In the tumultuous realm of forex trading, where market movements can make or break fortunes, every trader yearns for an edge over the competition. Enter the volume indicator, a beacon of enlightenment that illuminates trading paths and empowers traders to make informed decisions. Let us embark on a journey into the world of forex volume indicators, deciphering its intricacies and harnessing its potent insights.

Image: howtotradeonforex.github.io

The Essence of Volume in Forex

Volume, as its name suggests, measures the number of trades executed within a specific time frame. It serves as a gauge of market activity, revealing the intensity of buying and selling pressure. Armed with this knowledge, traders can assess the true strength of market moves and identify potential turning points with greater accuracy.

Volume Indicators: A Trader’s Swiss Army Knife

Forex volume indicators transform raw volume data into digestible and actionable insights. These indicators employ mathematical formulas to highlight volume patterns, anomalies, and discrepancies, allowing traders to discern the underlying market sentiment and make informed trading decisions. Prominent volume indicators include:

- On-Balance Volume (OBV): This indicator measures the cumulative volume flow into or out of a security, providing insights into the underlying buying and selling pressure.

- Accumulation/Distribution Line (A/D): The A/D line represents the cumulative volume-weighted price difference, helping traders gauge the momentum behind price movements.

- Volume Profile: This indicator visualizes volume distribution at different price levels, identifying areas of support and resistance as well as potential trading opportunities.

Harnessing Volume Indicator Insights

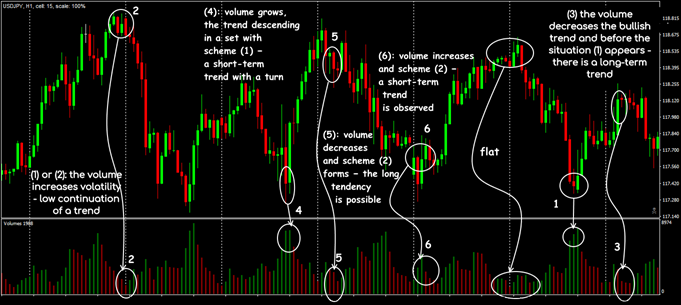

Mastering volume indicator interpretation is crucial for exploiting its potential. Here are a few trading strategies to consider:

- Divergence: When price action diverges from volume, it can signal an impending trend reversal. For instance, a bullish trend accompanied by declining volume may indicate a weakening uptrend.

- Confirmation: Volume can act as a confirmation signal for price breakouts or reversals. A strong volume surge coinciding with a breakout signifies heightened conviction among market participants.

- Trend Identification: Heavy volume on up days and low volume on down days suggests an uptrend. Conversely, the opposite pattern indicates a downtrend.

Image: forextester.com

Volume Analysis: A Trailblazer’s Guide

In the hands of a skilled trader, volume analysis unveils a wealth of opportunities. Consider these expert insights:

- Mark Fisher, Technical Analysis Specialist: “Volume is the lifeblood of the market. It provides insights into the emotions and motivations of the participants, allowing traders to gauge the true strength of market moves.”

- Kathy Lien, Managing Director at BK Asset Management: “Volume is a valuable tool for discerning divergences and identifying market inefficiencies. By incorporating volume into our analysis, we can uncover potential trading opportunities that others may miss.”

Forex How To Use Volume Indicator

Conclusion: Ascending to Forex Mastery

Mastering the volume indicator is an essential step towards achieving forex trading proficiency. By delving into volume patterns, discrepancies, and anomalies, traders can unlock a treasure-trove of market insights. Whether you are a seasoned professional or a fledgling trader, harnessing the power of volume indicators will elevate your trading strategies and optimize your path to success.