In the ever-evolving landscape of global finance, understanding the intricacies of foreign exchange (forex) accounting is crucial for businesses and individuals alike. This comprehensive guide will delve into the world of forex gain or loss accounting treatment in Tally, empowering you with the knowledge and strategies to navigate this complex terrain confidently and effectively.

Image: absssupport.zendesk.com

Understanding Forex Gain or Loss: A Foundation for Accurate Accounting

Forex gain or loss arises when the value of a foreign currency held or transacted differs from its original value at the time of acquisition or sale. As businesses engage in international transactions, it is essential to account for these fluctuations accurately to maintain the integrity of financial statements. Tally, a robust accounting software, offers powerful features to manage forex transactions efficiently.

Forex Gain or Loss Accounting in Tally: A Step-by-Step Guide

To ensure accurate accounting of forex transactions in Tally, the following steps are crucial:

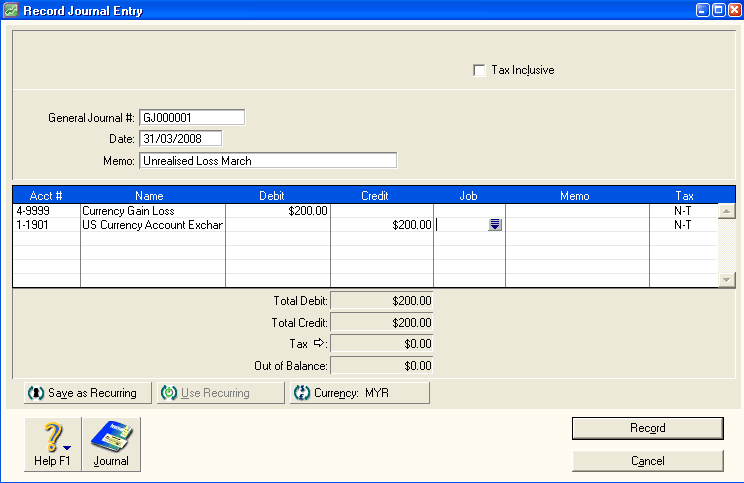

1. Record Forex Transactions Accurately: Enter forex transactions in Tally by creating vouchers. Ensure that the exchange rate used is the rate prevailing on the transaction date and that all relevant details, such as the type of transaction, amount, and currency, are captured meticulously.

2. Create and Update Exchange Rate Master Details: Tally allows you to define exchange rates for various currencies. Regularly updating these rates is vital to ensure that the system calculates gains or losses accurately. You can automate this process by fetching live exchange rates from reliable sources.

3. Enable Forex Gain or Loss Module: Before recording forex adjustments, enable the Forex Gain or Loss module in Tally’s Accounting Features tab. This step ensures that Tally calculates and records forex gains or losses automatically.

4. Create Ledger Accounts for Forex Gain and Loss: In Tally, create separate ledger accounts for Forex Gain and Forex Loss. These accounts will serve as the repository for all realized gains or losses, providing a clear record of forex-related fluctuations.

5. Adjust Forex Gain or Loss Regularly: To ensure up-to-date accounting records, it is essential to adjust forex gain or loss periodically. Tally offers an automated option to perform this adjustment based on the latest exchange rates.

6. Tailor Reporting to Your Needs: Tally allows you to customize reports to meet specific reporting needs. You can generate reports that summarize forex gains or losses by period, currency, or transaction type, providing insights into your forex activities.

Image: www.youtube.com

Forex Gain Or Loss Accounting Treatment In Tally

Expert Advice on Managing Forex Gains and Losses

Beyond the technical aspects, there are strategic considerations that can help businesses optimize forex gain or loss management:

1. Use Forward Contracts to Manage Risk: Forward contracts allow businesses to lock in exchange rates for future transactions, mitigating the impact of adverse forex fluctuations.

2. Explore Currency Exchange Options: Businesses can consider using options contracts to gain further control over currency exchange rates, allowing them to hedge against potential losses or lock in favorable rates.

3. Diversify Currency Exposures: Maintaining a diversified portfolio of currencies can help spread the risk associated with foreign exchange fluctuations, reducing the overall impact on financial performance.