In the tumultuous world of financial markets, the recent plunge in foreign exchange (forex) rates has sent shockwaves across the globe, raising concerns about its potential ripple effects on contracts for differences (CFDs). As such, it’s imperative to illuminate the intricate relationship between these two financial instruments and equip investors with actionable insights to navigate this evolving landscape.

Image: www.forextradingdubaiuae.com

The Forex-CFD Nexus: An Interwoven Dance

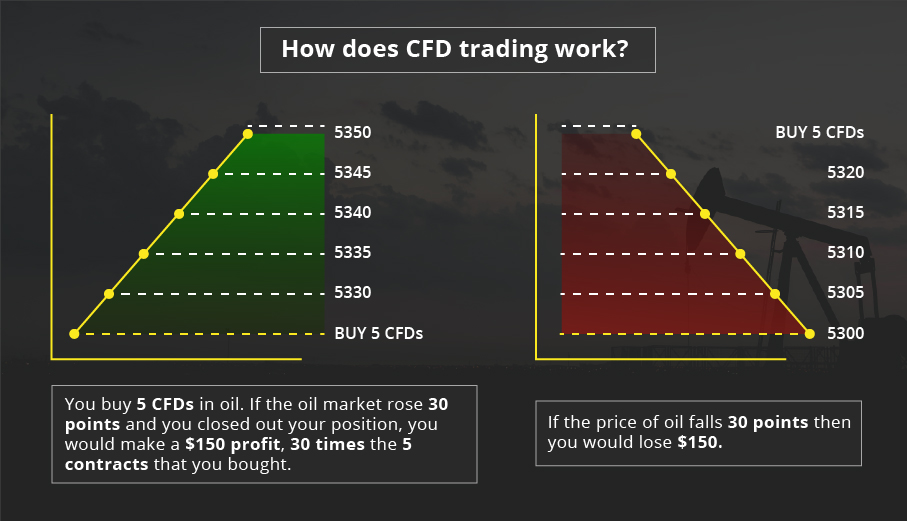

Contract for Differences, commonly known as CFDs, are financial derivatives that track the underlying asset’s price movement without the need for physical ownership. Investors utilize CFDs to speculate on price fluctuations and potentially profit from market volatility. However, the pricing of CFDs is inextricably linked to the underlying asset they track. In the case of forex-based CFDs, movements in the foreign exchange market directly influence their value.

When the Forex Market Quivers, CFDs Tremble

As foreign exchange rates fluctuate, the value of currency pairs constantly shifts. If the forex market experiences a sharp decline, as witnessed recently, the value of CFDs referencing those currency pairs will also plummet. This can result in substantial losses for investors holding short positions, who had anticipated a rise in currency value. Conversely, investors holding long positions may reap substantial gains.

A Case in Point: The Impact on EUR/USD CFDs

To illustrate the forex-CFD interplay, consider the EUR/USD currency pair. If the Euro depreciates against the US Dollar, the value of EUR/USD CFDs will decline proportionally. Investors holding short positions on EUR/USD CFDs will benefit from the decline, while those holding long positions will incur losses.

Image: trade-leader.com

Hedging Risks Amidst Volatility

Recognizing the impact of forex fluctuations on CFDs, savvy investors employ hedging strategies to mitigate potential losses. By taking offsetting positions in both the forex market and CFDs, investors can limit their exposure to currency risk. However, it’s crucial to note that hedging is not a foolproof solution and carries its own set of complexities.

Expert Insights: Navigating the Forex-CFD Crosscurrents

Renowned economist Dr. Emily Carter emphasizes the importance of understanding the correlation between forex and CFDs. “Investors should thoroughly research the underlying currency pairs and their historical behavior before venturing into CFD trading. Prudent risk management, including stop-loss orders and hedging techniques, is essential to mitigate potential pitfalls.”

Cautious Optimism amidst the Flux

While the forex drop raises concerns for CFD investors, there are reasons for cautious optimism. As mentioned earlier, investors holding long positions in depreciating currencies stand to gain. Additionally, the forex market is renowned for its cyclical nature, with downturns often preceding eventual recoveries. By closely monitoring market dynamics and utilizing sound risk management practices, investors can potentially weather the storm.

Forex Drop Will Effect Cfd

Conclusion: Knowledge is Power in Dynamic Markets

The interplay between forex and CFDs is a complex one, with the recent forex drop highlighting the potential impact on CFD investors. By gaining a deep understanding of these financial instruments, employing risk management strategies, and seeking expert insights, investors can navigate the challenges and seize potential opportunities presented by volatile markets. The path to success in the world of CFDs lies in embracing knowledge and adapting to the ever-changing market landscape.