Surge Ahead with Precision: Dive into the depths of forex support and resistance indicators and emerge as a market master.

Image: www.earnforex.com

In the ever-changing landscape of the currency arena, precision is a precious commodity. Traders navigate turbulent waters, interpreting market dynamics to ensure they stay afloat. Amidst this trading tempest, forex support and resistance indicators emerge as indispensable tools, illuminating the path towards informed decisions. Discover how these indicators unravel the mysteries of forex markets, empowering traders with the wisdom to make every trade a calculated triumph.

Defining the Pillars of Support and Resistance: A Glimpse into Market Boundaries

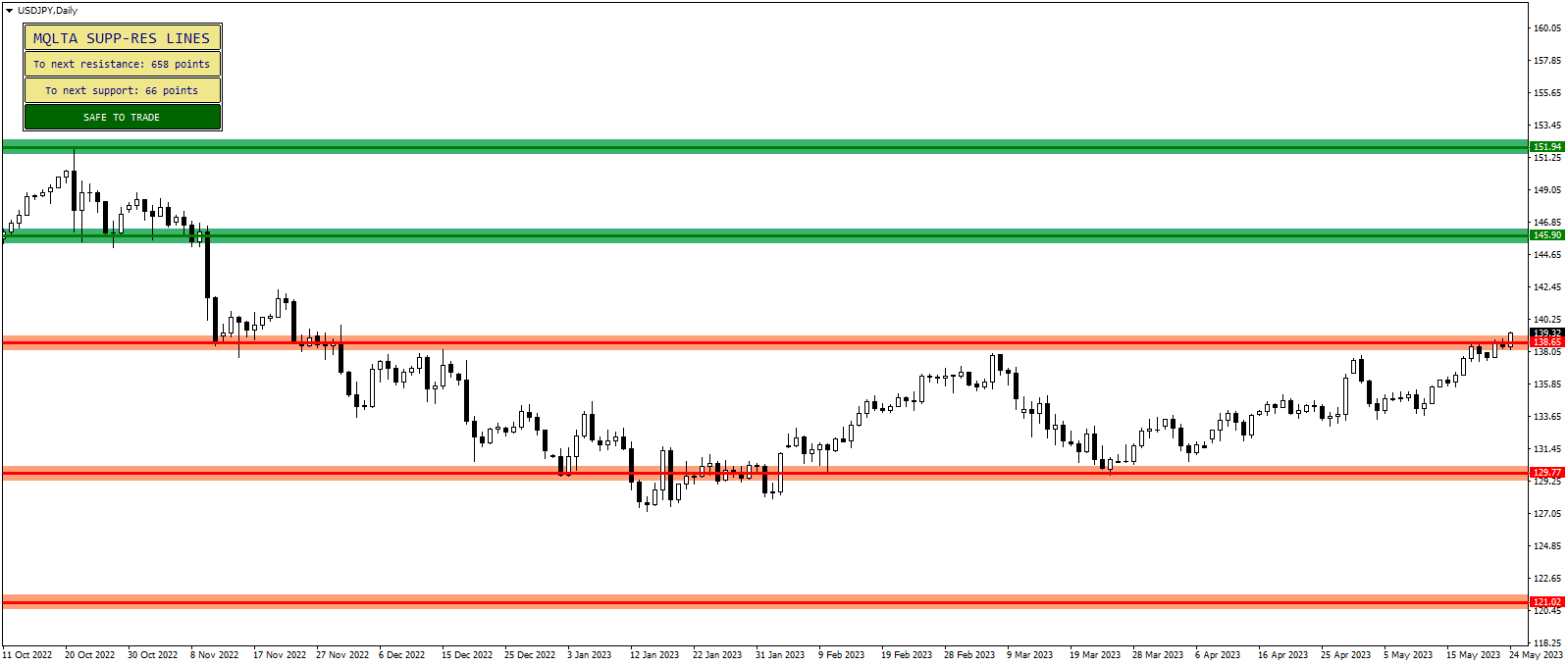

Forex support and resistance indicators unveil the invisible boundaries that shape market movements. Support, a formidable force, acts as a protective shield, blocking the relentless downward march of prices. Should the market tumble, support levels intercept this descent, like steadfast guardian angels restoring equilibrium. Conversely, resistance, an indomitable barrier, stands tall, preventing prices from skyrocketing uncontrollably. When the market surges upward, resistance lines step forward, acting as formidable obstacles that tame the relentless ascent of prices. These two anchors mark the frontiers of market volatility, providing invaluable insights into potential price fluctuations.

Unlocking the Secrets of Support and Resistance Indicators: A Guide to Forex Mastery

A plethora of support and resistance indicators grace the trading realm, each designed to unravel market intricacies and empower traders with an arsenal of insights. Moving averages, a perennial favorite, trace the average price over a defined period, forming a clear and reliable trendline. These multi-faceted indicators identify both support and resistance levels, equipping traders with a solid foundation for strategic decision-making. Bollinger Bands, a dynamic duo, construct an adaptable trading channel around a moving average, with upper and lower bands indicating potential resistance and support zones. Traders leverage these dynamic boundaries to identify trading opportunities when prices touch or deviate from these bands.

Harnessing the Power of Support and Resistance: Strategies for Profitable Trading

Traders who master the art of incorporating support and resistance indicators into their trading strategies wield a formidable weapon in the currency arena. When prices approach a support level, a flicker of hope ignites, signaling a potential buying opportunity. Traders anticipate a price rebound off this support floor, presenting an opportune moment to enter the market with a strategic buy order. Conversely, as prices near a resistance level, traders grow cautious, sensing the potential for a price reversal. Seasoned traders seize this opportunity to place calculated sell orders, aiming to profit from the anticipated price decline.

