Venturing into the dynamic world of forex trading involves navigating a labyrinth of choices, including the critical decision between fixed spreads and commission-based trading models. Grasping the nuances of each approach empowers traders with the knowledge to optimize their trading strategies and maximize profitability.

Image: www.forexinthai.com

Decoding Fixed Spreads: Predictability and Stability

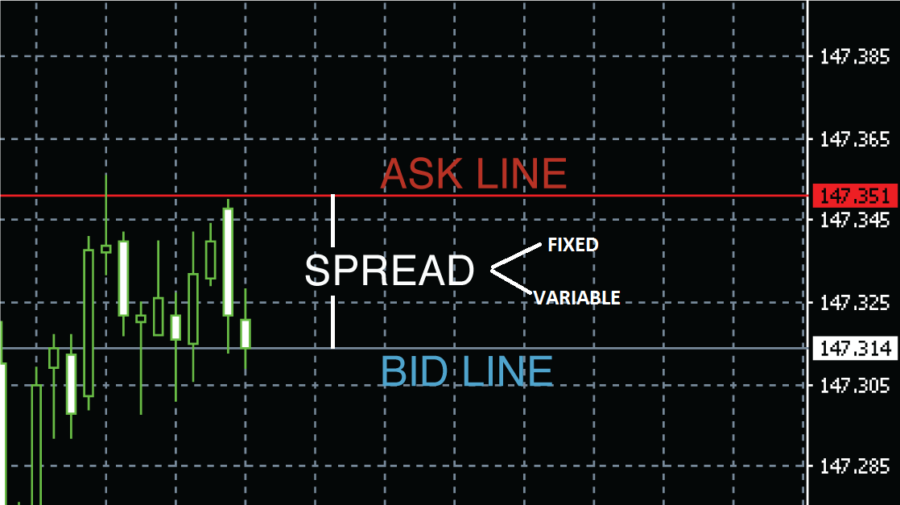

Fixed spreads offer the allure of predictable trading costs, ensuring that the difference between the bid and ask prices remains constant throughout the trading day. This stability provides traders with a clear understanding of their transaction fees upfront, eliminating the element of uncertainty. Particularly for novice traders, the simplicity and transparency of fixed spreads can instill confidence and reduce trading apprehensions. Moreover, traders who prefer a consistent trading environment, regardless of market conditions, may find solace in the predictability offered by fixed spreads.

Unveiling Commissions: Flexibility and Potential Savings

In contrast, commission-based trading introduces a variable cost structure where traders pay a predetermined fee for each executed trade. This approach offers greater flexibility, as traders can adjust their trade sizes to optimize commission costs. Seasoned traders with a knack for identifying favorable market conditions may find commission-based trading advantageous, as they can capitalize on opportunities with narrower spreads. Additionally, traders who engage in high-volume trading may find commission-based models more cost-effective than fixed spreads.

Delving into the Advantages and Pitfalls

To further illuminate the merits of each approach, let’s delve into the specific advantages and potential drawbacks:

Image: www.mediahacker.org

Fixed Spreads:

Advantages:

- Predictable trading costs

- Transparency and ease of budgeting

- Less susceptibility to market volatility

Pitfalls:

- May result in higher spreads during periods of high market volatility

- Reduced flexibility in optimizing commission costs

Commission-Based Trading:

Advantages:

- Potential cost savings on trades with favorable spreads

- Flexibility in adjusting trade sizes to optimize commission costs

- Suitability for high-volume traders

Pitfalls:

- Variability in trading costs can impact profitability

- May introduce additional complexity for novice traders

Choosing the Ideal Approach

The optimal choice between fixed spreads and commissions hinges on individual trading preferences, risk tolerance, and trading volume. Traders who prioritize predictability and simplicity may gravitate towards fixed spreads. Conversely, experienced traders seeking flexibility and potential cost savings may prefer commission-based trading.

Fixed Spreads: A Haven for Stability-Seekers

Traders who value consistent trading costs and a structured trading environment will find solace in fixed spreads. This approach offers predictability and a clear understanding of transaction fees, fostering confidence and reducing uncertainty.

Commission-Based Trading: A Tool for the Savvy Trader

Traders with a keen eye for favorable market conditions and a knack for optimizing trading strategies may find commission-based trading advantageous. This approach provides flexibility in managing commission costs and the potential for significant savings on trades with narrower spreads.

Forex Fixed Spread Or Commission

Navigating the Nuances with Expert Guidance

Navigating the complexities of forex trading, including the nuances of fixed spreads versus commissions, requires expertise and guidance. Seeking insights from experienced traders, reputable brokers, and educational resources can empower you with the knowledge and confidence to make informed decisions.

The vast landscape of forex trading presents a plethora of opportunities, but also challenges. By understanding the intricacies of fixed spreads versus commissions and aligning your trading strategy with the optimal approach, you can harness the potential of this dynamic market and embark on a path towards profitability.