Step into the World of Forex Entry Point Indicators

Navigating the intricate world of forex trading, timing market entries and exits is crucial for success. Enter the forex entry point indicator, a valuable tool designed to assist traders in identifying opportune entry and exit points in the fast-paced forex market. In this comprehensive review, we delve deep into the nuances of forex entry point indicators, exploring their definition, history, types, and invaluable role in enhancing trading strategies.

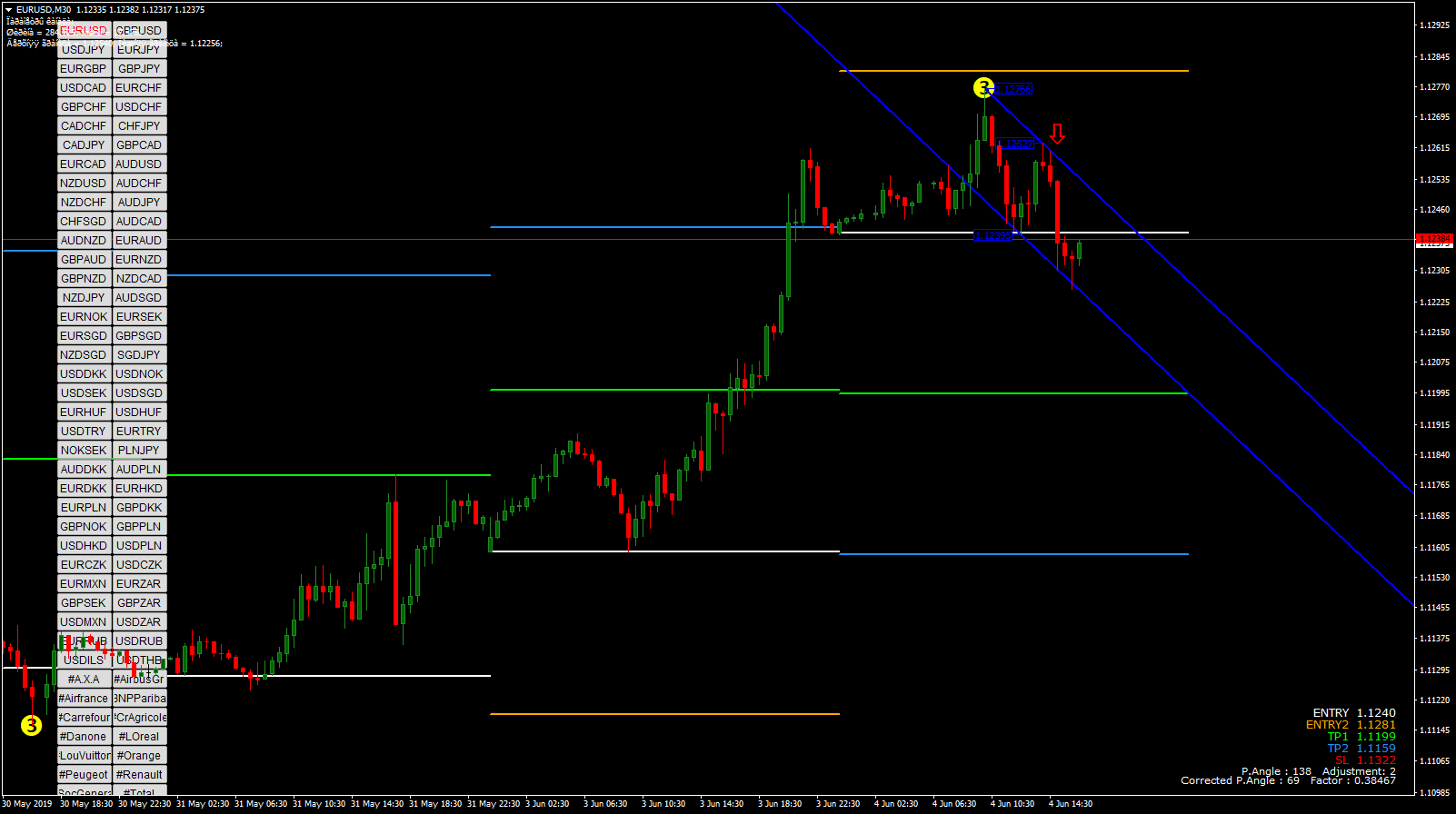

Image: seedgarden.ru

A Clear Definition: What is a Forex Entry Point Indicator?

