers to the significant fluctuations in the exchange rates of currencies over time. These fluctuations can be attributed to various factors, including economic data releases, political events, central bank monetary policies, and market sentiment. Currency volatility can have a direct impact on the costs of importing and exporting goods and services, as well as on the profits and losses of multinational companies.

Consequences of Exchange Rate Volatility for Businesses

For businesses involved in international trade, exchange rate volatility can affect profitability and operational efficiency. When the value of a country’s currency depreciates against another, the cost of imports from that country increases, resulting in higher production costs and potentially lower profit margins. Conversely, a currency appreciation can make exports more expensive for foreign buyers, potentially leading to a decline in demand and lost market share.

Opportunities for Currency Speculators and Traders

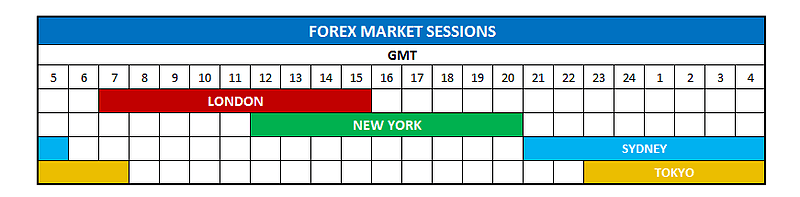

While volatility poses challenges for businesses engaged in physical trade, it also presents opportunities for currency speculators and traders who seek to profit from exchange rate fluctuations. By analyzing market trends, economic indicators, and political events, these individuals aim to predict currency movements and make profitable trades. Leveraging financial instruments such as spot FX, forward contracts, and options, currency traders can hedge against risk or speculate on the direction of exchange rates.

Government Interventions and Monetary Policies

Governments and central banks play a significant role in managing exchange rate volatility through monetary policies and interventions. By altering interest rates, influencing money supply, and intervening in the Forex market, central banks can attempt to stabilize exchange rates and mitigate the impact of volatility on the economy. However, these interventions can also have unintended consequences, such as inflation or currency depreciation if not implemented prudently.

Image: dailypriceaction.com

Technology and Innovation in Forex Trading

In recent years, technological advancements have transformed the Forex market, making it more accessible and efficient. Electronic trading platforms have revolutionized the way currencies are bought and sold, providing real-time quotes, advanced charting tools, and automated trading strategies. The proliferation of algorithmic trading and machine learning techniques has also enhanced the accuracy and speed of trade execution.

The Future of the Forex Market

The future of the Forex market is likely to be characterized by continued technological innovation, increasing participation from retail investors, and growing interest in digital currencies. Advancements in artificial intelligence, blockchain technology, and cross-border payments are expected to further enhance the efficiency and accessibility of the Forex market.

Forex Issues In Any Country

Conclusion

The Forex market, a vital cog in international trade and finance, is inherently volatile due to numerous economic and political factors. While exchange rate volatility can pose challenges for businesses involved in cross-border transactions, it also presents opportunities for currency speculators and traders to capitalize on market movements. Governments and central banks play a crucial role in managing volatility through monetary policies and interventions. With continued technological innovation and increasing retail participation, the Forex market is poised for further growth and evolution in the years to come.