Unlock the Secrets of Forex EA Hedging: The Power of Automated Trading

Image: tradingkit.net

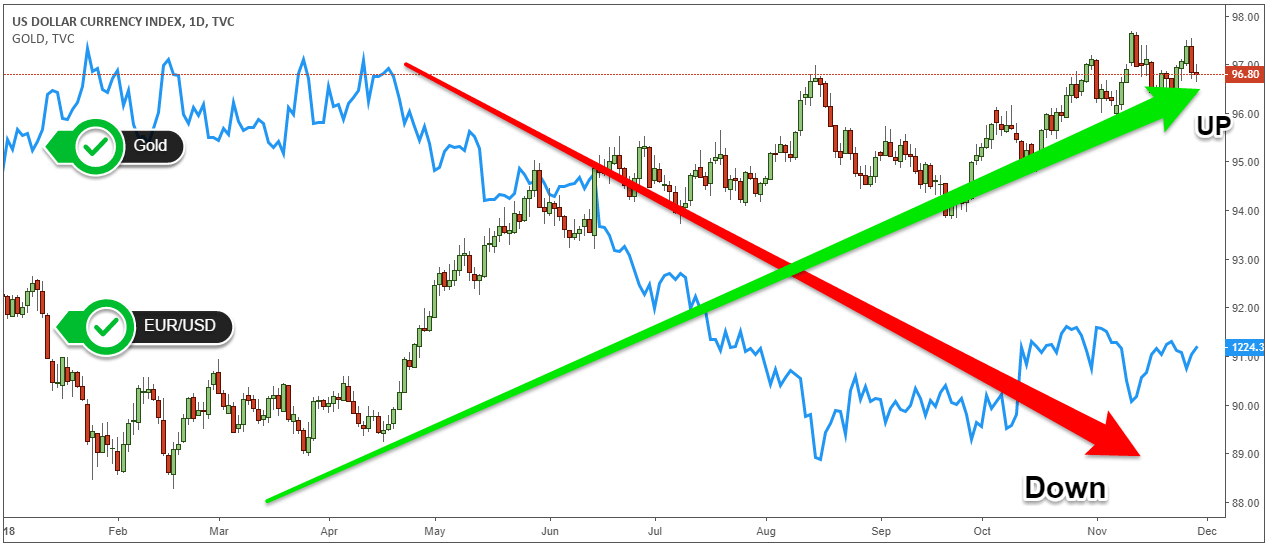

In the fast-paced world of forex (foreign exchange) trading, maximizing profits while minimizing risks is paramount. Enter expert advisors (EAs), automated trading tools that grant traders unparalleled precision and efficiency. Among them, forex hedging EAs stand out with their ability to mitigate market volatility and enhance profitability.

What is Forex EA Hedging?

Forex hedging involves opening multiple opposing positions in different currencies to mitigate the risks associated with exchange rate fluctuations. By creating a “safety net,” hedging strategies aim to limit potential losses while setting the stage for steady gains. Forex EA hedging employs automated rules and algorithms to execute these strategies, removing the need for manual intervention and allowing traders to capitalize on market opportunities even while away from their trading terminals.

The Close All Button: A Trader’s Lifeline

One crucial feature of forex EA hedging is the close all button. This button empowers traders to quickly and effortlessly exit all open positions with a single click. In the volatile forex market, the ability to close positions swiftly can be the difference between substantial profits and devastating losses. The close all button provides peace of mind, allowing traders to manage their risk exposure effectively.

How Forex EA Hedging Empowers Traders

Forex EA hedging offers numerous advantages to traders of all levels:

- Risk Management: By mitigating market risks through hedging strategies, EAs safeguard traders’ capital and prevent catastrophic losses.

- Time Saving: With EAs handling trades automatically, traders save valuable time that would otherwise be spent on manual trading.

- Improved Execution: EAs execute trades with unmatched precision and speed, ensuring that trades are entered and exited at the most opportune moments.

- Emotional Control: By removing emotional biases from trading decisions, EAs help traders avoid impulsive moves and maintain a disciplined approach.

Integrating Forex EA Hedging into Your Trading

To effectively integrate forex EA hedging into your trading strategy, consider the following steps:

- Choose a Reputable Broker: Select a broker that offers reliable and stable trading conditions and supports automated trading EAs.

- Select a Suitable EA: Explore different forex hedging EAs, compare their features, and choose one that aligns with your risk tolerance and trading style.

- Customize Settings: Tailor the EA’s settings to suit your specific preferences and market conditions. This includes defining hedging parameters, stop-loss levels, and profit targets.

- Monitor Performance: Regularly review the performance of your forex EA hedging strategy and make adjustments as needed to optimize results.

Embrace Automation and Unleash Your Trading Potential

Forex EA hedging is a valuable tool that can significantly enhance the trading experience. By automating complex strategies and providing traders with essential risk management features, EAs empower traders to navigate the forex market with confidence. Embrace automation and unlock the true potential of your forex trading journey.

Image: howtotradeonforex.github.io

Forex Ea Hedging Ea Close All Button Soehoe