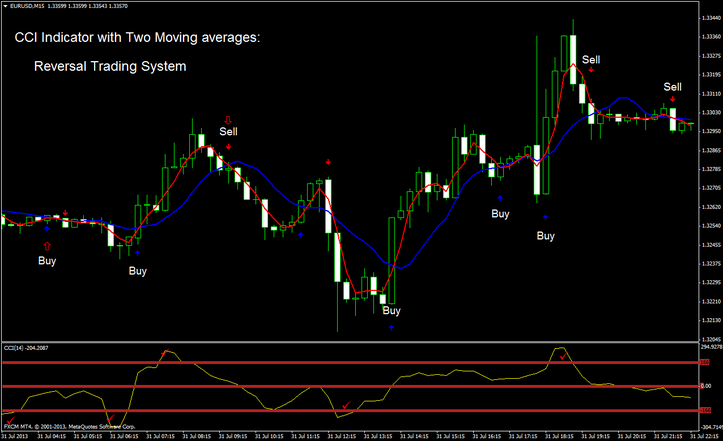

Navigating the dynamic forex market requires a sharp eye for opportunities and a clear strategy for managing risk. The Commodity Channel Index (CCI) is a powerful technical indicator that can empower traders with valuable insights into market trends, overbought and oversold conditions, and potential entry and exit points. This comprehensive guide will delve into the nuances of CCI entry and exit strategies, providing traders with a strong foundation for maximizing their profitability.

Image: forexstrategiesresources.com

CCI: A Versatile Market Tool

Understanding CCI’s Genesis and Utility

Developed by Donald Lambert in the 1980s, the CCI measures the current price level relative to a statistical average over a specified period. By comparing the typical price range to the current price, it identifies potential trend reversals and extreme price fluctuations. Traders can utilize the CCI to identify overbought or oversold conditions, spot potential trading opportunities, and make informed decisions regarding entry and exit points.

CCI Parameters: Customizing Indicators to Market Conditions

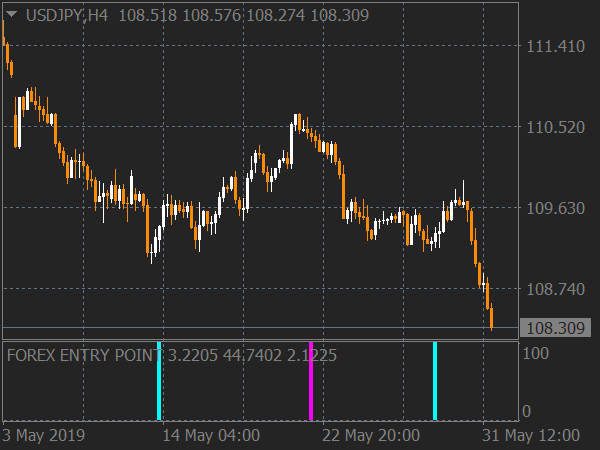

The standard CCI calculation uses a 14-period moving average, but traders can adjust this parameter based on their preferred timeframe and market volatility. A shorter period (e.g., 7 days) is more sensitive to price changes and generates more frequent signals, while a longer period (e.g., 21 days) is smoother and reduces signal noise. Additionally, traders can modify the average type (e.g., simple moving average, exponential moving average) to tailor the CCI to specific market conditions.

Image: www.best-metatrader-indicators.com

CCI Entry Strategies: Identifying Market Opportunities

Overbought and Oversold Signals: Pinpointing Potential Trends

One of the primary uses of the CCI is identifying potential trading opportunities based on overbought and oversold conditions. When the CCI crosses above +100, it indicates that the market is overbought, and a potential sell opportunity may arise. Conversely, when the CCI crosses below -100, it signals an oversold condition, and a potential buy opportunity may present itself. Traders should note that these signals alone do not confirm a trend reversal, and additional analysis is required to determine the validity of the signal.

Divergence: Unveiling Hidden Opportunities Amidst Apparent Trends

Divergence occurs when the CCI trend deviates from the price trend. For example, when the price is making higher highs but the CCI is making lower highs, it indicates a potential bearish divergence, suggesting a possible trend reversal. Conversely, when the price is making lower lows but the CCI is making higher lows, it signals a potential bullish divergence, suggesting a possible trend reversal. Divergence can provide traders with an early indication of a potential trend change, allowing them to adjust their trading positions accordingly.

CCI Exit Strategies: Managing Risk and Locking in Profits

Trailing Stops: Protecting Profits While Capturing Market Trends

Trailing stops are a popular exit strategy when using the CCI. As the price moves in a favorable direction, the trailing stop is adjusted to trail the current price by a specified percentage or number of pips. This allows traders to protect their profits while still allowing the position to run if the trend continues. However, it is crucial to adjust the trailing stop parameters based on market volatility and risk tolerance.

Using CCI Oscillations to Identify Profit-Taking Opportunities

The CCI can also be used to pinpoint profit-taking opportunities. When the CCI crosses back above or below the zero line, it indicates that the current trend may be losing momentum. Traders can consider taking profits when the CCI crosses back above +100 for sell positions or below -100 for buy positions. Additionally, traders can use the CCI to identify potential consolidation zones or trend reversals, allowing them to exit positions before significant losses occur.

Expert Insights and Tips

Combining Indicators for Enhanced Market Analysis

While the CCI is a powerful indicator on its own, combining it with other technical indicators can provide traders with a more comprehensive view of market conditions. For example, using Moving Averages or Bollinger Bands in conjunction with the CCI can help confirm trends and identify potential support and resistance levels. By incorporating multiple perspectives, traders can increase their confidence in their trading decisions.

Understanding Sentiment and Contextual Factors

Technical indicators, including the CCI, should not be used in isolation. Traders must also pay attention to market sentiment, news events, and economic data that can impact market behavior. By combining technical analysis with fundamental analysis, traders can make more informed decisions and navigate market volatility more effectively.

Frequently Asked Questions

- Is the CCI a leading or lagging indicator?

The CCI is considered a lagging indicator because it is based on historical price data. However, it can provide valuable insights into potential trend reversals when combined with other market analysis techniques.

- What are some common CCI trading strategies?

Common CCI trading strategies include overbought/oversold trading, divergence trading, and using trailing stops. Traders can customize these strategies based on their trading style and risk tolerance.

- Can the CCI be used on any timeframe?

Yes, the CCI can be used on any timeframe, ranging from 1-minute charts to monthly charts. The optimal timeframe depends on the trader’s preferred trading style and the volatility of the market being traded.

- Is the CCI a reliable indicator?

All technical indicators have their limitations and should not be relied upon solely. The CCI can be a valuable tool when used in conjunction with other analysis techniques and market context. Traders should always use risk management techniques and understand that no indicator is 100% accurate.

Conclusion: Enhancing Trading Decisions with the CCI

Incorporating the CCI into your trading strategy can provide valuable insights into market trends, overbought and oversold conditions, and potential entry and exit points. By understanding the nuances of the CCI, traders can enhance their decision-making process and increase their chances of trading success. Remember to combine technical analysis with fundamental analysis, practice proper risk management, and continuously evaluate and refine your strategies to optimize your trading performance.

Forex Indicators Cci Entry & Exit

Are You Ready to Explore CCI Trading Strategies?

If you are interested in learning more about CCI entry and exit strategies and how to apply them to your trading, explore our comprehensive resources and connect with our community of experienced traders. Gain the knowledge and confidence you need to navigate the forex market with greater precision and profitability.