Introduction to Pips and Their Importance

Pips, short for “points in percentage,” are the fundamental unit of measurement for price changes in forex trading. Understanding pips is crucial for traders, as they determine the potential profit or loss on each trade. In this article, we will delve into the intricacies of forex pips, including their calculation, significance, and impact on trading strategies.

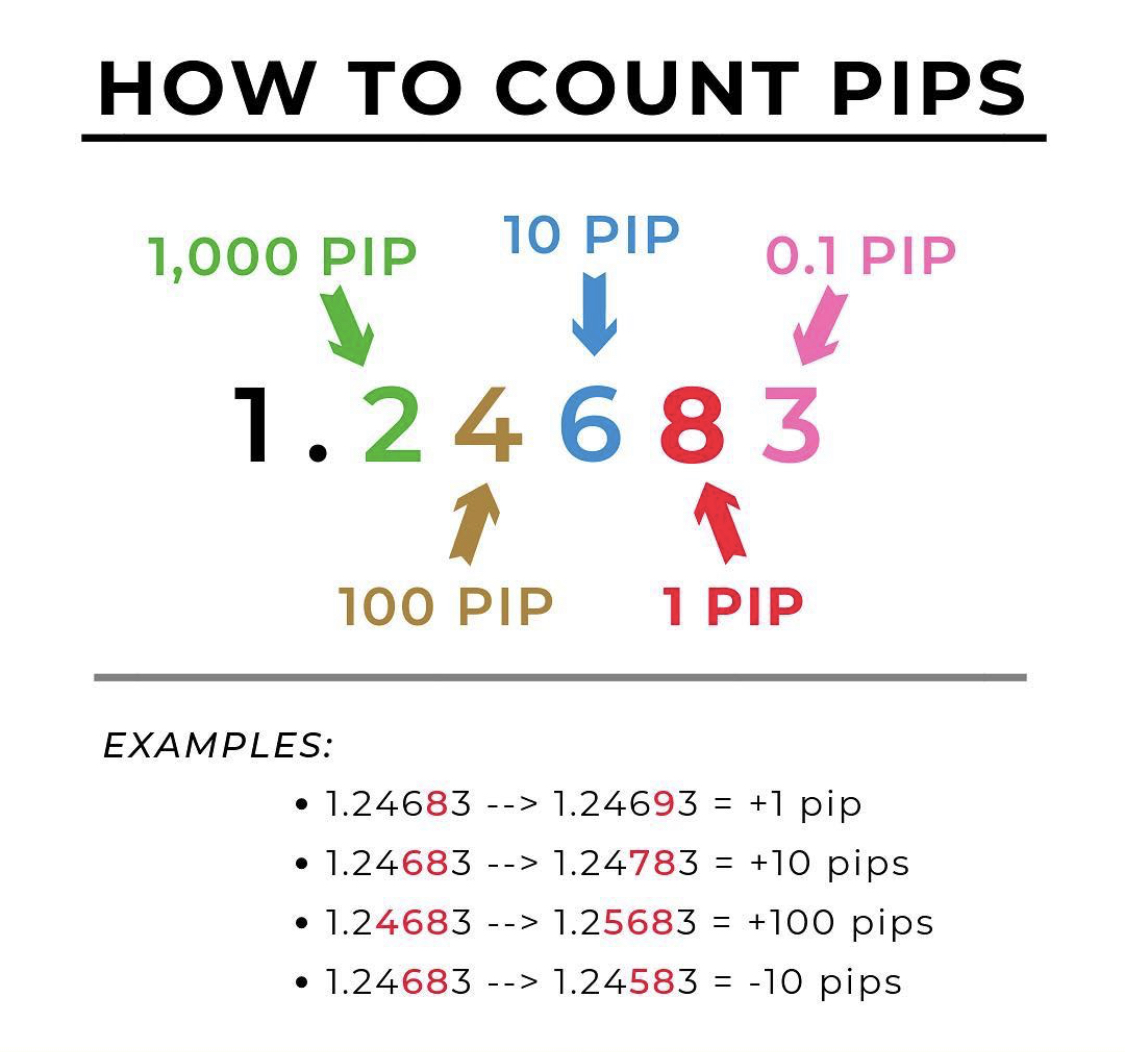

Image: www.youtube.com

Understanding the Calculation of Pips

Calculating pips involves determining the change in value between two currency pairs. The formula to calculate pips is as follows:

Pips = (|Price Change| / Price of Base Currency) * 10,000For example, let’s say you buy the EUR/USD currency pair at 1.1000 and it rises to 1.1010. The pip change would be calculated as:

Pips = (|0.0010| / 1.1000) * 10,000 = 10Hence, the EUR/USD pair has moved 10 pips in value.

Types of Pip Values

Pips represent the smallest increment of price change for a currency pair. However, different pairs have different pip values due to variations in their price quotations. The most common types of pip values are:

Standard Pip: Represents a 0.0001 change in the value of a currency pair, most commonly used for major currency pairs like EUR/USD.

Mini Pip: Represents a 0.00001 change in currency value, often used for high-value pairs like USD/JPY.

Micro Pip: Represents a 0.000001 change in currency value, suitable for extremely volatile pairs where minuscule price movements are significant.

Impact on Trading Strategies

Pips play a pivotal role in various trading strategies, including scalping, range trading, and breakout trading. Scalpers, who focus on capturing small and frequent profits, rely on pip changes to gauge market movements. Range traders profit from the price fluctuations within predefined boundaries, using pips to calculate entry and exit points. Breakout traders wait for price breakouts from specific support or resistance levels, and pips help them determine optimal entry and stop-loss levels.

Image: howtotradeonforex.github.io

Advanced Pip Calculation

Beyond basic pip calculation, traders can utilize advanced techniques such as:

Pips per Dollar (PPD): Measures the number of pips gained or lost for every dollar traded, taking into account the lot size.

Unrealized Pips: Represents the potential gain or loss on an open trade, calculated based on the difference between the current market price and the entry price.

Realized Pips: Represents the actual profit or loss generated from a closed trade, taking into account slippage and spread costs.

Misconceptions and Best Practices

Misconception: Pips are a Measure of Profit: Pips only indicate the change in currency value, not the profit. Profit is determined by various factors, including the number of pips gained or lost, lot size, and account equity.

Misconception: All Pairs Move the Same Number of Pips: Each currency pair has a unique pip value, and pips will vary depending on the pair traded.

Best Practice: Understand Pair Quotations: Traders should be familiar with the price quotations of their chosen currency pairs, which affects pip calculations.

Best Practice: Consider Spread and Commission: Spread and commission costs can impact trading, so traders should factor these into their profit calculations.

How To Calculate Pips Forex

Conclusion

Understanding pips is essential for effective forex trading. By mastering pip calculations and applying advanced techniques, traders can enhance their trade analysis and develop more precise strategies. However, it’s crucial to avoid common misconceptions and adhere to best practices to ensure accurate trading decisions and maximize profit potential.