Unlocking the Secrets of Round-the-Clock Trading

Imagine the financial world as a vibrant tapestry woven by the interconnectedness of global markets. Forex, the foreign exchange market, stands as a central thread, orchestrating the exchange of currencies from every corner of the globe. Its pulse beats strong, twenty-four hours a day, five days a week, as traders from different time zones exchange currencies, shaping market dynamics.

Image: admiralmarkets.com

Understanding the intricacies of forex global market trading hours is crucial for any aspiring trader. It empowers you to strategize your trading, capitalize on market fluctuations, and manage risk effectively. In this comprehensive guide, we will delve into the fascinating world of forex trading hours, unveiling the secrets of round-the-clock trading.

Navigating the Forex Market’s Time Zones

The forex market, like a tireless traveler, traverses time zones, connecting financial hubs across continents. As one trading day ends in one part of the world, another begins elsewhere, ensuring a perpetual cycle of market activity.

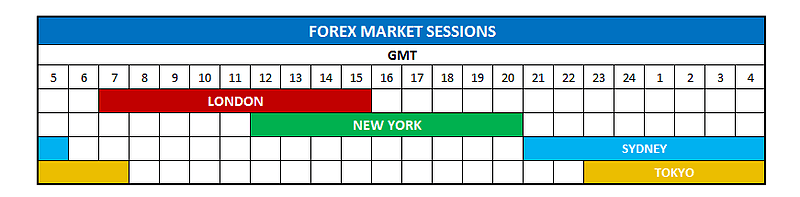

Key financial centers like London, New York, Tokyo, and Sydney serve as the epicenters of forex trading, each operating during specific hours that overlap to create an uninterrupted flow of liquidity. These overlapping sessions offer traders the flexibility to trade at times that align with their preferred market conditions.

Comprehensive Overview of Forex Trading Hours

- Sydney Session (00:00 – 08:00 UTC): Kicking off the trading day, the Sydney session sets the tone for the Asia-Pacific region. It overlaps with the end of the New York session, providing a bridge between the Eastern and Western hemispheres.

- Tokyo Session (01:00 – 09:00 UTC): The Tokyo session overlaps with both the Sydney and London sessions, creating a period of high liquidity. It is during this time that news from the Asian markets has a significant impact on currency pairs involving the Japanese yen.

- London Session (08:00 – 16:00 UTC): The London session is the cornerstone of the forex market, overlapping with both the Tokyo and New York sessions. It is during this time that the highest volume of trading occurs, as major financial institutions and corporations execute their orders.

- New York Session (13:00 – 21:00 UTC): The New York session overlaps with both the London and Sydney sessions, ensuring a seamless transition as trading shifts from West to East. It is during this time that macroeconomic data releases from the United States have a profound impact on currency pairs involving the US dollar.

Trending Updates and Technological Advancements in Forex Trading

The forex market is constantly evolving, and so are its trading technologies and practices. Artificial intelligence (AI) and machine learning (ML) algorithms are increasingly being used by traders to analyze market data, identify trading opportunities, and execute orders.

Furthermore, the advent of mobile trading platforms has made it possible for traders to access the market and manage their positions from anywhere, at any time. These advancements have democratized the forex market, making it accessible to a broader range of participants.

Image: dailypriceaction.com

Expert Advice for Maximizing Forex Trading Opportunities

- Choose Your Trading Times Wisely: Identify the forex trading hours that align with your risk tolerance and market conditions. Trading during periods of high liquidity can minimize slippage and spread.

- Monitor Global Events: Stay abreast of economic indicators, political developments, and geopolitical events that can impact currency markets. Understanding the macroeconomic environment will help you make informed trading decisions.

- Emphasize Risk Management: Implement stop-loss and take-profit orders to protect your capital and manage risk. Maintain a realistic trading plan and avoid overleveraging your positions.

- Practice Patience and Discipline: Forex trading requires patience and discipline to maximize returns. Avoid emotional decision-making and stick to your trading strategy even when faced with market volatility.

FAQ on Forex Global Market Trading Hours

Q: What are the key time zones for forex trading?

A: London, New York, Tokyo, and Sydney are the key time zones for forex trading.

Q: When does the forex market close?

A: The forex market operates 24 hours a day, 5 days a week, with different trading sessions overlapping.

Q: Is it possible to trade forex on weekends?

A: No, the forex market is closed on weekends.

Q: What time are the most active trading hours?

A: The London and New York trading sessions (08:00 – 16:00 UTC and 13:00 – 21:00 UTC respectively) are the most active trading hours.

Q: Do all forex brokers offer trading during all hours?

A: Not all forex brokers offer trading during all hours. Some brokers may have specific trading hours that align with the major trading sessions.

Forex Global Market Trading Hours

Conclusion

Understanding forex global market trading hours is essential for suksesful trading. A grasp of the market’s rhythm empowers traders to capitalize on market trend shift, manage risk efficiently and optimize trading strategies. Whether you are a seasoned veteran or a novice, a profound understanding of trading hours will provide you with a competitive edge. We invite you to dive deeper into the topic and uncover the myriad of trading opportunities that the global forex market holds.