Unveiling the Secrets of Forex Trading with Support and Resistance Indicator

Navigating the dynamic forex market requires astute insights and effective trading strategies. The support and resistance indicator is a valuable tool that assists traders in identifying key price levels where buying or selling pressure predominates. This indispensable technical indicator equips traders with a clear understanding of market trends, enabling them to make informed trading decisions and enhance their trading performance.

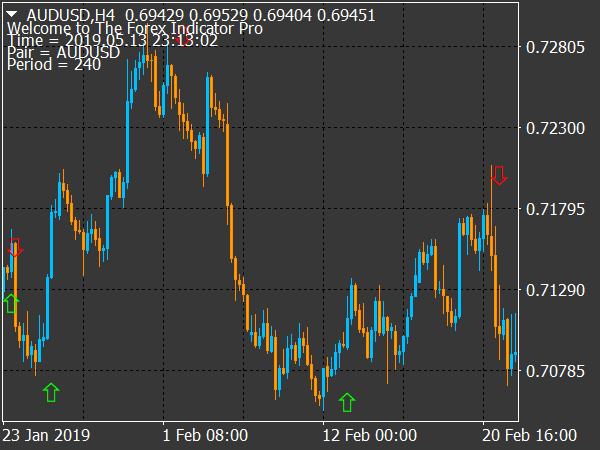

Image: howtotradeonforex.github.io

Understanding Support and Resistance Levels

The support level in forex trading represents the price threshold below which demand is believed to exceed supply, indicating a potential buying opportunity. Conversely, the resistance level signifies the price threshold above which supply exceeds demand, signaling a potential selling opportunity. These levels demarcate areas where price has consistently struggled to move past, creating a psychological barrier for traders.

Devising Strategies Using Support and Resistance Indicators

Support and resistance levels provide pivotal clues for developing robust trading strategies. When price approaches a support level, traders may anticipate a potential price reversal, offering an ideal entry point for long positions (buy). Conversely, when price nears a resistance level, traders may expect a potential price decline, facilitating a favorable entry point for short positions (sell).

Latest Trends and Developments

Advancements in forex trading technology have catalyzed the development of sophisticated variations of the support and resistance indicator. For instance, dynamic support and resistance indicators reflect market conditions in real-time, adjusting pivot points based on changing market dynamics. Furthermore, volatility-based support and resistance indicators incorporate volatility metrics to identify areas of increased price variability, aiding traders in managing risk more effectively.

Image: www.best-metatrader-indicators.com

Tips and Expert Advice for Forex Traders

Embarking on forex trading necessitates a strategic approach, and the following expert advice can elevate your trading prowess:

- Diligent Trend Analysis: Scrutinize trend patterns and observe how price interacts with support and resistance levels to gauge the overall market sentiment.

- Multiple Indicators: Combine the support and resistance indicator with other technical indicators, such as moving averages and oscillators, for comprehensive market insights.

- Risk Management: Place stop-loss orders below support levels for long positions and above resistance levels for short positions to mitigate potential losses.

Frequently Asked Questions (FAQs)

Q: How do I interpret the signals from the support and resistance indicator?

A: Analyze the price action in conjunction with the indicator. If price repeatedly bounces off a support level, it indicates strong buying pressure. Conversely, if price repeatedly encounters resistance at a particular level, it suggests intense selling pressure.

Q: Can the support and resistance indicator predict future price movements?

A: While technical indicators offer guidance, they cannot definitively predict future price movements. They merely provide probabilities based on historical data and market tendencies.

Conclusion

The support and resistance indicator is a crucial tool for forex traders, facilitating the identification of potential trading opportunities and the formulation of informed decisions. Embracing this powerful technical indicator empowers traders to navigate market complexities, enhance their trading strategies, and unlock the potential for successful forex trading.

Forex Indicatorssupport And Resistance Indicator Mt4

Call to Action

Embark on your transformative forex trading journey today! Are you ready to unlock the power of the support and resistance indicator and propel your trading performance to unprecedented heights? Let’s explore this invaluable indicator together and conquer the dynamic forex market.