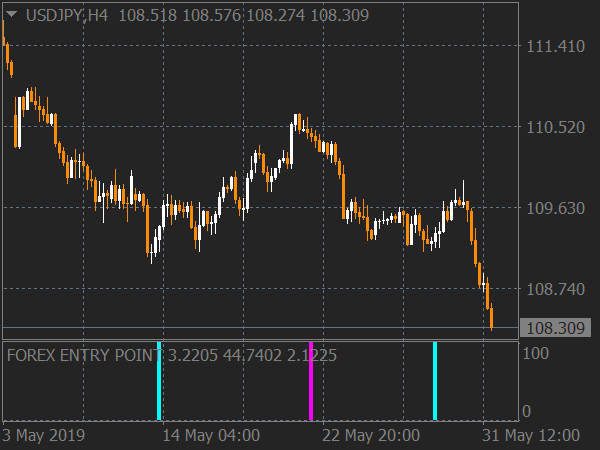

In the ever-evolving world of forex trading, finding the perfect entry point can often be the key to success. One valuable tool that traders rely on is forex entry point indicators. However, like any tool, these indicators can sometimes provide late signals, which can lead to missed opportunities or even losses. Understanding how to identify and avoid these late signals is crucial for maximizing the effectiveness of your trading strategy.

Image: nontrcon.blogspot.com

What are Late Signals in Forex Entry Point Indicators?

Late signals in forex entry point indicators occur when the indicator provides a buy or sell signal after the price has already made a significant move in the indicated direction. Traders relying on such signals may enter the market late, missing out on potentially substantial profits or facing higher risk exposure due to the price movement that has already occurred.

Causes of Late Signals in Forex Entry Point Indicators

Several factors can contribute to late signals in forex entry point indicators:

-

Indicator Lag: Some indicators rely on historical data to make predictions. This can result in a natural delay before the indicator reflects the most up-to-date market conditions.

-

Filtering and Smoothing: Indicators that apply filters or smoothing techniques to reduce false signals may also introduce some delay in their responses to price changes.

-

Incomplete Calculations: Certain indicators require a specific number of data points or a certain period of time to complete their calculations. This can sometimes lead to late signals when the indicator needs additional data before generating a tradable signal.

-

Technical Limitations: Some technical indicators have inherent limitations that can lead to late signals, especially in fast-moving markets or during periods of high volatility.

Consequences of Late Signals in Forex Trading

Late signals can have significant consequences for forex traders:

-

Missed Opportunities: If an entry point indicator provides a late buy or sell signal, traders may miss out on profitable opportunities that occur before the signal is generated.

-

Increased Risk: Late signals can lead to entering the market after the price has already moved significantly. This increases the potential risk of loss should the market reverse direction.

-

Diminished Confidence: Repeatedly receiving late signals can undermine traders’ confidence in the reliability and effectiveness of their entry point indicators.

Image: kasderon.blogspot.com

Identifying and Avoiding Late Signals in Forex Entry Point Indicators

Addressing late signals requires a proactive approach from traders:

-

Recognize the Limitations: Understanding the inherent limitations of the indicators being used can help traders manage expectations and identify potential sources of late signals.

-

Test and Optimize: Traders should thoroughly test and optimize their entry point indicators using historical data or a demo account. This allows them to assess the frequency of late signals and make adjustments accordingly.

-

Combine Multiple Indicators: Using multiple entry point indicators, each with its own strengths and weaknesses, can help mitigate the risk of late signals. Diversifying indicator strategies increases the probability of catching timely entry points.

-

Consider Alternative Indicators: Traders may explore alternative entry point indicators that have a lower propensity for late signals. This requires ongoing research and experimentation to find the best fit for individual trading styles.

-

Monitor Market Context: It’s essential to consider the broader market context when assessing entry point signals. Fundamental factors, economic data, and geopolitical events can significantly impact forex prices and influence the reliability of indicators.

-

Use Confirmation Signals: Traders can employ additional confirmation signals, such as price action confirmation or support and resistance levels, to reduce the chances of relying solely on late entry point indicators.

Forex Entry Point Indicator Late Signals

Embrace the Challenge, Enhance Your Trading

Late signals in forex entry point indicators are an inevitable part of trading, but their impact can be minimized with careful consideration and proactive measures. By understanding the causes and consequences of late signals, traders can develop robust trading strategies that increase their chances of successful trades. Remember, the ability to identify, avoid, and mitigate late signals is an invaluable skill that can significantly enhance the accuracy and profitability of any trader’s approach.