In the fast-paced world of forex intraday trading, traders are constantly seeking strategies to outsmart the markets and maximize their profits. Among these, non-repainting indicators have emerged as valuable tools, allowing traders to make educated decisions based on reliable technical analysis. This article delves into the world of forex intraday strategies using non-repainting indicators on MT4, a renowned platform trusted by traders worldwide. Join us on this journey to discover how these indicators can transform your trading game and empower you with a powerful knowledge that can lead you down the path of consistent profitability in the forex markets.

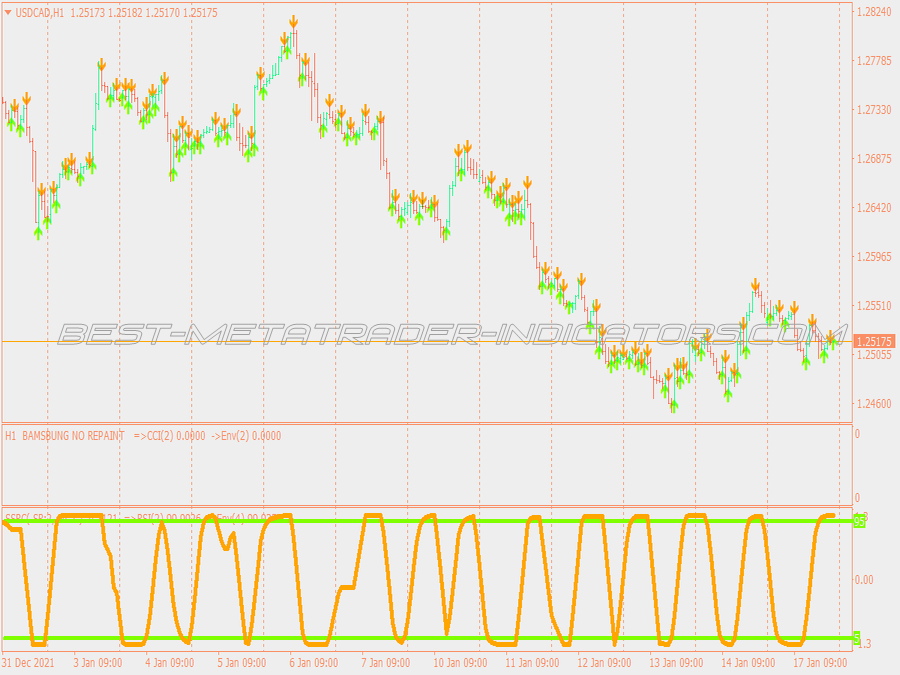

Image: www.best-metatrader-indicators.com

Stepping into the Realm of Non-Repainting Indicators

Non-repainting indicators are a game-changer in forex trading, offering traders a distinct advantage over their counterparts who rely on traditional indicators that redraw historical data at every new candle. This unique quality of non-repainting indicators ensures that the signals they generate remain constant, protecting traders from falling prey to false or misleading signals. Whether you’re a seasoned trader or just starting your foray into the world of forex, harnessing the power of non-repainting indicators can significantly enhance your trading performance and elevate your chances of achieving consistent profitability.

A Comprehensive Analysis of Effective Non-Repainting Indicator Strategies

In this section, we will provide an in-depth analysis of some highly effective non-repainting indicator strategies commonly used by successful Forex traders. Each strategy will be thoroughly explained with clear and concise instructions, empowering you to implement them seamlessly into your trading arsenal.

VWAP Strategy: The Volume-Weighted Average Price (VWAP) is a powerful indicator that reflects the average price of a currency pair weighted by its trading volume. By utilizing non-repainting VWAP indicators, traders can identify potential trading opportunities when price action deviates significantly from the VWAP, signaling potential reversals or continuations of the prevailing trend.

MA Cross Strategy: Moving Averages (MAs) are popular technical indicators widely used to determine the overall trend of a currency pair. By combining multiple MAs with varying periods and utilizing non-repainting versions, traders can construct effective trading strategies based on MA crossovers and divergences, helping them make informed entries and exits.

Bollinger Bands Strategy: Bollinger Bands are a versatile indicator that provides valuable insights into market volatility and price action. The non-repainting Bollinger Bands can help traders identify potential trading opportunities when price moves outside the bands or touches the band’s boundaries, indicating potential trend reversals or continuations.

RSI Divergence Strategy: The Relative Strength Index (RSI) is a momentum oscillator that measures the strength and direction of a trend. The non-repainting RSI divergence strategy helps traders spot potential trading opportunities when the RSI indicator diverges from price action, indicating a possible trend reversal or exhaustion of the current trend.

Ichimoku Cloud Strategy: The Ichimoku Cloud is a comprehensive technical indicator that combines multiple components to provide a comprehensive view of market conditions. The non-repainting Ichimoku Cloud strategy helps traders identify potential trading opportunities based on the position of price action relative to the cloud, as well as crossovers between the cloud’s components.

The Edge in Intraday Trading: A Step-by-Step Implementation Guide

Having explored the power of non-repainting indicators and their potential to enhance intraday trading performance, let’s delve into a step-by-step implementation guide to help you seamlessly incorporate these valuable tools into your trading routine:

-

Choose a Reliable Broker: The foundation of successful trading lies in selecting a trustworthy and regulated broker. Partner with a broker that offers the MT4 platform and provides access to non-repainting indicators.

-

Install Non-Repainting Indicators: Once you have chosen a broker, download and install the non-repainting indicators discussed in this article onto your MT4 platform. Ensure that the indicators are correctly configured and added to your charts.

-

Develop a Trading Plan: A well-defined trading plan is crucial for consistent profitability. Identify the specific non-repainting indicator strategies you want to employ, define your entry and exit criteria, and determine your risk management parameters.

-

Practice and Refine: Before risking real capital, practice your non-repainting indicator strategies on a demo account or through paper trading. This allows you to refine your strategies, gain confidence, and minimize the risks associated with live trading.

-

Monitor and Adjust: Once you start live trading, it’s essential to monitor your results and make adjustments to your strategies as needed. The forex market is dynamic, and strategies that work well in certain conditions may not perform optimally in others. Be prepared to adapt and refine your approach.

Image: forex-nn.com

Forex Intraday Mt4 Strategies With Non Repainting Indicators

Unlocking the Potential of Non-Repainting Indicators for Forex Intraday Trading

Non-repainting indicators are a valuable asset for forex traders looking to make informed decisions and enhance their profitability. By incorporating these powerful tools into your trading arsenal and following the step-by-step implementation guide outlined in this article, you can gain a significant advantage in the fast-paced world of intraday trading. Remember to choose a reputable broker, install the indicators correctly, develop a sound trading plan, practice and refine your strategies, and continuously monitor and adjust your approach to maximize your chances of success in the forex markets.