Introduction

In the dynamic world of forex trading, understanding the intricacies of forex gains and losses accounting is paramount for investors seeking to navigate the markets strategically and enhance their financial performance. Forex gains and losses accounting involve meticulous record-keeping of transactions to determine the profitability of trades and comply with regulatory requirements. In this comprehensive guide, we will delve into the fundamentals of forex gains and losses accounting, exploring its significance, practical implementation, and strategic implications.

Image: www.forex.academy

Understanding the Basics of Forex Gains and Losses

Forex gains refer to the profit earned when a currency pair is bought at a lower price and sold at a higher price, while forex losses occur when the opposite happens. Accounting for these gains and losses is essential for accurately determining the financial status of a trader or investment fund. Forex gains and losses are recorded in the income statement, typically under the “FX Gains/Losses” section.

Importance of Forex Gains and Losses Accounting

Effective forex gains and losses accounting provides traders with several critical benefits:

- Tax Compliance: Financial authorities in many jurisdictions require traders to declare their forex gains and losses for tax purposes. Accurate accounting ensures compliance with these regulations.

- Accurate Financial Reporting: Transparent accounting of forex gains and losses enables investors to assess the performance of their trades and make informed decisions regarding risk management and portfolio allocation.

- Profit Optimization: By tracking forex gains and losses, traders can identify the most profitable trading strategies and optimize their performance. It also allows them to minimize losses and maximize returns.

- Risk Management: Comprehensive forex gains and losses accounting facilitates risk management by providing traders with a clear picture of their exposure to market fluctuations. This information enables them to manage their risks effectively and minimize potential losses.

Accounting Methods for Forex Gains and Losses

Two primary methods are used for forex gains and losses accounting:

- Realization Method: This method records forex gains or losses only when a position is closed. It is commonly used by retail traders and small investment firms.

- Mark-to-Market Method: This method involves valuing open positions at their current market value on a daily basis. It provides a more accurate representation of a trader’s financial position but is more complex than the realization method.

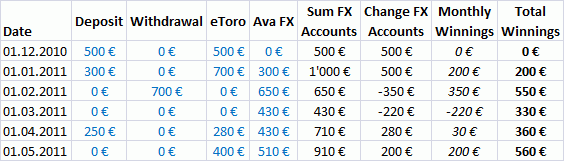

Image: www.brokerreviews.org

Strategic Considerations in Forex Gains and Losses Accounting

Beyond its accounting implications, forex gains and losses have significant strategic implications for traders:

- Tax Planning: By understanding the tax implications of forex gains and losses, traders can optimize their tax strategy and minimize liabilities.

- Currency Management: Active monitoring of forex gains and losses allows traders to make informed decisions about currency diversification and hedging strategies.

- Risk Mitigation: Effective accounting provides a framework for traders to identify and mitigate potential risks associated with forex trading, such as currency exchange rate fluctuations.

Forex Gains And Losses Accounting

Conclusion

Forex gains and losses accounting is a crucial aspect of forex trading that empowers traders to maximize profitability, minimize risks, and ensure compliance with regulatory requirements. By mastering the fundamentals of forex gains and losses accounting and adopting strategic approaches, traders can enhance their financial performance and navigate the complexities of the forex markets with confidence.