In the dynamic forex market, where currencies constantly dance in response to global events and technical factors, the ability to analyze both fundamental and technical aspects is indispensable for traders seeking sustainable success. While fundamental analysis focuses on economic indicators and political news, technical analysis deciphers price patterns and historical data. By understanding how these two analytical approaches complement each other, traders can enhance their forex trading strategies and make more informed decisions.

Image: forextraininggroup.com

Before delving into the synergy of fundamentals and technicals, let’s establish their distinct characteristics. Fundamental analysis relies on economic data, central bank policies, political developments, and global events that influence the value of currencies. It examines indicators such as GDP, interest rates, inflation, and unemployment to assess a currency’s health and vulnerabilities. By gauging the underlying economic strengths and weaknesses, traders can forecast future currency movements.

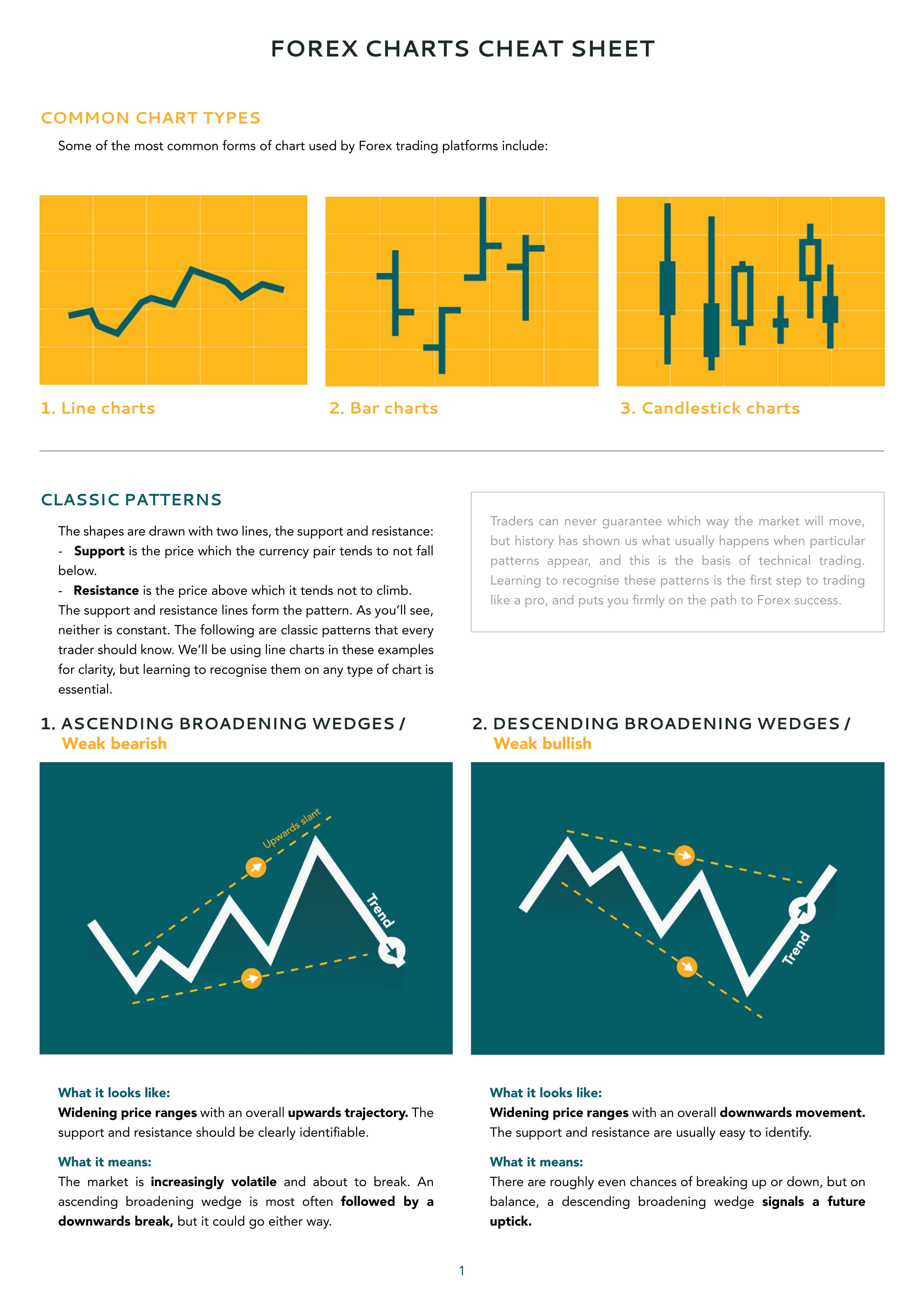

Technical analysis, on the other hand, focuses on price movements. By studying charts and historical data, traders identify patterns, trends, and support and resistance levels. They employ technical indicators, such as moving averages, oscillators, and chart patterns, to generate buy and sell signals. Technical analysis assumes that past price action can provide valuable insights into future trends, allowing traders to anticipate market reversals and capitalize on price fluctuations.

While fundamental and technical analysis may seem like contrasting approaches, their convergence offers a well-rounded perspective for forex traders. Combining the insights derived from both methods can help traders develop more comprehensive trading strategies that address different market conditions. By marrying fundamental analysis with technical analysis, traders can identify potential trading opportunities, assess market sentiment, and manage risk effectively.

Let’s delve deeper into how each analytical method complements the other:

Fundamentals provide the foundation for long-term trends: Economic data and political events, unveiled through fundamental analysis, often serve as catalysts for major currency movements. By understanding the economic forces driving currency markets, traders can position themselves for long-term trends and avoid whipsaws caused by temporary market fluctuations.

Technicals refine the timing of trades: While fundamentals provide a roadmap for potential long-term price direction, technical analysis enables traders to pinpoint optimal entry and exit points. By identifying chart patterns and using technical indicators, traders can anticipate market reversals, ride trends, and limit losses.

Fundamentals mitigate false signals: Technical analysis can generate false signals, but combining it with fundamental analysis can help traders filter out these false signals and increase trading accuracy. A strong fundamental outlook supporting a technical setup can provide traders with added confidence and conviction in their trading decisions.

Technicals uncover hidden opportunities: Sometimes, fundamental factors may be slow to manifest in currency prices. Technical analysis can uncover hidden opportunities by identifying price divergences and technical patterns that indicate potential price moves ahead of fundamental shifts.

Risk management and diversification: Understanding both fundamental and technical aspects allows traders to better manage risk and diversify their portfolios. By considering the macroeconomic environment alongside price action, traders can allocate their capital wisely, hedge against currency fluctuations, and mitigate losses in volatile market conditions.

In conclusion, the convergence of fundamental and technical analysis empowers forex traders with a multifaceted approach that enhances their understanding of currency markets and trading opportunities. By embracing both analytical methods, traders can make more informed decisions, identify optimal entry and exit points, manage risk effectively, and seize the full potential of the forex market. Remember, consistent research, staying abreast of market news, and continuous learning are key to mastering the art of forex trading with fundamental and technical strategies.

Image: www.forexcrunch.com

Forex Fundamental Technical Analysis Forexfactory