In the fast-paced and dynamic world of forex trading, staying ahead of the curve is paramount to maximizing profits and mitigating risks. Enter high-frequency trading (HFT) algorithms –sophisticated computational tools designed to execute a plethora of trades at lightning speed. By leveraging the power of these algorithms, traders can gain a significant advantage in the competitive forex market. In this comprehensive guide, we delved into the realm of HFT algorithms, providing you with a wealth of insights, practical applications, and a forex hft algorithm indicator download link, so you can harness the power of this cutting-edge technology.

Image: admiralmarkets.com

Forex HFT Algorithms: A Comprehensive Overview

High-frequency trading (HFT) algorithms are a class of advanced computational tools employed in the forex market to execute a vast number of orders in a matter of milliseconds. Unlike manual trading, which relies on human judgment and execution, HFT algorithms are programmed to make autonomous trading decisions based on pre-defined parameters, leveraging sophisticated mathematical models and real-time data analysis. This automation enables HFT algorithms to react swiftly to market fluctuations, identify potential trading opportunities, and execute trades with ultra-low latency, maximizing the potential for profitable outcomes.

Benefits of Utilizing Forex HFT Algorithms

The advantages of incorporating forex HFT algorithms into your trading strategy are multifaceted, enabling traders to:

-

Execute Trades with Unmatched Speed: HFT algorithms operate at lightning speed, executing numerous trades in a matter of milliseconds, giving traders a significant edge over manual traders. This speed advantage can be crucial in volatile market conditions, where even the slightest delay can result in missed opportunities or substantial losses.

-

Capitalize on Short-Term Market Inefficiencies: HFT algorithms are adept at identifying and exploiting short-lived market inefficiencies, such as price discrepancies between different exchanges or deviations from expected price movements. By capitalizing on these fleeting opportunities, traders can accumulate profits that would otherwise be inaccessible to manual traders.

-

Remove Emotional Bias from Trading Decisions: Unlike human traders, HFT algorithms are not susceptible to emotional biases, which can cloud judgment and lead to irrational decision-making. By eliminating the influence of emotions, HFT algorithms can execute trades with consistent precision and objectivity, enhancing the overall trading performance.

-

Manage Risk Effectively: Advanced HFT algorithms often incorporate sophisticated risk management modules that monitor market conditions and adjust trading strategies accordingly, minimizing potential losses. These algorithms can set stop-loss orders, adjust position size based on market volatility, and employ hedging techniques to mitigate downside risk.

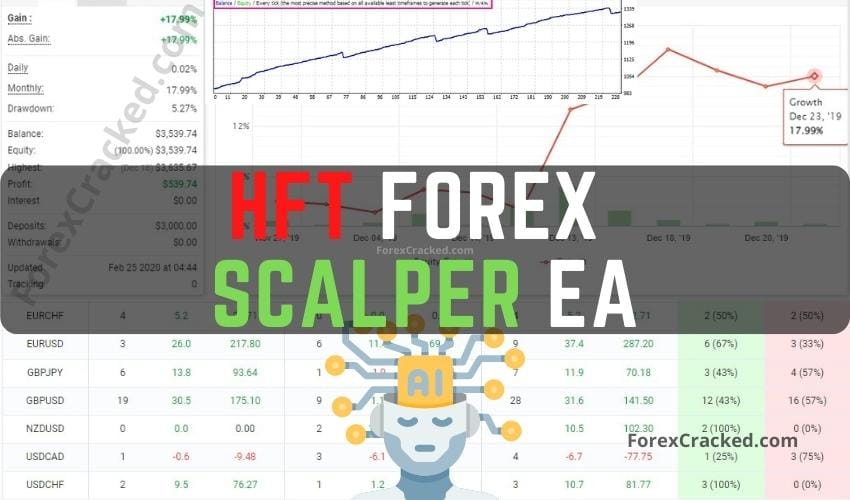

Image: www.forexcracked.com

Forex Hft Algorithm Indicator Download

Forex HFT Algorithm Indicator Download: A Gateway to Enhanced Trading

To empower you with the power of HFT algorithms, we have compiled a curated collection of reputable and reliable forex HFT algorithm indicators. These indicators, compatible with popular trading platforms such as MetaTrader 4 and MetaTrader 5, can seamlessly integrate with your existing trading setup.

Disclaimer: Please note that while these indicators have been carefully selected, we recommend conducting thorough research and due diligence before using any HFT algorithm indicator in your trading activities. Seek professional advice from financial experts or experienced traders to fully understand the risks and nuances of HFT before deploying it in your own strategies.