When embarking on a foray into the world of forex trading, understanding the nuances of early delivery charges is paramount to leveraging opportunities and mitigating potential losses. Early delivery charges, often labeled as “overnight financing charges” or “rollovers,” stem from the fundamental concept of currency carry trade. This article aims to illuminate the intricacies of early delivery charges, empowering traders with the knowledge to navigate the forex market with clarity and precision.

Image: ar.inspiredpencil.com

Synopsis of Early Delivery Charges

Understanding Currency Carry Trades

Currency carry trades involve borrowing a low-yielding currency and investing the proceeds in a high-yielding counterpart, effectively pocketing the interest rate differential. This strategy hinges on the premise that the appreciation of the high-yielding currency against the borrowed currency will outpace the overnight interest rate spread. However, if the currency pair moves against the trader’s position, early delivery charges come into play.

Calculating Early Delivery Charges

The calculation of early delivery charges is contingent on the following variables:

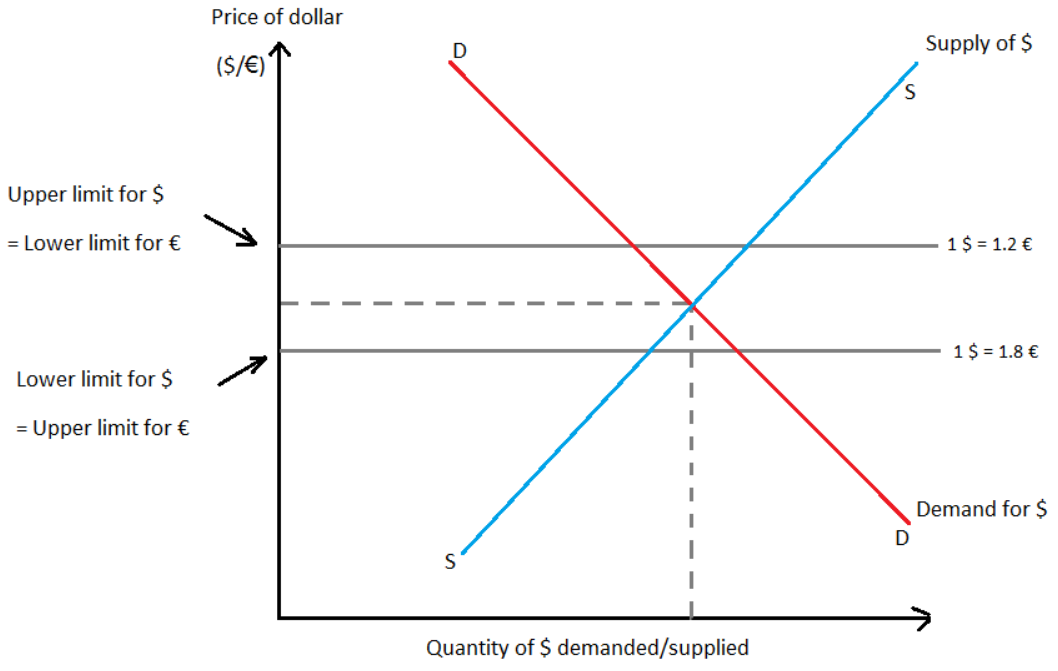

– Spot exchange rate (market rate at the time of trade)

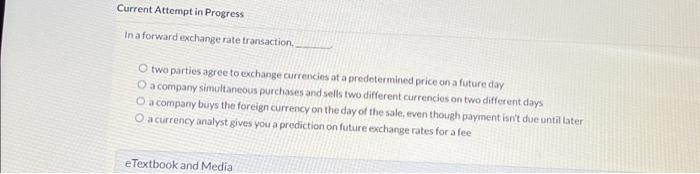

– Forward exchange rate (rate agreed upon for future settlement)

– Number of days until the contract’s settlement

– Interest rate differential between the two currencies involved

The formula for calculating early delivery charges is:

Early Delivery Charge = (Forward Exchange Rate – Spot Exchange Rate) X (Number of Days Until Settlement) X (Interest Rate Differential)

It is noteworthy that early delivery charges are subject to variations based on the specific currency pair and the prevailing market conditions. Real-time data and reliable sources of information are essential for traders to stay abreast of the most up-to-date charges.

Minimizing Early Delivery Charges

Prudent risk management techniques can help minimize the impact of early delivery charges. Traders should diligently monitor market conditions and assess the potential for adverse price movements. Adjusting positions accordingly, employing stop-loss orders, and utilizing hedging strategies can mitigate losses and safeguard capital.

Expert Advice

- “Always keep abreast of global economic events and central bank announcements, as these can significantly influence interest rates and early delivery charges.”

- “Consider short-term currency carry trades to limit exposure to early delivery charges over extended periods.”

Image: www.chegg.com

FAQ

Q: Why are early delivery charges important in currency carry trades?

A: They ensure that both parties involved in the transaction receive the correct amount of interest accrued during the settlement period.

Q: Can early delivery charges be positive or negative?

A: Yes, they can be either positive (if the forward rate is higher than the spot rate) or negative (if the spot rate is higher than the forward rate).

Q: How do I minimize the impact of early delivery charges on my trading strategy?

A: By monitoring market trends, employing risk management techniques, and seeking professional guidance when necessary.

Forex Exchange Early Delivery Charges Calculation

Conclusion

Mastering the calculation and implications of early delivery charges empowers traders to navigate the forex market with confidence. By adhering to the principles outlined in this article, traders can optimize currency carry trades, mitigate risks, and enhance their overall trading performance. Embracing early delivery charges as an integral part of the trading process will lead to informed decision-making and ultimately, success in the dynamic and ever-evolving world of forex.

Interested in delving deeper into the intricacies of forex exchange early delivery charges? Explore our comprehensive resources, engage with expert insights, and join a thriving community of traders eager to share knowledge and insights. Together, we can unlock the full potential of currency carry trades and conquer the financial markets.