Introduction:

In the ever-evolving realm of finance, understanding the nuances of forex gain and loss is paramount for traders seeking success. Tally.ERP9, a ubiquitous accounting software, offers a sophisticated tool—the forex gain loss worksheet—that empowers businesses to meticulously track and analyze these financial intricacies. This comprehensive guide delves into the intricacies of the forex gain loss worksheet, providing an invaluable resource for both novice and experienced traders alike.

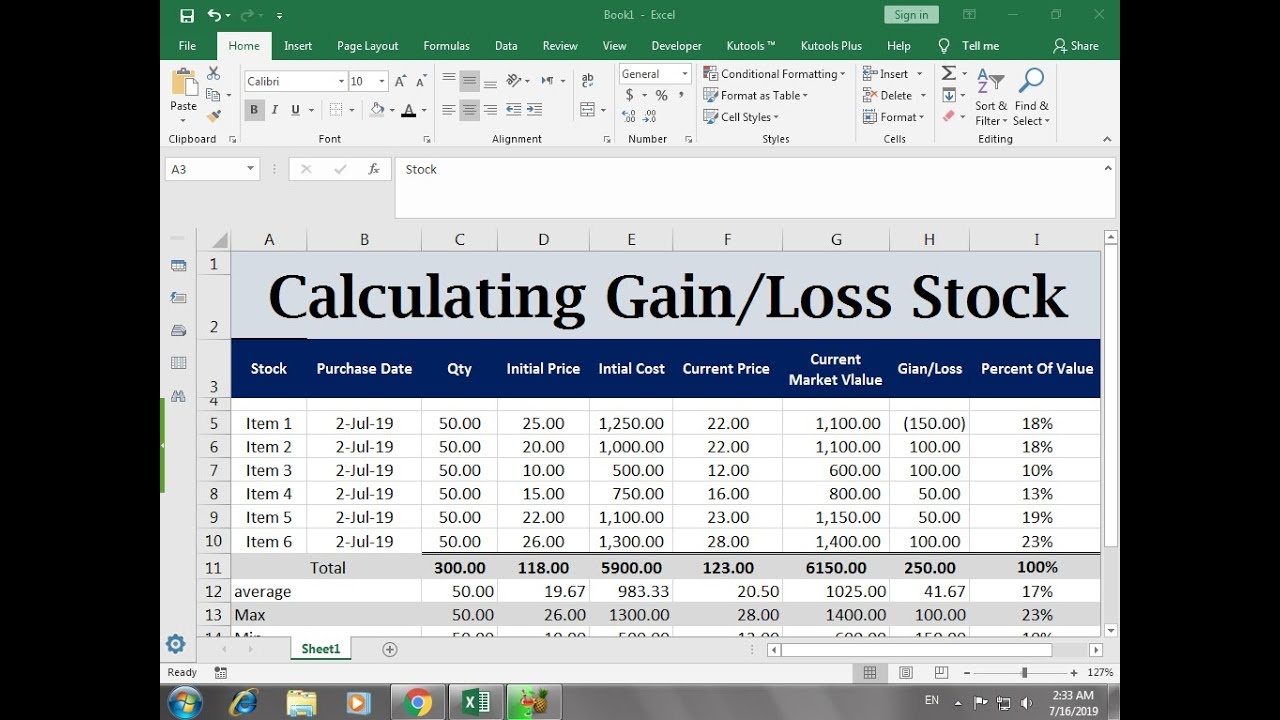

Image: www.youtube.com

1. Deciphering the Concept ofForex Gain and Loss:

Forex, an abbreviation of foreign exchange, refers to the trading of currencies from different countries. Market valuations fluctuate constantly, influenced by a myriad of economic, political, and social factors. These fluctuations give rise to foreign exchange gains and losses, a common occurrence in international business transactions. When the value of a currency rises, a trader holding that currency may realize a gain, while a decline in currency value may result in a loss.

2. Exploring the Forex Gain Loss Worksheet in Tally.ERP9:

Tally.ERP9’s forex gain loss worksheet is an indispensable tool that enables businesses to meticulously track, analyze, and record forex gains and losses. Accessible via the “Gateway of Tally” menu, the worksheet provides a detailed snapshot of all relevant transactions, allowing users to gain a comprehensive understanding of their positions and associated profits or losses. Moreover, the worksheet offers several customizable features that can be tailored to meet specific business requirements.

3. Understanding the Worksheet’s Structural Components:

The forex gain loss worksheet is structured into four primary sections: Forex Ledger, Forex Profit/Loss A/c, Realized Gain/Loss A/c, and Unrealized Gain/Loss A/c. Each section plays a distinct role in capturing and analyzing forex transactions. The Forex Ledger records all forex-related entries, including purchases, sales, and adjustments. The Forex Profit/Loss A/c accumulates the net gain or loss arising from closed (realized) forex transactions. Unrealized gains or losses, representing the potential profit or loss on open (unsettled) forex positions, are reflected in the Realized Gain/Loss and Unrealized Gain/Loss A/c, respectively.

Image: dvidya.com

4. Illustrating the Worksheet’s Practical Implementation:

Suppose a business purchases goods worth USD 100,000 when the exchange rate is 1 USD = INR 70. The transaction is recorded in the Forex Ledger. Subsequently, if the exchange rate changes to 1 USD = INR 72, the business stands to gain INR 20,000, which is recorded in the Realized Gain/Loss A/c when the transaction is settled. Conversely, if the exchange rate had fallen to 1 USD = INR 68, the business would have incurred a loss of INR 20,000, reflected in the same account.

5. Mastering the Art of Forex Gain Loss Analysis:

The forex gain loss worksheet not only facilitates meticulous record-keeping but also empowers traders with valuable insights into their financial performance. By analyzing trends and patterns in forex gains and losses, businesses can identify opportunities, manage risks, and make informed decisions that drive profitability. The worksheet provides a comprehensive view of forex-related transactions, enabling traders to assess the impact of currency fluctuations on their overall financial position.

6. Maximizing the Worksheet’s Capabilities:

To harness the full potential of the forex gain loss worksheet, it is essential to understand how to customize it effectively. The worksheet can be tailored to accommodate different currencies, exchange rates, and accounting periods. Businesses can also define custom fields to capture additional transaction-related information, enhancing the usefulness and flexibility of the worksheet.

Forex Gain Loss Worksheet In Tally.Erp9

7. Conclusion:

The forex gain loss worksheet in Tally.ERP9 is an invaluable tool that empowers businesses to navigate the complexities of foreign exchange transactions. By leveraging its comprehensive features, insightful analysis, and customizable options, businesses can gain a competitive edge, optimize their financial performance, and conquer the ever-evolving world of forex trading. Embracing this powerful tool is a step towards financial success in an interconnected global marketplace.