In the adrenaline-pumping world of finance, where fortunes are made and lost with every tick of the clock, there exists an arena that attracts the bold, the brave, and the fiercely determined – the foreign exchange market, or Forex as it is commonly known. Like a high-stakes poker game played on a global scale, Forex is a dynamic and often unforgiving market that can reward the astute and punish the reckless.

Image: nurtasapra.blogspot.com

The Forex market serves as a colossal marketplace, where currencies from different nations are bought, sold, and traded around the clock. This $6 trillion-per-day behemoth, larger than the combined volume of all global stock exchanges, facilitates global trade, tourism, and international investments. At its core, the market functions on a simple principle – buying currencies that are expected to appreciate in value while selling those anticipated to depreciate.

Forex traders, hailing from diverse backgrounds, share a common goal – to capitalize on the constant fluctuations in currency exchange rates. Leveraging complex trading strategies, they analyze economic indicators, political events, and market trends to anticipate price movements and position themselves accordingly. Success in Forex requires a blend of razor-sharp analytical skills, impeccable timing, and a healthy dose of risk appetite.

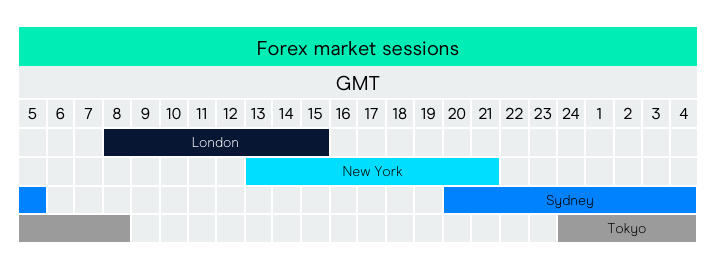

The Forex market offers a tantalizing array of advantages that sets it apart from other investment arenas. Its 24/7 accessibility allows traders to capitalize on market movements at any time of day or night. Liquidity, a defining feature of Forex, ensures that traders can enter or exit positions swiftly and without incurring significant execution delays. Furthermore, the presence of a vast community of experienced traders, accessible via online forums and social media platforms, promotes knowledge sharing, learning, and a sense of camaraderie.

Yet, it is essential to recognize that Forex is not a risk-free endeavor. As with any investment, substantial rewards come hand-in-hand with potential pitfalls. Currency values can be volatile, and market sentiments can shift abruptly, leading to significant losses. Therefore, Forex traders must possess a profound understanding of market dynamics, employ prudent risk management strategies, and never wager more than they can afford to lose.

Stepping into the Forex arena demands a comprehensive grasp of fundamental concepts, including currency pairs, bid-ask spreads, and pips, the smallest unit of price movement. Technical analysis, a crucial tool in the Forex trader’s arsenal, involves deciphering market trends, identifying patterns, and predicting future price movements based on historical data.

Various trading strategies exist to navigate the complexities of Forex, each tailored to specific risk profiles and trading styles. Scalping, a high-frequency trading approach, aims to capture tiny profit margins by executing a multitude of trades in rapid succession. Day trading involves buying and selling currencies within a single trading day, while swing trading involves holding positions for several days or even weeks.

As the Forex market continues its relentless evolution, technological advancements are transforming the trading landscape. Automated trading algorithms, powered by artificial intelligence and machine learning, have become indispensable tools for traders seeking to execute trades with precision and efficiency. Social trading platforms have emerged, empowering traders to follow and share strategies.

The Forex market presents a unique and alluring opportunity for those with an appetite for risk and a passion for financial markets. It is a realm where fortunes can be made and lessons learned, where nerves are tested, and instincts are honed. As in any endeavor, success in Forex is predicated upon knowledge, skill, and unwavering determination. So, if you possess the audacity and the drive, strap yourself in for the exhilarating ride known as Forex.

Image: www.pinterest.com

Forex Is A Hor Market