Introduction

Forex trading, the exchange of currencies between nations, is a significant financial market. To ensure transparency and compliance, many countries have implemented Goods and Services Tax (GST) on forex transactions. Calculating GST manually can be a daunting task, especially for high-volume traders. Here’s where an Excel template can be a game-changer. In this comprehensive guide, we will delve into the intricacies of forex GST calculation and provide a step-by-step process to create a user-friendly Excel template that will streamline your GST calculations.

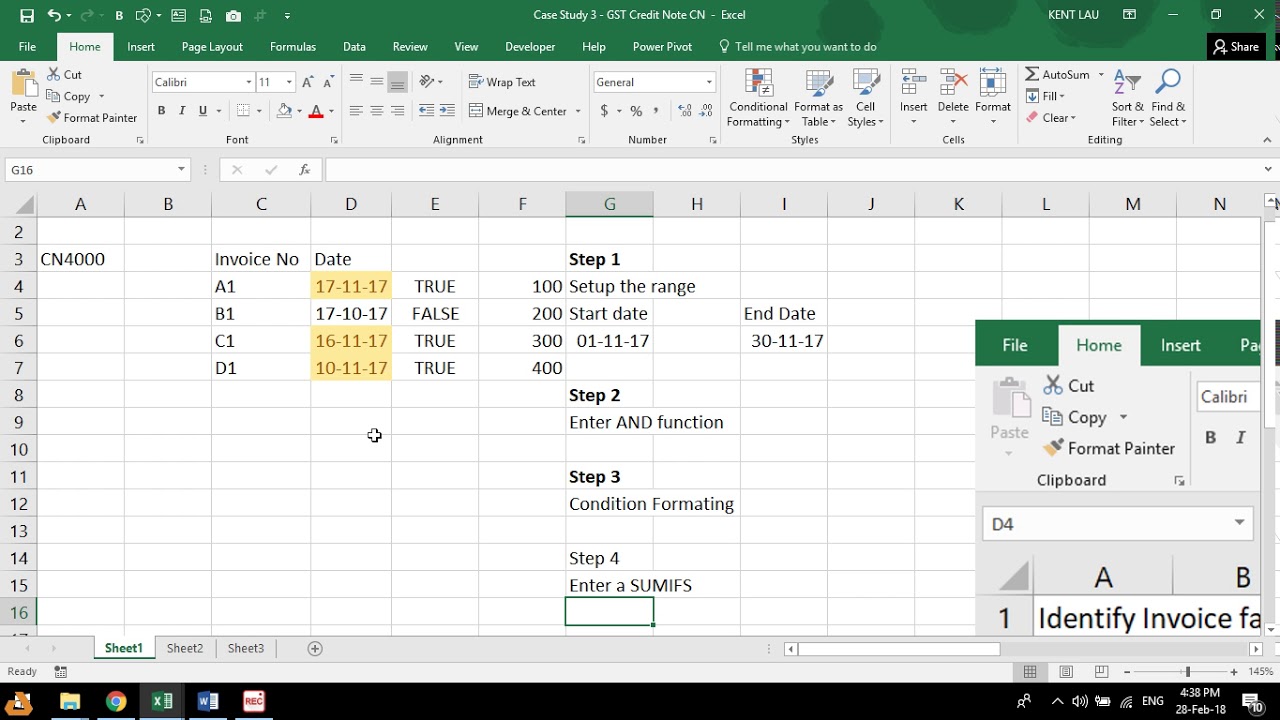

Image: nsaveri.weebly.com

Understanding Forex GST

GST on forex transactions typically varies depending on the country’s tax laws. It is usually calculated as a percentage of the transaction value, commonly known as the GST rate. Traders are responsible for paying GST on both profits and losses. Failing to comply with GST regulations can result in penalties and legal consequences.

Benefits of Using an Excel Template

An Excel template offers numerous advantages when it comes to forex GST calculations:

- Accuracy: Excel’s formulas ensure precise GST calculations, eliminating human errors.

- Efficiency: Automating calculations saves time and effort, enabling traders to focus on making trades.

- Convenience: Traders can easily input their transaction data and instantly see the GST payable.

- Transparency: A well-structured template provides a clear record of GST calculations for tax audits.

- Customization: Templates can be modified to suit individual trading needs.

