A Journey into the Realm of Automated Trading

In the ever-evolving world of forex trading, where markets dance to a complex rhythm, technology has emerged as a game-changer. Forex Expert Advisors (EAs) and indicators have become indispensable tools, empowering traders of all levels to navigate the financial waters with greater confidence and precision.

Image: tradingforexguide.com

EAs, also known as automated trading systems, are software programs that execute trades autonomously based on predefined parameters. They automate trading decisions, allowing traders to take advantage of opportunities that might otherwise be missed. Forex indicators, on the other hand, are technical analysis tools that provide insights into market trends and help identify potential trading opportunities.

The Anatomy of an EA

EAs are typically coded using programming languages such as MetaTrader Scripting Language (MQL). They consist of three main components:

-

Indicators: EAs often rely on technical indicators to analyze market data. These indicators can identify trends, support and resistance levels, and other patterns that help the EA make informed trading decisions.

-

Trading logic: This is the core of the EA, defining how it will interpret the indicators and execute trades. The trading logic should be carefully designed to balance risk and reward, considering factors such as market volatility and trade size.

-

Risk management: EAs should incorporate robust risk management strategies to minimize potential losses. Common risk management techniques include stop-loss orders, trailing stops, and position sizing calculations.

The Benefits of Using EAs

-

Round-the-Clock Trading: EAs can operate 24/5, allowing traders to capture opportunities even during their sleep.

-

Reduced Emotion: Automated trading eliminates the influence of emotions, which can often cloud judgment and lead to poor trading decisions.

-

Backtesting and Optimization: EAs can be rigorously tested using historical data, allowing traders to fine-tune their parameters and maximize profit potential.

-

Disciplined Trading: EAs enforce predefined trading rules, ensuring consistency and discipline in trading execution.

Indicators: Your Forex Navigation System

Forex indicators are essential tools for analyzing market trends and identifying trading opportunities. There are numerous indicators available, each with its own strengths and limitations. Here are a few commonly used indicators:

-

Moving averages: These indicators smooth out market fluctuations, creating a trendline that can help identify support and resistance levels.

-

Relative Strength Index (RSI): RSI measures the strength of price momentum by comparing the magnitude of recent gains to losses. It helps identify overbought and oversold conditions.

-

Stochastic Oscillator: The Stochastic Oscillator compares the current closing price to the recent price range, providing insights into momentum and potential trend reversals.

-

Support and resistance levels: These levels represent areas where the price has historically struggled to break through, indicating potential trading opportunities when the price approaches these levels.

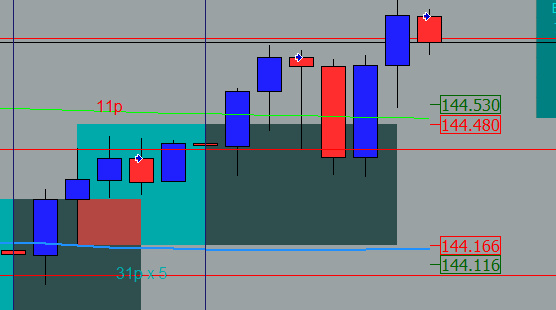

Image: www.forexfactory.com

Choosing the Right EA and Indicator Combination

Selecting the right EA and indicator combination is crucial to trading success. Here are some considerations:

-

Trading style: Choose an EA that aligns with your trading style, whether it’s scalping, day trading, or swing trading.

-

Market volatility: Some EAs are better suited for high-volatility markets, while others perform better in calmer conditions.

-

Backtesting performance: Evaluate the EA’s performance over different market conditions using historical data.

-

Ease of use: Choose an EA that is user-friendly and easy to configure according to your preferences.

Forex Ea And Indicator Add

Conclusion

Forex EAs and indicators offer powerful tools to enhance trading performance. By understanding their capabilities and limitations, traders can optimize their trading strategies, automate decision-making, and maximize their profit potential. Remember, while technology can empower traders, it’s always important to use these tools judiciously, with a solid understanding of market dynamics and sound risk management practices.