The Forex market, a trillion-dollar industry, presents countless opportunities for savvy investors. However, navigating the complex and often unpredictable world of Forex trading requires knowledge, time, and meticulous analysis.

In the realm of Forex trading, the advent of Expert Advisors (EAs) has revolutionized the game for traders of all levels. EAs, also known as automated trading robots, provide a convenient and efficient method of automating Forex trades based on predefined criteria and algorith

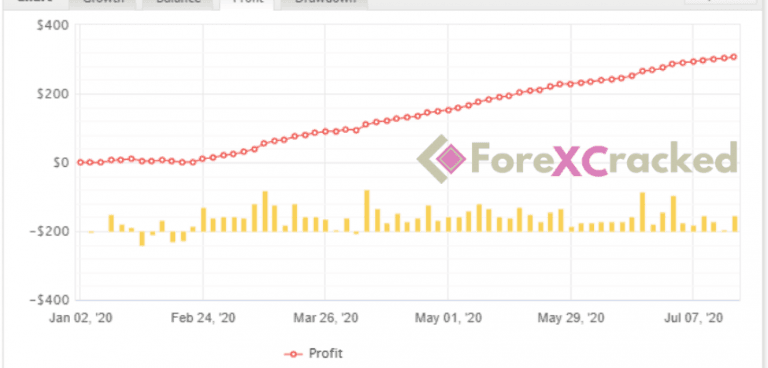

Image: www.forexcracked.com

The Allure of Forex EA 100 Daily Returns

One particular class of EAs has gained significant attention in the trading community: the Forex EA 100 daily returns bots. These advanced trading algorithms are designed to deliver consistent and substantial returns, promising to generate daily profits of up to 100%. While the concept of achieving such high returns may seem enticing, it is crucial to approach these claims with caution and a thorough understanding of the risks involved.

Forex EA Performance Metrics

A Forex EA’s performance is typically evaluated based on several key metrics:

a. Win Rate: This reflects the percentage of trades that result in profits.

b. Profit Factor: A measure of the ratio between profits and losses. Ideally, this should be above 1.

c. Maximum Drawdown: The most significant loss incurred during a specific trading period.

It is important to note that these metrics are historical performance indicators and do not guarantee future results. Forex trading involves inherent risks, and past performance is not always indicative of future success.

Factors Affecting Forex EA Performance

The performance of a Forex EA is influenced by a multitude of factors, including:

a. Market Conditions: Economic events, geopolitical uncertainties, and market volatility can significantly impact trading outcomes.

b. Underlying Strategy: The trading logic and algorithms employed by the EA play a crucial role in determining its effectiveness.

c. Parameters and Settings: Each EA requires optimization and calibration to align with the trader’s risk tolerance and trading style.

Image: www.youtube.com

Forex EA 100 Daily Returns: Reality Check

While some Forex EA 100 daily returns bots may deliver impressive results under specific market conditions, it is essential to manage expectations and recognize that consistent returns of 100% are highly unlikely. Achieving such extraordinary returns on a daily basis would necessitate an unreasonably high win rate and aggressive risk management, potentially exposing traders to substantial losses. The vast majority of successful Forex traders adopt a more realistic approach to profitability, focusing on consistent and sustainable gains rather than unsustainable windfalls.

Tips for Selecting a Forex EA

If you are considering using a Forex EA, it is imperative to exercise due diligence and consider the following tips:

a. Conduct Thorough Research: Evaluate the EA’s performance history, underlying strategy, and reviews from reputable sources.

b. Test the EA: Run the EA on a demo account or historical data to assess its performance under various market conditions.

c. Optimize and Monitor: Regularly adjust the EA’s parameters and closely monitor its performance to ensure alignment with your trading goals.

d. Practice Risk Management: Always adhere to sound risk management principles, including proper position sizing, stop loss orders, and margin awareness.

Forex Ea 100 Daily Returns

Conclusion

While the idea of achieving Forex EA 100 daily returns is alluring, it is crucial to approach such claims with a balanced and realistic perspective. Forex trading involves inherent risks, and consistent returns of such magnitude are extremely challenging to achieve. By managing expectations, conducting thorough research, and employing robust risk management, traders can navigate the world of automated Forex trading with a greater chance of success.

Are you an experienced trader intrigued by the possibilities of Forex EA trading? Share your insights and perspectives in the comments below