Creating an Excel Template

Here’s a step-by-step guide to create a forex GST calculation Excel template:

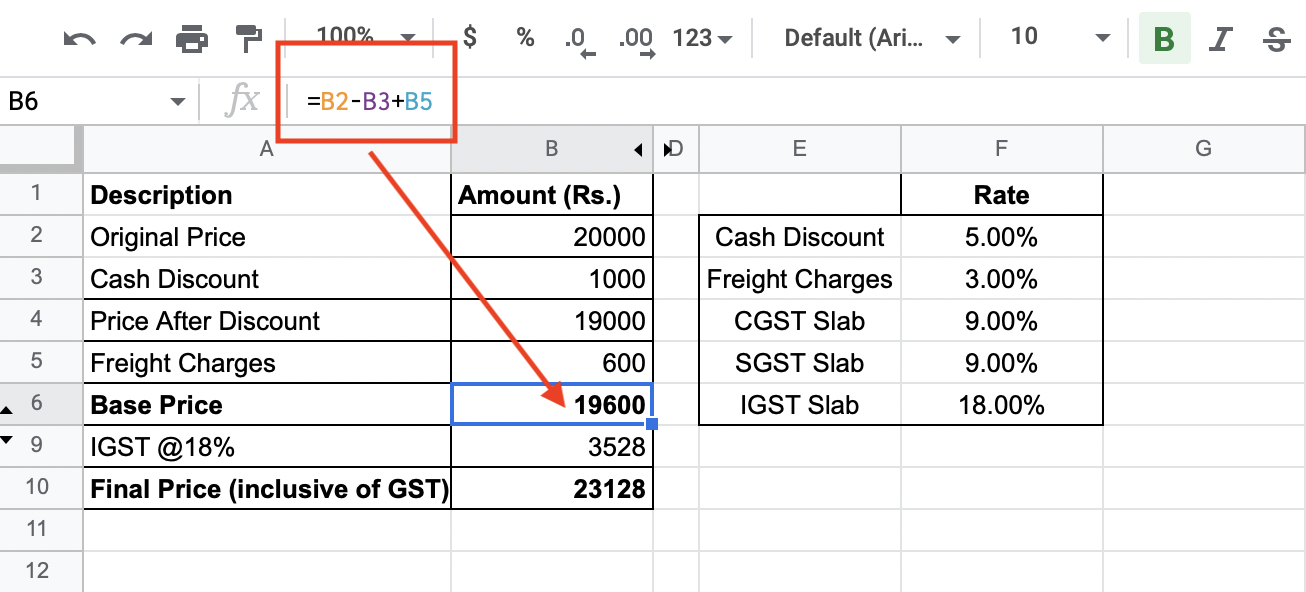

Image: www.hotzxgirl.com

1. Set Up the Worksheet

- Create a new Excel worksheet.

- Label the columns as follows: Transaction Date, Currency Pair, Transaction Value, GST Rate, GST Amount, Gross Amount (Transaction Value + GST).

2. Enter the GST Rate

- In the “GST Rate” column, enter the applicable GST percentage for your country. For example, if the GST rate is 5%, enter 5%.

3. Insert the Transaction Details

- In the respective columns, enter the transaction date, currency pair, and transaction value for each trade.

4. Calculate the GST Amount

- In the “GST Amount” column, use the formula “=(C2*D2)/100” to calculate the GST for each transaction. “C2” represents the transaction value, and “D2” represents the GST rate.

5. Calculate the Gross Amount

- In the “Gross Amount” column, use the formula “=C2+E2” to calculate the gross amount, which includes both the transaction value and the GST.

6. Sum Up the Values

- At the bottom of the worksheet, use the SUM function to calculate the total GST amount and the total gross amount.

7. Customize the Template

- You can customize the template to include additional information, such as trader details, client details, or trade notes.

- If you trade in multiple currencies, create separate worksheets for each currency to avoid currency conversion errors.

Forex Gst Calculation In Excel Format

https://youtube.com/watch?v=ogqs_IKIDhI

Conclusion

An Excel template for forex GST calculation is an indispensable tool that simplifies this complex task. By following the steps outlined in this guide, you can create a tailored template that streamlines your GST calculations, ensuring accuracy, efficiency, and compliance with tax regulations. By embracing this tool, you can allocate more time to making profitable trades while maintaining transparency and accountability in your forex operations.