Simply put, a forex entry point indicator is a technical analysis tool designed to provide traders with signals that indicate potential profitable entry and exit points in the forex market. These indicators analyze historical price data and employ mathematical formulas to detect patterns and trends, thereby offering traders actionable insights into market behavior.

Historical Evolution: The Journey of Forex Entry Point Indicators

The concept of forex entry point indicators has roots in the early days of technical analysis, where traders observed price patterns and devised rules to guide their trading decisions. The advent of computers and advanced software accelerated the development of sophisticated indicators, enabling automated analysis of vast amounts of data. Today, a plethora of entry point indicators are available, each utilizing unique algorithms and techniques to identify potential trading opportunities.

Unveiling the Range of Forex Entry Point Indicators

The diverse landscape of forex entry point indicators can be broadly categorized into the following types:

- Trend-following Indicators: These indicators, such as the moving average and Bollinger Bands, help identify the prevailing market trend and anticipate its continuation.

- Momentum Indicators: Indicators like the relative strength index (RSI) and stochastic oscillator measure the strength and direction of price movements, providing insights into market momentum.

- Volume Indicators: Volume-based indicators, such as the volume-weighted average price (VWAP) and on-balance volume (OBV), shed light on the volume of trading activity, providing clues about market sentiment.

- Volatility Indicators: Volatility gauges like the average true range (ATR) and Bollinger Bands measure price fluctuations, helping traders assess market volatility and risk.

Image: theforexgeek.com

Maximizing Trading Strategies with Entry Point Indicators

Forex entry point indicators offer a myriad of benefits that enhance trading strategies:

- Objective Evaluation: Indicators provide an objective perspective on market conditions, minimizing the impact of emotions and biases on trading decisions.

- Timely Signals: By generating buy and sell signals, indicators alert traders to potential trading opportunities in a timely manner.

- Improved Accuracy: Utilizing multiple indicators and combining their signals can significantly enhance the accuracy of entry and exit decisions.

- Adaptability: Entry point indicators can be customized to suit individual trading styles and market conditions, ensuring adaptability to diverse scenarios.

Expert Tips for Effective Implementation

To harness the true potential of forex entry point indicators, consider these expert tips:

- Understand the Underlying Logic: Delve into the mathematical formulas and principles behind different indicators to fully comprehend their behavior.

- Combine Multiple Indicators: Avoid relying on a single indicator; instead, triangulate signals from diverse indicators for increased confidence.

- Calibrate Indicators: Fine-tune indicator parameters based on the specific trading conditions and time frames.

- Complement with Other Analysis: Use entry point indicators in conjunction with other forms of technical and fundamental analysis for a holistic approach.

Frequently Asked Questions about Forex Entry Point Indicators

Q: Are forex entry point indicators foolproof?

A: While indicators provide valuable guidance, they are not foolproof. Market behavior is complex and subject to unexpected shifts.

Q: Which is the best forex entry point indicator?

A: The effectiveness of an indicator depends on individual trading style and market conditions. Experiment with various indicators to find those that best suit your needs.

Q: Is it possible to develop custom entry point indicators?

A: Yes, advanced users can utilize programming languages like MQL4 or Python to create tailored indicators that meet specific trading requirements.

Forex Entry Point Indicator Review

Conclusion: Empowering Forex Traders with Precision

In the dynamic realm of forex trading, forex entry point indicators have emerged as indispensable tools, arming traders with crucial insights into market conditions. By understanding the types, benefits, and expert advice associated with these indicators, traders can refine their strategies, improve decision-making, and ultimately enhance their profitability. As we wrap up this article, we invite you to explore the world of forex entry point indicators and discover their potential to transform your trading journey. Are you ready to unlock the power of precision in forex trading?