Delve into the World of Foreign Exchange Analysis

The international Forex market offers a thrilling and dynamic environment for traders, where every currency fluctuation holds both potential gain and risk. Navigating this complex ecosystem requires astute decision-making, a thorough understanding of market trends, and a mastery of analytical tools. Enter Excel, the industry-leading spreadsheet software, and its invaluable repository of forex historical data.

Image: www.youtube.com

Unveiling Forex Historical Data’s Significance

Forex historical data, the chronicles of currency price movements, empowers traders with invaluable insights into market behavior. By studying past trends, identifying recurring patterns, and analyzing correlations between currency pairs, traders can make informed predictions, assess risk levels, and optimize their trading strategies. Excel, with its robust data manipulation and visualization capabilities, becomes the perfect medium to harness this data for strategic advantage.

Importing and Cleaning Forex Data in Excel

Embarking on a data-driven forex trading journey begins with importing historical data into Excel. Numerous reputable data providers offer customizable data sets that can be easily integrated into the software. Once imported, meticulous data cleaning becomes essential to ensure accuracy and consistency. This involves removing duplicate entries, standardizing date and time formats, and correcting any data anomalies.

Leveraging Excel’s Data Analysis Capabilities

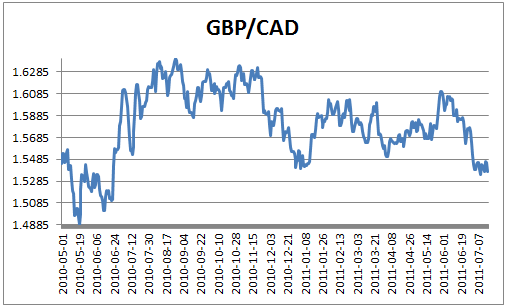

Excel’s arsenal of data analysis tools empowers traders with the means to unlock actionable insights from historical data. Create pivot tables to summarize and compare data across multiple dimensions, revealing market trends and correlations. Utilize charting capabilities to visualize price patterns, identify support and resistance levels, and track technical indicators. Statistical functions provide further insights, enabling traders to calculate descriptive statistics, perform hypothesis tests, and assess the significance of their observations.

Image: investexcel.net

Devising Effective Trading Strategies

The culmination of data analysis leads to the development of effective trading strategies. Based on identified market patterns, traders can devise rule-based systems or employ quantitative models to make buy and sell decisions. Backtesting these strategies on historical data allows traders to gauge their potential profitability and refine their approach before risking real capital.

Integrating Excel with Trading Platforms

Modern trading platforms often provide the ability to integrate with Excel, enabling seamless data transfer and real-time analysis. This integration streamlines the workflow, allowing traders to analyze historical data and make trading decisions within a single software suite. Automation features, such as automated order placement and conditional alerts, can further enhance efficiency.

Tips for Enhanced Data Analysis

1. Focus on Relevant Data:

Tailor your data selection to the specific currency pairs and time periods relevant to your trading strategy. Avoid unnecessary noise by filtering out irrelevant data.

2. Apply Technical Analysis:

Employ technical indicators and chart patterns to identify trends, support and resistance levels, and momentum. Enhance your decision-making by integrating technical analysis into your data analysis.

3. Monitor Economic News:

Economic news events can significantly impact currency prices. Stay informed about upcoming news releases and factor them into your analysis to stay ahead of market movements.

FAQs on Forex Historical Data in Excel

1. Where can I obtain forex historical data?

Many reputable data providers offer paid or free access to historical forex data. Determine which data source best suits your specific requirements.

2. How can I clean and prepare forex data in Excel?

Utilize Excel’s data cleaning tools, such as the “Remove Duplicates” function, to eliminate errors and inconsistencies. Standardization of data formats ensures accurate analysis.

3. What is the benefit of backtesting trading strategies?

Backtesting allows you to evaluate the profitability and efficiency of your trading strategies using historical data, minimizing risk before implementing them in live trading.

Forex Historical Data In Excel

Conclusion

Empowering yourself with forex historical data analysis in Excel opens up a world of possibilities in the foreign exchange market. By understanding market trends, identifying correlations, and developing robust trading strategies, you can navigate the volatile forex landscape with confidence and precision.

Are you ready to take your Forex trading to the next level? Unleash the potential of historical data analysis in Excel and harness its power to maximize your gains in the dynamic world of foreign exchange markets.