Dynamic Adaptations: Customizing Indicators for Optimal Performance

The forex market is a dynamic entity, constantly evolving and challenging traders to adapt. Savvy traders recognize the value of customizing their chosen indicators to suit their unique trading style and market conditions. Adjustable periods, moving averages, and Bollinger Band settings allow traders to tailor their indicators to align with their risk tolerance and time horizon. This flexibility ensures indicators remain responsive to market shifts, empowering traders to make informed decisions in real-time.

Expert Insights: Wisdom from the Masters of the Market

“Support and resistance levels provide invaluable guidance in the tumultuous waters of forex trading,” proclaims renowned trader Mark Douglas. “These indicators illuminate potential turning points, enabling traders to make insightful decisions that steer them towards success.”

Echoing Douglas’s sentiments, trading legend Alexander Elder emphasizes the importance of patience when utilizing support and resistance indicators. “Market movements often test these boundaries multiple times before a decisive breakout occurs,” Elder advises. “Traders must exercise patience and avoid premature entries, allowing the market to reveal its true intentions.”

Embrace the Journey: Continuously Refining Your Trading Skills

Mastering forex support and resistance indicators is a continuous journey of refinement and adaptation. As traders navigate the evolving market landscape, they must remain diligent in testing and fine-tuning their strategies. Each trade offers valuable lessons, shaping their understanding of market behavior and empowering them to make informed decisions. With unwavering perseverance and a commitment to continuous learning, traders transform into formidable market navigators, equipped to seize opportunities and conquer the challenges that lie ahead.

Courageous Conclusion: Embracing Market Challenges with Confidence

In the intricate world of forex trading, the ability to identify support and resistance levels is a harbinger of success. Forex support and resistance indicators illuminate market dynamics, providing traders with the foresight to make decisive trades. Embrace the power of these invaluable tools, unlocking the secrets of price movements and empowering yourself to navigate the complexities of the currency arena with confidence. Every trade, whether a triumph or a lesson, forges the path towards trading mastery. Let the journey begin.

Image: mt4datablaze.com

Forex Indicator Support And Resistance Indicator Mt4