Introduction

Image: www.slideshare.net

Are you an international business, investor, or traveler who wrestles with currency fluctuations that threaten to erode your profit margins? If so, you’re not alone. Currency risk is a lurking reality in today’s interconnected world, where financial transactions transcend borders. Fortunately, there’s an effective solution: forex derivatives. These financial instruments provide a safety net against the unpredictable tides of currency markets, allowing you to mitigate risk and enhance your financial well-being. Let’s delve into the dynamic world of forex derivatives and discover how they can safeguard your financial future.

Forex derivatives have long been a trusted ally in navigating the global currency landscape. These versatile instruments offer numerous benefits, primarily in reducing exchange rate risk. By locking in today’s rates, they eliminate the uncertainty that comes with currency volatility, enabling businesses to plan and execute cross-border transactions with confidence. This stability safeguards profit margins and insulates companies from unforeseen currency swings.

Hedging: The Key to Currency Risk Mitigation

Hedging with forex derivatives is a proactive strategy to neutralize the impact of currency fluctuations. Let’s say your business anticipates receiving a significant payment in euros in six months. Without hedging, you expose yourself to potential losses if the euro weakens against your home currency. However, with a forward contract, you can lock in today’s exchange rate. If the euro’s value falls in six months, you’ll still receive the agreed-upon amount, protecting your bottom line.

Speculation: A Calculated Gamble for Potential Gains

Forex derivatives aren’t just defensive tools; they can also be used for speculation, offering a chance to capitalize on favorable market conditions. If you foresee a currency’s appreciation, you can enter into a forward contract to buy it at today’s rate, anticipating a profit when its value increases. Speculation, however, carries higher risk and should be approached cautiously.

Types of Forex Derivatives

A diverse range of forex derivatives exists, each tailored to specific needs. Let’s explore the most common types:

- Forward Contract: A customized agreement between two parties to exchange currencies at a predetermined rate on a future date.

- Future Contract: A standardized contract traded on an exchange, obligating the buyer to buy and the seller to sell a specified amount of currency at a set price on a specific day.

- Option Contract: Grants the buyer the right, but not the obligation, to buy or sell a currency at a predetermined rate on or before a specified date.

- Swap Contract: An agreement to exchange cash flows in different currencies at predetermined intervals.

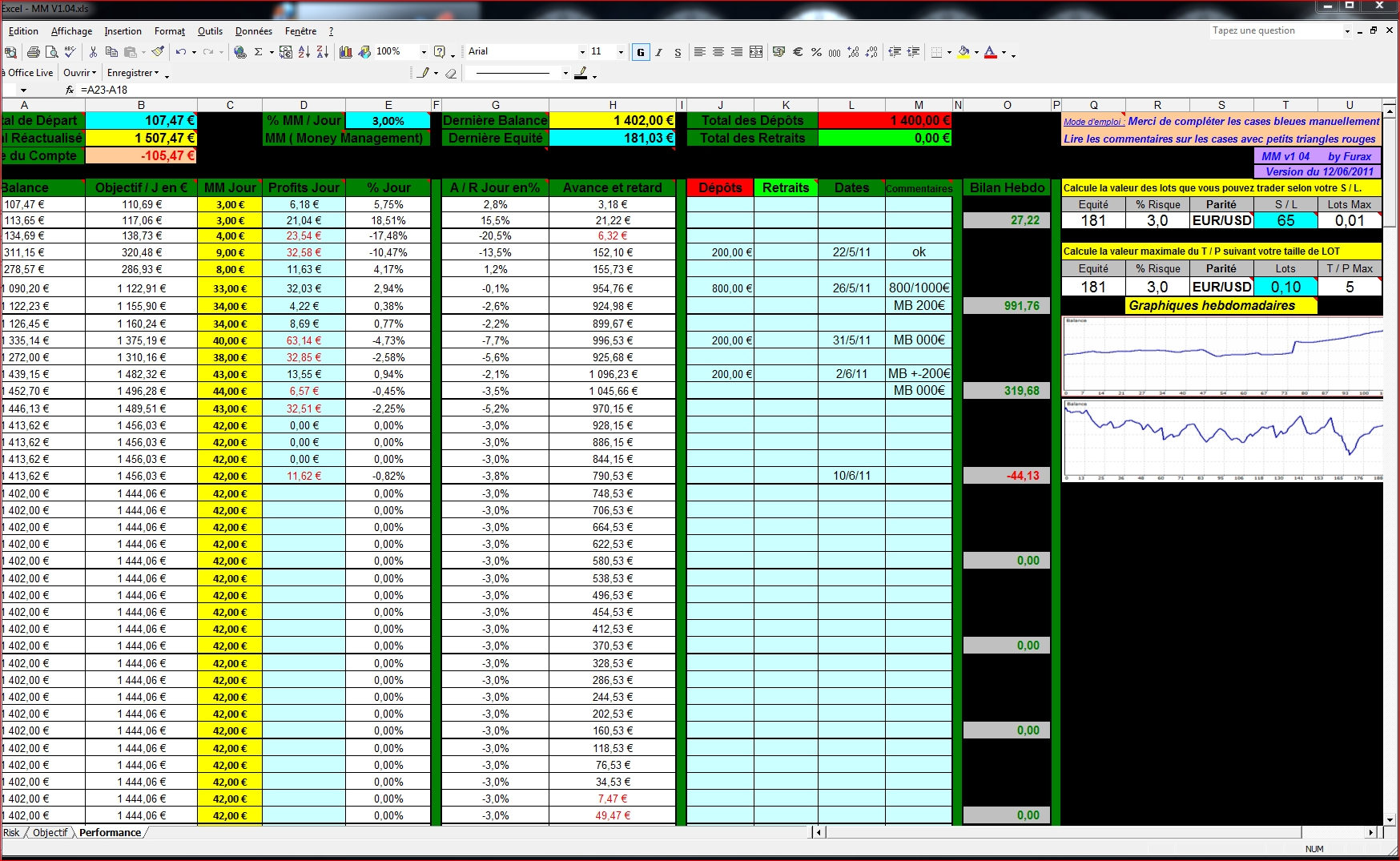

Image: db-excel.com

Real-World Applications

Forex derivatives have myriad real-world applications. Here are a few examples:

- International Trade: Importers and exporters reduce currency risk associated with cross-border transactions using forward contracts.

- Multinational Corporations: Manage exposure to foreign exchange fluctuations in different operating regions through currency swaps.

- Investment Funds: Hedge foreign currency investments or speculate on currency movements using futures and options.

- Speculators: Take calculated risks to potentially profit from currency appreciation or depreciation.

Forex Derivatives For Currency Risk Management

Conclusion

Forex derivatives are indispensable tools in today’s complex financial landscape. They provide a powerful means to mitigate risk, enhance profitability, and capitalize on market opportunities. By understanding the different types of forex derivatives and their applications, you can effectively navigate the currency markets and achieve financial success in a globalized economy. Remember, like any financial instrument, derivatives have their nuances, and it’s crucial to consult financial professionals or brokers for guidance tailored to your unique circumstances. Embrace the power of forex derivatives and chart a course toward currency risk management mastery.